Here’s why most of us don’t

Being set unrealistic targets is hardly likely to motivate anyone at any age. Yet this is often the case with retirement savings targets. Today we take a more realistic approach by using the factual ‘middle’ savings amounts for those about to retire, to demonstrate how quite modest savings can last the distance.

Why is this important?

The most commonly quoted targets for retirement spending and saving are those published quarterly by the Association of Super Funds Australia (ASFA). Much attention is paid to the so-called ‘comfortable’ amounts. The most recent targets (2023) are:

Couple:

Annual spend (early retirement years) $73,337(reduces to $67,647 after 85).

Savings required (at retirement) $690,000.

Singles:

Annual spend (early retirement years) $52,085 (reduces to $48,879 after 85).

Savings required (at retirement) $595,000.But very few retirees achieve these levels of savings by the time they enter retirement. There has also been a steep increase in the number of Australians retiring with debt, many with sizable mortgages. That’s why the median savings levels are much more useful indicators of how people will manage their savings across their full retirement journeys.

What’s so magical about ‘median’ amounts?

Unlike average amounts, median numbers reveal how most people are doing. For instance, somewhere in Australia is a person who has $544 million in their self-managed super fund. There are another 27 people with more than $100 million. So these ‘mega-high’ balances totally skew the ‘average’ amount when the sums are done. Using the median super savings allows us to isolate the amount that the largest number of people have at the pointy end of retirement – when they leave full time work, generally between 65-69. By using the median, we know that about half of the population will have more than this amount and half less, so it sits right in the middle and provides a useful benchmark when calculating long-term retirement income.

According to Australian Tax Office (ATO) data, the 2023 median amounts were as follows:

Singles (aged 65-69)

Male $213,986, Female $201,233

Couple (aged 65-69, based upon total of above amounts) $415,219

Crunching the numbers

We used the Retirement Essentials Retirement Forecaster tool to check how well the median amounts would fund a full retirement journey for a couple and a single.

The following assumptions were made:

- All savings are in super (i.e. no other financial assets)

- House contents are valued at $10,000

- Car value is $30,000

The scenario for both a couple (Jim and Jan) and a single (Dianne), were based upon a retirement age of 67. Here’s how it works.

Couple – Jim and Jan

If Jim and Jan want to maintain ASFA standards of ‘comfortable’ income level (spending $73,337 per annum earlier in retirement, $67,647 from age 85 and over) there is only a 25% probability there will be any of their wealth remaining at 92. They are likely to have run out of their savings before this and be reliant on the Age Pension alone.

However, if they are spending $66,000 per annum earlier in retirement, then reducing down to $60,000 per annum from age 85 onwards, there is an 85% probability there is still some wealth remaining to continue to maintain their standard of living at age 92.

In other words there is only a 15% probability that, approaching age 92, they will have run out of money and may need to make changes to their situation. Such changes could be to spend less, downsize, access home equity, etc. The $66,000 per year is achieved by a combination of a (current) Age Pension of $44,855, with a $21,145 per annum top up from their super.

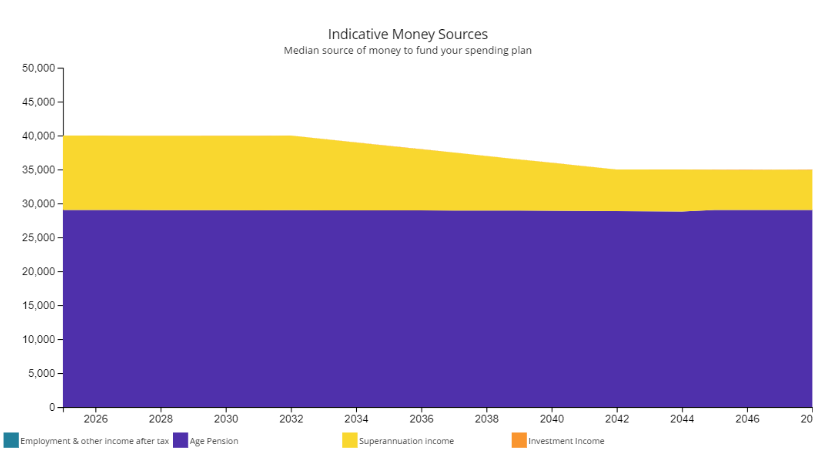

Single – Dianne

Dianne’s savings are also unlikely to stretch to the suggested ASFA spending amounts.Assuming she is not working, she can spend $41,000 per annum earlier in retirement, reducing down to $35,500 per annum from age 85 onwards. There is (approximately) an 85% probability there is still some wealth remaining to continue to maintain her standard of living beyond age 92. The $41,000 income is achieved with a full Age Pension of $29,754 and a top up of $11,246 per annum from her super. The following chart from the Retirement Forecaster shows how this works.

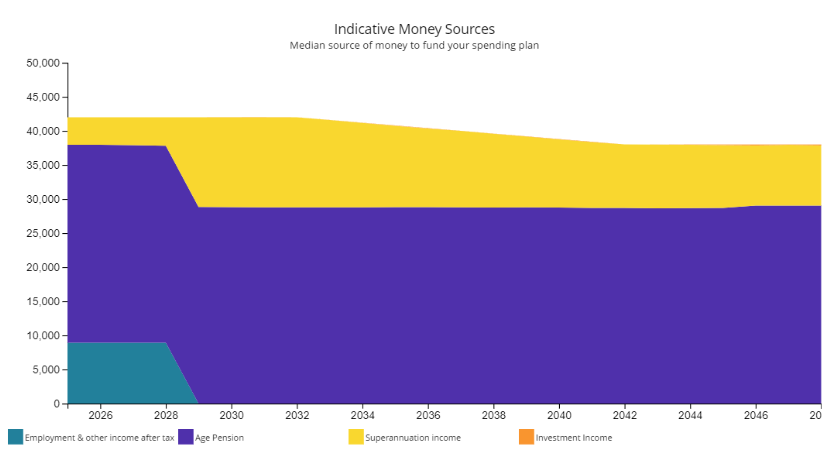

What if Dianne works?

Let’s assume Dianne decides to work part-time and earn $10,000 per annum until age 72.

This employment income of $10,000 per annum for another five years allows an increase of $2,000 – $3,000 spending per annum throughout retirement.

Rather than spending $41,000 per annum early in retirement and then reducing to $35,500 from age 85 she can now spend $43,500 per annum earlier in retirement, then reducing down to $38,000 per annum from age 85 onwards. She will be able to spend an extra $2,000 – $3,000 per annum throughout her retirement and still have (approximately) an 85% probability that there will still be some wealth remaining to continue to maintain her standard of living beyond age 92. The chart below shows how these three different income streams combine over time.

(NOTE: These spending levels without part time-work result in only a 49% probability of maintaining spending to age 92.)

Other assumptions

The above examples are simple, in order to illustrate the way that super and extra work can top up an Age Pension over the years. To keep the calculations easy to follow, we have also assumed the following:

- no other lump sum expenses,

- Age Pension entitlement calculations remain consistent throughout the next 25 years,

- changes in spending over time with inflation are factored in and

- the asset allocation of the super is invested in line with a Market Risk Level 5.

If you would like to see these scenarios in action for your own financial peace of mind, a Retirement Forecasting consultation will allow you to play with different levers to check the longevity of your savings. Or perhaps you simply wish to know more about your Age Pension and super options, in which case an Understanding Super consultation may suit you better.

How do you project your own retirement income needs?

Do you find savings targets a useful way to calculate whether your money might last? Or are there other benchmarks that help more with these sums?

Almost all calculations you make regarding what you need to live a comfortable life in retirement ignores whether or not you own a property. That is, the money you need is significantly higher if you need to pay rent as a retired.

Hi Mats, that is a great point to call out! Just so you know though, Retirement Essentials’ staff and calculators are conscious of this and will factor the estimated costs of home ownership/rent should you proceed with a consultation with them. You can read more and make a booking to find out for yourself HERE.

Most calculations seem to assume that the client lives in the city.

Is it cheaper to live outside metropolitan areas?

Or (dare I say it) away from the coast?

it’s travel that puts a huge dent in savings. I’m now solo and last trip cost $25000. as I had a medical bill on ship of $6000aud which i couldn’t claim as alcohol involved. unforeseen expenses can really add up when travelling overseas.

I pay $250 per week for Lifestyle Village fees. and will soon have resort like facilities so will stay home and enjoy these.

so I think my travel days will have to now be limited or I will run out of money .

I am not on pension and dread the thought of having to live on it .

I am very fortunate as long as my smsf with shares doesn’t crash.