Talking about risk and retirement is a little like talking about debt and retirement. We may be aware that we need to confront this, but words like risk and debt can have negative connotations. This means many of us will avoid ever ‘going there’. But this can be a mistake. It’s usually only by managing debt and understanding risk that we can fully maximise our later life income.

In search of an easier way to tackle these thorny issues, it occurred to me how much most of us love a makeover. Whether it’s a farmer in search of a wife, a ‘grand design’ for a renovation or a bootcamp in the jungle to fast-track fitness, most of us love to see the foundational work-in-progress which is necessary to create better outcomes.

How does this foundational work translate to managing money? Not as a quick fix, that’s for sure. But creating strong foundations by understanding investment risk is a very useful strategy. It starts with self-knowledge and then applying this understanding to the way you invest and the settings you choose. Today we explore this topic and look at a ‘makeover’ that could lead to $100,000 extra in retirement savings, should Bevan and Anne make this choice.

Know thyself to improve the investment outcomes

It all starts with knowing your retirement goals and how much risk you are prepared to take to achieve them. Knowing your investment personality can help a lot when it comes to your retirement goals and income. Not everybody will take the time to carefully define their major retirement goals, but those who do will be amply rewarded. That’s because they will have moved from the ‘how long is a piece of string’ retirement income dilemma to being able to cost both your short and long term aims. This leads to greater clarity on your capacity to fund these goals. As well as understanding your needs and wants, it’s also helpful to understand your potential life expectancy. This gives you a ‘best guess’ target (your likely lifespan) as a basis which to crunch future income calculations.

Understanding your options and how diversification may help

Diversification is often used as shorthand for a somewhat simplistic choice between investing in major asset classes such as cash, shares or property as well as whether these assets sit within the super environment, or outside. But today’s investor has a fast-increasing range of investment options. These options now include indexed funds, exchange-traded funds, Bitcoin, works of art and other collectables. Managing diversification also means managing timing – when you buy and when you sell. It’s tricky and so-called experts can often get the timing wrong. That’s another reason why more fully understanding your own risk appetite can help guide you in all aspects of investment choices.

Short term shocks v longer term gain

Holding your nerve if the stock market dips is a valuable attribute. The continual bombardment about where the ‘market’ went today is both distracting and unsettling

Investing for retirement income usually means investing for the long haul. So how do you hold your nerve as assets rise and fall? Understanding a little more about the context of your investments is always helpful. There are many projections which can show you the relative increase in value of different assets over an extended period of time (One of the most highly regarded is the Vanguard Index Chart). This chart underscores a truth of investment – that those who hold assets and don’t sell down during a market tremor will normally do better over the long haul.

Choosing the right setting for your temperament

Again, your ‘comfort factor’ is really important when it comes to choosing the right settings for your investments, particularly large sums invested in super whether in accumulation (saving mode) or when you start to draw down (spending mode).

It’s not quite as simple as picking a conservative, balanced, or growth profile. Some funds offer ‘pre-mixed’ investments. Alternatively, you can pick and choose the ratios yourself, including cash investments and perhaps ethical, if that is your preference.

Retirement Essentials has a risk tolerance calculator that helps you understand your tolerance for risk and the investment portfolio best suited to your risk tolerance. It uses a scale from 1 to 8. 1 indicates you are extremely risk averse while at the other end of the scale a score of 8 would indicate you are prepared to take a lot of risk to generate a high return. Your risk tolerance is then used to determine the type of investment portfolio that matches your profile. So someone with a risk tolerance score of 1 would be matched to an investment portfolio with a market risk level (MRL) of 1. This will be made up of cash and fixed interest investments. A MLR of 5 would be a mix of cash fixed interest as well as growth assets such as shares and property while a MLR of 8 would be almost all growth assets.

As retirees live longer lives, many will find that their investment approach can have a significant impact on their retirement savings. Today’s case study highlights how this might constrain your eventual income

Gearing up for an affordable retirement

Bevan (62) and Anne (60) are homeowners who are five years away from their anticipated retirement date. They currently have a total of $690,000 in assets and earn $55,000 and $35,000 respectively per annum. Their planned retirement ages are 67 for Bevan, 65 for Anne. Their planning ‘horizon’ (to cover longevity) is 95 years of age and they hope to live off $50,000 per annum in retirement. The two following charts are very revealing.

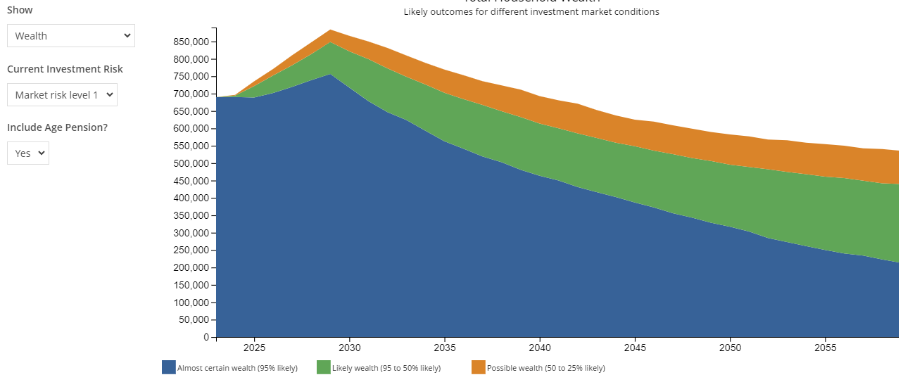

The first shows a conservative setting with a likely wealth level at retirement of $848,000.

Likely wealth level at retirement: $848,000 (in 5 years)

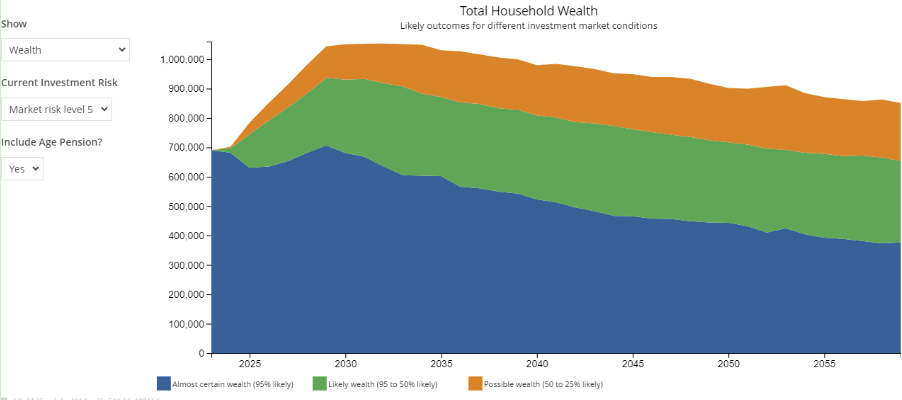

The second chart, with a more balanced investment mix, shows a likely wealth level of $937,000 over the same 5-year time span.

MRL 5

Likely wealth at retirement: $937,000 (in 5 years)

Did you spot the difference?

The first chart has a Market Risk Level (MLR) of 1 – highly conservative, made up of cash and fixed interest.

The second chart has a MLR of 5 which is much more balanced with property and shares as well as cash and fixed interest. Bevan and Anne’s savings are likely to last much longer in scenario 2 with a MRL of 5 and or they will most likely be able to spend at a higher level throughout their retirement.

Working out your risk tolerance and investment temperament is not easy to do on your own. Too much subjectivity may lead you to default to old perceptions of your attitudes and your ability to withstand financial market volatility. That’s why Retirement Essentials advisers offer affordable one-on-one (or two, if you are partnered) consultations to explore your risk tolerance and how this will affect your lifelong income potential. Is now the time to treat yourself to this highly tailored advice experience?

Making some of the more complex aspects of retirement income comprehensible is our aim. Next week we will share part-two of this explanation of risk by stepping through the key indicators of your risk appetite. We’ll also show how fine-tuning retirement income strategy can deliver significantly increased annual income further down the track. don’t miss it!

This article is provided by Retirement Essentials Representative Number: 001260855. We are an authorised representative of SuperEd Pty Ltd ABN 88 118 480 907 AFSL #468859. This information is not intended as financial product advice, legal advice or taxation advice. It does not take into account your personal situation, goals or needs and you should assess your own financial situation, consider if the information is suitable for you and ensure you read the relevant Product Disclosure Statement (PDS) if you choose to make any changes to your financial situation. It is always advisable to consult a financial adviser before making financial decisions.

50k a year wont cut it in 5 years time ! we retired 4 years ago on approx 58k (replacing net income) now our day to day budget we need at least 65k to keep pace with inflation n cost of living etc / and that’s only a moderate to comfortable lifestyle – no expensive holidays /cruises cars etc ( we are debt free as well)

totally agree! you need at least $65k for a modest retirement

We retired 8 years ago with an idea to spend $50,000 per year. We started at $39,000 and it’s increased a little each year to the last twelve months being $47,000. So still have not got to $50,000.

Remember the pension increases regularly, it’s a key component of your retirement income.