The right advice at the right time can be invaluable. Sometimes it is just a little help to solve a nagging problem. Other times, it’s just to confirm your decisions. Or it might be to unlock and explain the myriad of rules that apply, and the options available to you at a point in time.

In the past, high quality financial advice was only available to the wealthy. Typically it was provided on a “fee for service” basis or paid out of the commissions on the products sold by advisers (creating conflicts of interest). Fortunately commissions on investment products are now banned. However the cost of traditional advice provision means that it is still out of reach of most Australians.

So Retirement Essentials re-imagined how financial help, guidance and advice could be made available to everyone.

Our goal was to enable everyone to get affordable help, when it is needed, and in ’actionable steps’. We also believe in educating and empowering our members to be able to take control of their finances with confidence.

Everyone has a different journey to, and through retirement. So we try to break down the questions and answers into bite-sized chunks, allowing our members to tackle the issues they want, and in the order that’s relevant to them.

For some, it’s getting comfort that they won’t run out of money on their current plans. For others it’s working out when they can afford to retire, or whether they can take a special holiday or help their kids out financially. Whatever it is, the most important thing is to take that first step on your journey to retirement confidence.

Most Australians have a reasonable idea of their goals but may not be sure if they can be achieved. This is the starting point of your retirement planning journey. We then help you understand:

- the likelihood that your money will last,

- all options that you have and

- ways to maximise your government entitlements.

We then seek to keep you in control as you monitor and adjust.

Covering all this ground usually takes a few conversations – there’s a lot to consider and it doesn’t all have to be done at once. So the most important thing is to get started, and work with your adviser to prioritise and plan your journey. Start your journey now.

How Retirement Essentials helped Roslyn

Roslyn was shocked and distressed when she was suddenly widowed at age 64. She had assumed she would work for years longer, as would her older husband. But being suddenly single brought loneliness which, in turn, led to a strong desire to spend much more time in Denmark with her only daughter and grandchildren.

She reached out for advice on her super, asking how to access it and how to understand if it would allow her to travel annually for a few weeks at a time. She was surprised to learn that accessing her super in an Account-Based Pension meant a saving in tax. Our adviser Nicole Bell showed Roslyn (using our retirement forecasting tool) that her savings were more than enough to allow her to give up full time work and only pick up casual shifts when she wanted some extra income.

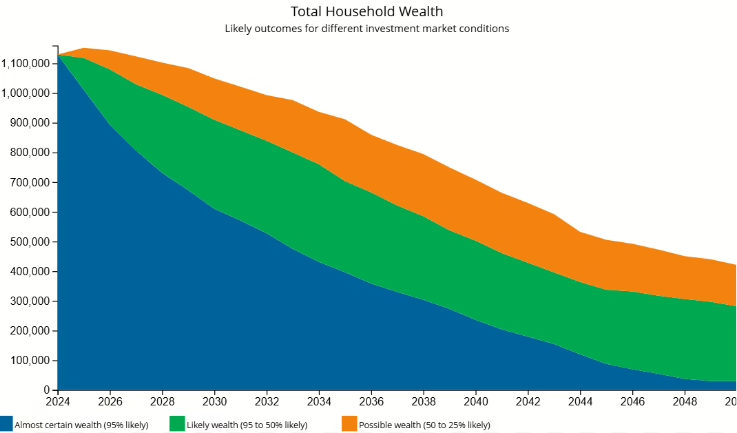

Our team can help you understand what your wealth is likely to look like over the years to come.

We use scenarios to compare options and big decisions that you may be contemplating, to help you make the right choice. Book now to see your future.

Why get advice

Research tells us time and again that those Australians who do seek advice generally report:

- an improved financial situation

- more peace of mind and

- a stronger sense of control.

But there are two major reasons that seem to prevent many Australians from contacting an adviser. The first is the ongoing fallout from the Royal Commission into financial services resulting in a lack of trust. The second is that they fear it will cost thousands of dollars that they can ill afford. Both these reasons can be surmounted. As can many other concerns for retirees who are swamped with information, to the point they don’t know how to get started.

Since the report from the Royal Commission, further regulation has seen a shake-up of the financial services industry, with clear regulation guiding what financial advisers can and cannot do. This has largely stamped out most of the poor previous practices that led to this enquiry. It has resulted in a much leaner financial services industry with an enhanced focus on customer outcomes. This has done a lot to improve the trust ratings for those offering advice. The cost of comprehensive advice can run to about $4000-$5000. But the rapid development of digital calculators now allows companies such as Retirement Essentials to use sophisticated tools to deliver relevant advice to customers for as little as $375.

What advice is most useful?

We asked our advisers what members are seeking when they book a consultation.

They replied that there are two main reasons those going into retirement seek advice:

- The first is because the member is heading into retirement and has literally no idea how to get started. They are overwhelmed by information but unsure of how to structure their planning, how to match goals with potential income and how to time their actions to most effectively make the transition.

- Others have ‘a bit of a plan’. They’ve done some research and have an idea of how they will fund themselves. But they would like these plans validated so that they are confident they are on the right track. They also want any possible pitfalls raised and anything they may not have known, or have overlooked, included in their calculations.

It is in response to these two overriding income concerns that Retirement Essentials created ‘bite-sized’ advice consultations. Our experience has shown that customers are hesitant to ask for help because they’re worried they will be pushed into new products they don’t understand or need, or that they will be locking themselves into advice fees forever. Booking with Retirement Essentials enabled them to understand what they needed to do, while feeling safe the advice they received for their situation was independent from their product. These advice consultations provide a process that ensures that both ‘one-off’ situational needs and longer term planning can be handled when and as needed. It reinforces the understanding that a 25 or 30-year retirement is a journey – and your financial support needs will vary at different ages and stages.

This is how bite-sized advice works

Roslyn’s assets mean that she is unlikely to qualify for an Age Pension until much later in life, so she wasn’t seeking information on that score. What she did need was guidance on super rules, specifically tax implications and how long her savings were likely to last.

She’s moved ahead with her decision-making but told Nicole that she would like to touch base again in 18-months because by then she believes she will be ready to sell the family home. As she still has a small mortgage, she wants to model whether using super to pay it down vs other options, including possibly selling and using downsizing contributions would be the best option to further boost her super and retirement spending.

What happens in a typical Retirement Essentials consultation?

Advisers meet clients for a 55-minute online consultation. They start by agreeing on the purpose of the meeting because the adviser is there to work through what is most important from the client’s perspective. Together they can then consider pros and cons of different options and look at what each of these choices may mean over the short and long term. This allows them to feel confident that the decision they make is the best for their circumstances. All options are assessed according to government rules. If relevant for your situation the key points are summarised, in a document called ‘Statement of Advice’ that is emailed after the consultation, along with any relevant helpful further information so that the client has a clear and concise picture of their financial situation and options.

Many clients are delighted to have their understanding confirmed and report feeling much more confident and in control. Others may want to do further research and then come back to model different options now that they have a fuller understanding of the way the rules actually work. As each consultation is a flat fee of $375 (including GST) our clients also confirm they are great value and feel that they can afford to come back as and when they need to.

How do most clients judge the value of their consultation?

Most clients come to us with a specific, nagging problem that they wish to solve. Our fully qualified advisers help them identify the details why this is a problem and then explore the options that they have to solve that particular need. The critical benefit they say they have received lies in the recognition of the main issue and the highlighting of relevant options that can be applied to their issue of concern. This often involves people gaining a better understanding of rules and the subsequent reassurance that they are likely to be okay in retirement – and that they can retire when they want to. These answers provide structure and direction for their plans. Says adviser Sharon Sheehan, ‘…most of us just want to know we will be okay.’

What is the Retirement Essentials’ point of difference in advice?

- Affordability

- No product recommendations

- Specific ‘episodic’ advice (you choose when you want a consultation)

- Clear upfront fees

- Best practice digital tools and expertise

The outcome

Put simply, many people planning retirement come to us concerned and confused and after their consultation, tell us that they are moving forward with confidence and capability.

There’s a lot to like about that!

What is the price for a consultation?

The consultation costs $375 for 55 minutes with one of our qualified advisers. Depending on your specific situation you may receive a ‘Statement of Advice’, a formal summary of the matters discussed and the options canvassed (it is also shareable with trusted others, including family or perhaps your accountant or lawyer). We may also provide you with other relevant information articles or links specific to your conversation and situation.

Types of ‘bite sized’ advice on offer from Retirement Essentials:

Retirement Forecasting – assists you to develop a safe spending plan and how your assets and income could look in the future.

Understanding more about your super – helps you to assess the options to make your super work harder and better.

Maximising your entitlements – allows you to see if you can make any changes to maximise your Centrelink entitlements.

Your home and your mortgage – considers the benefits of repaying or maintaining your mortgage in retirement.

Have you sought financial advice?

If not, what do you think is preventing you?

Good Morning

I retired in 2021 at the age of 77 and now 80 YOA

I have two nice nest eggs and would like to confirm if I am eligible for a part pension?

What would Retirement Essentials fee be for an assessment.

Thanks

Hi Laurie, we have a FREE calculator that you can use HERE if that is all you need. If you’d like to discuss your situation with someone and what could you do more/better/different/less then our Maximising Entitlements consultations cost $375 and to make a booking, please CLICK HERE.

Laurie with 2 nice nest eggs as you say why the hell would you worry about a pension ?

Invested well you will possibly never ever need a pension .. Think how long you may live and the amount of money you spend now for your wild life style at 80 ( I am 82 ) and slowing .

Centrelink is a mine field and the effort to get a part pension is just a challenge and not a must have. Yes talk to a smart and for the sake of 3-4 hundred bucks it is the easy way out. …