Last week Jeremy Duffield wrote about ways to understand and manage economic volatility. We received a lot of feedback on this article as it is a widespread concern for retirees. Jeremy’s stance is similar to that of most respected commentators; that it’s necessary to stay calm, avoid unnecessary kneejerk withdrawals and things will turn around.

But because that is the commonsense view doesn’t mean it can be embraced by every retiree. It’s important to recognise that some retirees are finding this advice really difficult to follow. Some say that they feel trapped, with dwindling assets and uncertain future income, and no way out.

Meet June and Marcus

June and Marcus (not real names) are one such couple. They contacted us last week as they wanted to better understand if they had any options at a time when they feel as though their finances are spiralling out of control.

What’s their situation?

They are both fully retired, on a combined couples part-Age Pension. Their personal assets are:

- Andrew’s Super: $500,000 in an Account-Based Pension (ABP)

- Louise’s Super: $200,000 – in an ABP

- Bank account: $10,000

- Personal assets: $50,000

They live in their own home with a small mortgage ($50,000). Their current combined Age Pension entitlement is $22,417.

At the time of speaking with Andrew, there had been a 6% drop in their super assets (this has since fluctuated even more). In adjusted terms, this means that their current financial assets are:

- Andrew’s Super: $470,000 (ABP)

- Louise’s Super: $188,000 (ABP)

- Bank account: $10,000

- Personal assets$ 50,000

So they felt that they had watched their super reduced by $42,000 in less than a week when the Australian Stock exchange had lost around 4%. This loss was on top of a 5% slide in their super savings since 1 January this year.

How do you ride out the storm?

How could they calmly ride this one out, they asked Retirement Essentials adviser Andrew Dunkerley? Andrew worked with June and Marcus in a Retirement Advice Consultation using two important tools to enable them to ‘see the future’ as far as their income and long term savings are concerned. Their main fear was a common one – fear of running out – which was exacerbated by the uncertainty around market volatility and tariff decisions made by leaders in other countries.

But first Andrew shared some good news, an action they could take immediately that did not involve crystallising the losses caused by the market slump.

How did Andrew help?

First Andrew checked their Age Pension entitlements, given their assets are now lower. He showed June and Marcus that they are now eligible for $25,693 per annum.

This can be achieved by immediately advising Centrelink of the drop in their superannuation balance, which means their Age Pension payments should increase by $3,276.

This has a secondary benefit. It also means that they can reduce how much they draw from their ABPs, thus reducing the long term impact of recent negative returns in their super accounts. If the current bear market becomes as severe as the Global Financial Crisis (GFC), they will still be able to meet their income needs, totalling $70,000 per annum until they are both beyond age 90.

The historical ups and downs

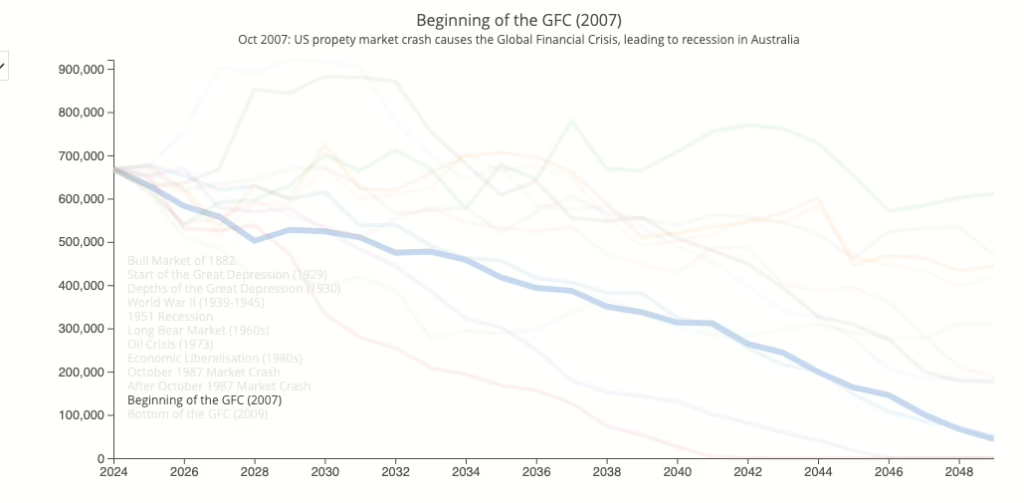

Market volatility is not a new occurrence. Many retirees will recall at least three shocks across their lifetimes, all of which needed to be understood and managed at that time. While these market falls had different catalysts, all were alarming to those living on fixed income in retirement when they first occurred. These shocks were:

- October 1987, also known as Black Monday. Triggered by drops in Wall Street, the ASX followed and fell by an estimated 50% across a two month period.

- September 2008, when the Global Financial Crisis (GFC) hit – causing another 50% revaluation in the ASX, over a period of two years. This fall is largely blamed on toxic housing mortgages which were out of control in the US in the years prior.

- March 2020 when the Covid Pandemic was declared, caused an overall drop of about 30%, with global lockdowns, and trade restrictions feeding into the uncertainty. Strong central government responses helped many citizens withstand the worst of this correction.

Using Retirement Essentials historical scenarios tool, Andrew was able to show June and Marcus what would happen had their (current) funds been invested at the start of the GFC, noting that they would still have money left beyond age 90. More precisely, they will have about $60,000 left in today’s dollars at age 90.

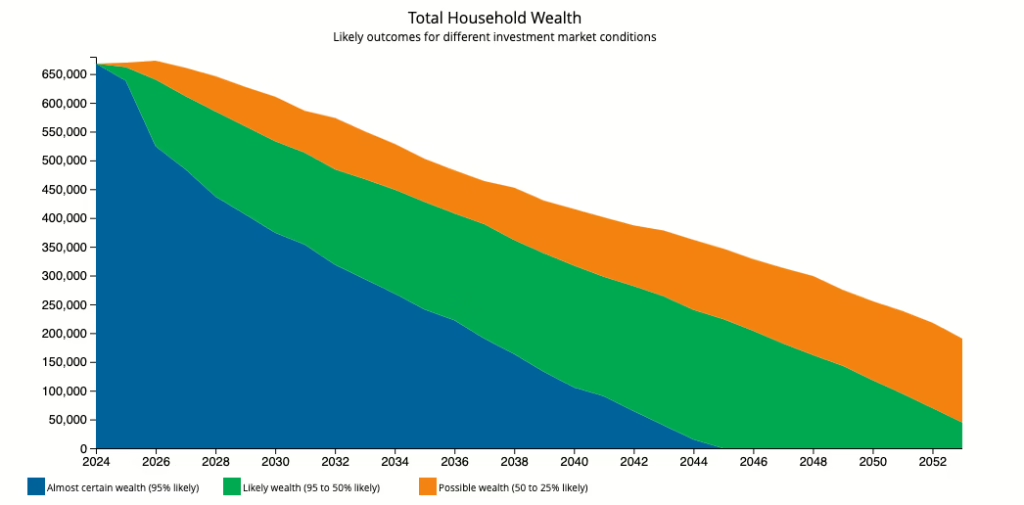

Next he assisted June and Marcus by modelling ‘likelihoods’ of the way their new balance of $658,000 would last from today (this financial year) through to their 90s. To forecast how your savings may grow or decline over time, we present three scenarios. Blue is our conservative estimate, indicating what we expect your assets to be worth at certain points in time (95% probability). Green highlights the most likely range of possible results, displaying values that are more likely to occur – 50% to 95% of the time. Orange indicates what is possible if market returns are favourable throughout retirement (25% to 50% probability).

Here’s how their money is likely to last:

Both June and Marcus felt both relieved and confident that their current plans and strategies are achievable.

Reframing financial stress

There are four useful takeouts from the consultation June and Marcus had with Andrew:

- The cause of the current market turmoil is unusual because it stems from unconventional decisions taken by the US government.

- However actual volatility is not unusual, and navigating short-term market downturns is a necessary part of investing for the long-term.

- External events including conflict in Europe, the Middle East and tariff decisions by trading partners are outside our control. We can respond to them, but never prevent them; accepting this can help manage feelings of stress and provide encouragement to take the actions available to us.

- Understanding super and other retirement savings as a pool of money designed to complement Age Pension entitlements or to pay your full retirement ‘wage’ is useful. Thinking of this money as a ‘nest egg’ that will never diminish is less so.

- Checking stock markets and balances on a daily or weekly basis is not necessarily good for your heart rate. Understanding your overall financials on a monthly basis may reduce your stress and still allow you to keep your finger on the pulse.

Andrew managed to reassure June and Marcus by sharing their likely long term prospects as well as sharing immediate action which can increase their current income. He says:

In my experience, when the market’s going down and you stay the course, when the financial markets recover, you will be happy. As the old saying goes, ‘frightened money never wins’.

Retirement Advice Consultations

At Retirement Essentials we appreciate that feeling in control and having peace of mind in retirement is not always easy and that everyone’s individual retirement journey is different. Every week our experienced advisers help our members to gain peace of mind through our Retirement Advice Consultations which promote confidence and a sense of control, regardless of the stage of your retirement journey.

Are you, too, alarmed at your shrinking savings?

If so, what’s your strategy to ride this out?

Relevant to this modelling is their age. For example, we have considerably less in Super and we are in an ABP and receive a part pension. Our ages are 73 and 74 respectively. I presume this couple are at least 65. To compare we would have to know their ages. Given we don’t know who they are, can we know their ages?

Hi Peter, thank you for reaching out! June and Marcus were 67 and 68 respectively.

i like the newsletter. have learnt a lot. not wishing to discredit any of the information given.not a financial advisor. single, widowed 74yrs, past managed own smsf.

experienced 1987 crash but no super at time.

experienced GFC first hand . late husband , a dr, had just closed his MLC account to open a SMSf, a ll his money was in cash. Then GFC. would have lost half his super if he had taken advice from financial advisors he saw. i know 2 friends who lost half their super and had to keep working.

2025 chaos, urrent. we have one unpredictable , uninformed , financially illerate person Trump, causing global chaos.

there is no end in site.

re hedge funds, banks, no one knows who has lost a lot of money.

it could get much worse.

i do not feel ignoring tge above unpredictability is the way to go for older retirees. capital preservation.

11yrs experience smsf i have changed my super asset class for now. conservative balanced to cash for now to halt my lossess. i do not want to lose my capital. there is a time to reinvest. not now

I’ve retired has I’m moving to live in the UK. I can get my super when I’m 60 next August. Should I take as a lump sum or withdraw certain amounts?

Hi Annette, that is a great question that it is important to get right. We’d need to hold a consultation with you to talk through the specifics of your situation which you can book HERE.