Geopolitical events, such as wars or global pandemics, can disrupt and cause significant volatility in markets. While these events are beyond our control, understanding their impact on your investments —and how to manage risk effectively—can protect your long-term financial goals.

The impact of geopolitical risk on markets

In their report for 2025, 56% of leading chief economists at this year’s Davos World Economic Forum are expecting weaker global economic conditions, compared to only 17% who expect improvement. The International Monetary Fund (IMF) projects global growth to stabilise at 3.3% in both 2025 and 2026, which is below the historical average of 3.7% from 2000 to 2019.

Donald Trump’s re-election as the 45th and now 47th American president has reignited commentary about potential market volatility, with his previous term marked by tax reforms, trade wars, and deregulation that created uncertainty for investors. However markets delivered strong returns during that period.

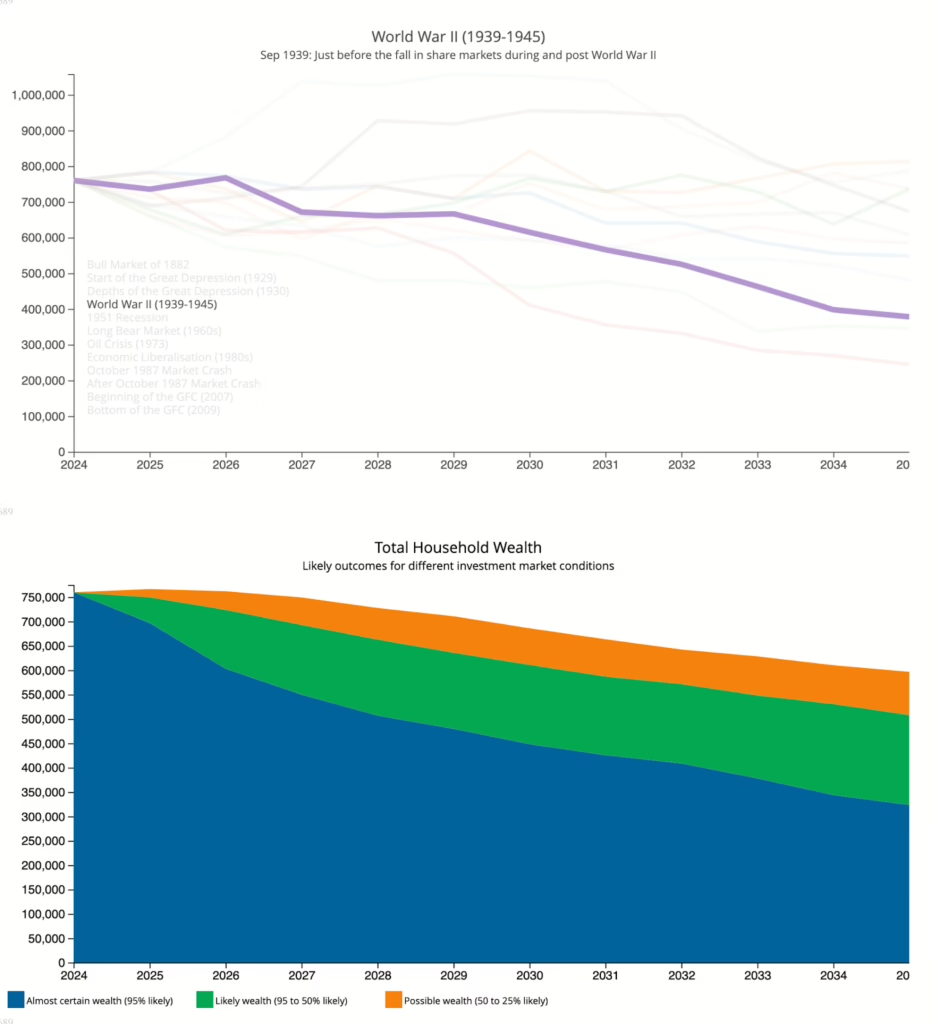

Without having a crystal ball, the next best thing is the benefit of hindsight. Geopolitical risks, including political instability and international conflicts, often trigger sharp market movements. While these events may cause short-term losses, markets typically recover as they adjust to new realities, as evidenced by the following graph:

Source: Saxo Bank 2025

John and June gaze through the crystal ball

Take John and June, for example, a retired couple both aged 67 with $750,000 combined in super and investments, and planning to spend $75,000 each year in their early years of retirement.

They’ve recently contributed funds from matured term deposits into their super to commence Account-Based Pensions (ABPs). Previously their superannuation was invested in the default balanced option of their super funds, which allocated 50% to growth assets. Along with the Age Pension, their Account-Based Pensions will now be their primary source of income in retirement, so as they begin to draw down funds, selecting an appropriate investment option is a key concern for them.

Looking at their projected super and investment savings over the next 10 years, our retirement forecasting tool shows ranges of likely future outcomes under different investment market conditions.

We can also use historical scenarios to demonstrate the impact of known historical events. For instance, simulating the effects of World War II on markets, we find that their total household wealth would be just over $400,000 in 10 years time – which falls within the green zone of our predicted likely outcomes based on their circumstances under ‘average’ market conditions.

Historically, markets have shown resilience, with long-term trends often rebounding from geopolitical shocks. Preparing for these risks ensures you’re ready to respond calmly when volatility strikes.

The dangers of panic: why moving to cash can be risky

In uncertain markets, some investors panic and move their assets to cash, fearing further losses. While this may feel like a safe choice, it locks in losses and prevents you from benefiting when markets recover.

Last year we reported on Bevan and Anne which is a great example of this, where moving from a defensive portfolio to having a balance of defensive and growth assets would likely increase their portfolio value by $89,000 over a five year period.

Balancing risk and reward: understanding your investment mix

A well-balanced portfolio of growth and defensive assets is key to managing risk. Growth assets, like shares, provide higher returns but come with more volatility. Defensive assets, like bonds and cash, are more stable but offer lower returns.

The mix of assets in your portfolio should reflect your goals and risk tolerance. For example, if retirement is near, a greater focus on defensive assets may suit your needs. If you have a longer investment horizon, growth assets might play a larger role.

The right balance depends on your own situation and needs. As one of our insightful Retirement Essentials’ members recently remarked on the benefits of long-term investing: ‘Many retirees may not live long enough to take advantage of it as in my case. So, in my circumstances I invest for the short term which will look after the medium to long terms should it materialise for me’

Time horizon: the importance of long-term planning

Your time horizon—the period you plan to invest—plays a critical role in managing risk. If retirement is decades away, short-term market drops are less likely to derail your strategy. However, if you’re nearing retirement, reviewing your portfolio and reducing risk exposure may be necessary.

A longer time horizon allows you to ride out temporary market downturns and take advantage of opportunities when markets recover. By understanding your time frame, you can stay focused on the bigger picture.

How Retirement Essentials can help

At Retirement Essentials, we assess your risk tolerance and help you manage market fluctuations. Our advice team works with you to evaluate your financial situation, goals, and time horizon, in a specific Understanding Investing consultation so you can take the steps to ensure your portfolio is appropriately balanced.

Conclusion: stay calm and stay focused

Geopolitical risks and market volatility are part of investing, but they don’t have to derail your retirement plans. By understanding your risk tolerance, balancing your portfolio, and aligning your investments with your time horizon, you can manage uncertainty with confidence.

Individual circumstances, rules, and opportunities vary greatly. However, the key principles remain the same:

- take a long-term view of your savings and income,

- make thoughtful and informed decisions, and

- stay up to date with market conditions and your financial situation.

These steps are essential to maintaining financial fitness throughout retirement.

Retirement Essentials offers tailored consultations designed to provide practical, bite-sized advice. If you’re looking to review your retirement income or entitlements, here are some of the services that may suit you:

• Retirement forecasting: Compare two scenarios to understand how your assets and income could look throughout your retirement journey.

• Making the most of your super: Explore strategies to maximise the effectiveness of your superannuation.

What’s your view?

• Are you confident in how your current financial setup supports your long-term retirement goals?

• Have recent market movements prompted you to consider adjusting your portfolio mix?

We’d love to hear your thoughts!

This article is provided by Retirement Essentials Representative Number: 001260855. We are an authorised representative of SuperEd Pty Ltd ABN 88 118 480 907 AFSL #468859. This information is not intended as financial product advice, legal advice or taxation advice. It does not take into account your personal situation, goals or needs and you should assess your own financial situation, consider if the information is suitable for you and ensure you read the relevant Product Disclosure Statement (PDS) if you choose to make any changes to your financial situation. It is always advisable to consult a financial adviser before making financial decisions.