Keeping Retirement Simple – Part 9

If you’re fortunate enough to own your home – about 3 of 4 of our clients do – then you have a great opportunity to consider what role your house plays in your retirement plans. For Australians overall, housing is their largest single source of wealth, well ahead of superannuation. Some think of it as the “fourth pillar” of our retirement system…and there are a number of possibilities for using your housing asset to improve your retirement.

So, Principle #9 in our Keeping Retirement Simple series is: Think about your house as a part of your retirement strategy as well as a nice place to live.

The Home and Retirement

Owning your own home has numerous advantages in retirement:

- You don’t have to pay rent – so it should reduce your outgoings as long as maintenance and any interest costs are under control.

- Many people want to age in their own home and ownership provides the assurance that you can do that.

- An owned home (your primary residence) doesn’t count as an asset for the Age Pension …so you can have a highly valuable asset without having your pension reduced.

- Over Australia’s history, housing, while subject to some down periods, has been a remarkable store of wealth and growth.

- Housing can serve as an asset to borrow against – providing a potential source of income or emergency funds when needed.

Different views about the home

Seniors’ attitudes to housing in retirement vary. Many people think of it only as a “roof over our heads” and don’t think about the financial implications or how it might help out in retirement. Others think of it as insurance against a rainy day. They think… “well, there’s always the house.” Or “If something goes wrong with my investments, I can sell it.” Or “If I need to move to Aged Care I can use it to fund the Aged Care deposit.” Others think of it as a legacy … “I can leave to my kids, something to pass down to the next generation.” And then some people think about it strategically as part of their retirement plan. “I’ve got this valuable asset; how can I use it to create income to fund my expenses?”

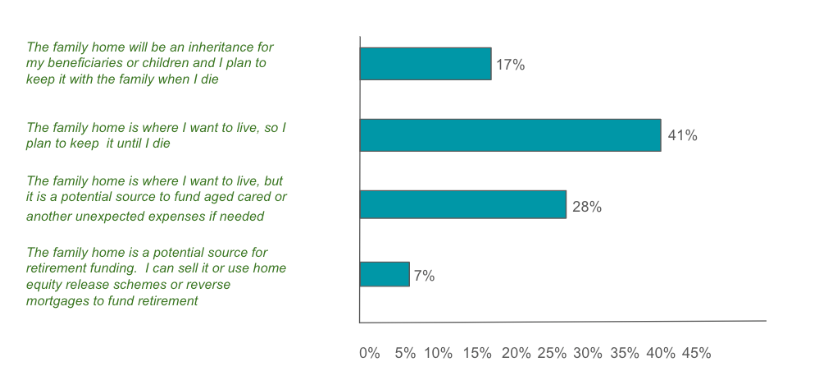

The chart below shows the very interesting results of Vanguard Australia research on how retired Australians view the home:

Source: Vanguard Investments Australia: How Australia Retires 2024

Your home can help fund your retirement

What’s perhaps surprising is the relatively small number, seven percent, who think of using their home to create retirement funding. Given the extraordinary increase in the value of housing, many Australians are “asset rich” and “income poor.” Locked up in the value of their home is a source of income available to be tapped. Let’s talk about that.

There are a couple of ways you can turn this major asset into income. The first is selling the home or downsizing. Many people find their houses are much bigger than they need – once the kids are gone. They might want to downsize (like I did). Buying a smaller place or moving to an apartment may free up cash to invest to earn income. Although we hear many people end up changing houses but spending as much on the new place as the old one; it’s just different.

But if you do downsize, and you’re over 55, there’s now the opportunity to make a downsizer contribution to super for up to $300,000 or $600,000 for a couple. One of our Understanding More About Super Consultations can help you to assess if this could benefit you.

That’s a really useful way to top up your super, if that’s your objective. If you’re on the part Age Pension, you do need to be aware that increasing your super increases your assets and deeming for purposes of the Assets and Incomes test and so is likely to lead to a decrease in your Age Pension. Remember under the assets test, for those on the part Age Pension, every extra $1000 in assets leads to a reduction of $78 per year in the Age Pension payout. Income is also deemed on your super balance so you might also be impacted by the income test.

A second way to use your home as part of your retirement strategy is to get access to the equity you have in your home. The most common way to do this is through a reverse mortgage. This is a loan backed by the equity in your home. You’re able to borrow a portion of the home’s value and not have to pay interest until the house is sold. You retain the right to stay in your home and you are typically assured of no “negative equity” – that you won’t be penalised should the loan come to exceed the value of your property.

Reverse mortgages can be used for multiple purposes. Some people use them to fund lump sum expenditures, like a renovation or a new car. They can also be used for topping up regular income.

Reverse mortgages are available from both the government and from private providers (such as Household Capital). The government’s program is called the Home Equity Access Scheme and is available to those of Age Pension age (67) – even to people who don’t qualify for the Age Pension. The Scheme allows regular payments up to 150% of the Age Pension rate – which includes any Age Pension entitlements. So, if you were already on the full Age Pension, you could get another 50% of the Age Pension rate. If you’re not on the Age Pension, you could be eligible for one and a half times the full Age Pension rate.

Currently, the government’s Scheme has a very low, probably unsustainable, interest rate of 3.95%. Private offerings of reverse mortgages have a much higher interest rate. However, they often offer much more flexibility and choice. So, you can shop around and find what might work for you.

A third way to potentially increase your income for retirement applies to those people who have a mortgage. We find about 15% of Retirement Essentials clients still have a mortgage going into retirement.

If you’re on a part Age Pension, and have a mortgage, you may be better off by paying down the mortgage with your super or savings. Doing that reduces your assets which count against the Assets Test and may qualify you for more Age Pension. Again, for a part pensioner, reducing assets by $1,000 increases the Age Pension by $78 per year. Retirement Essentials offers an Understanding Your Mortgage consultation which can help you think through your options.

So, there are a number of ways your home can help you in retirement. It deserves some thought on what works best for you.

Re downsizer contribution to super: my partner and I met a few years ago, we are both 63 years old and fully retired since April 2024. We had lived in our houses for more than 15 years (both are paid off) before we met. June 2023 we bought a house together which is our home.

My previous home is now a rental property, but for tax purposes is known as my principal place of residence. I now know if I sell this property, I can take $300k from the proceeds and contribute it to super under the downsizer rules.

My partner sold his previous home last financial year 16/1/24 and the proceeds are basically sitting in the bank. We didn’t know about the downsizer contribution then. Is it too late for him to put $300k into super as a downsizer contribution? (He has already transferred $110k as a non-concessional contribution). thank you, Liza and Derek.

Hi Liza, the rules are tricky to navigate and as such we can’t comment with certainty without understanding a few extra things. It’d be better to book a 1v1 consultation with one of our specialists HERE who can go through it all with you.

thanks Steven but we found out the answer was quite simple. You only have 90 days after settlement for the downsizer contribution, so my partner is too late.

Owning one’s home is a plus but, apart from daily essentials like food, costs such as body corp fees or council rates and insurance are constantly on the rise. Same with reverse mortgages, somewhere at some point, they have to be paid back by someone. This unfortunately is reality for many if not for most retirees.

My husband who is 77 this year is currently on holiday and long service leave until late October this year when he will retire. So, he is still basically earning money and we don’t know how to fill out all the associated questions regarding income. When should we apply for the age pension? I understand it can take up to 4 months. I am retired and earned nothing for 9 years, I am 72.

Hi Vicki, Centrelink will assess your husband as still being employed and therefore whatever his yearly salary is will be assessable as income. If you are still under the threshold then you can apply now but if his salary puts you over the threshold then you would need to delay applying until 13 weeks prior to his retirement (approx. 1st August).

your subject of reverse mortgage is interesting and one I would love to do. however with many retired people buying into lifestyle communities where we own the home and not the land we are locked out of this valuable option to use our home equity in retirement

I am permanently separated from my (younger) wife. I fully own my house (worth circa $400,000) which I bought outright from my previous property split of my then wife. My present wife may apparently be able to claim about 25$ were I to sell my house. I receive a full Centrelink aged pension, have no super and live from my Aged pension alone (VERY carefully). Can a reverse mortgage (probably government) give me a little more fortnightly income?

Hi Nicholas, it’s great you are seeking guidance as it is a big decision that you are considering. It would be best to properly sit down with a specialist to go through all the pros/cons of each of your options. CLICK HERE to make a booking.

Is a Reverse Mortgage funding liable to income tax and does it affect the pension amount?

Hi Lily, funds received from a reverse mortgage are not liable to income tax but can affect your pension depending on what you do with the money. Obviously if you use it to buy an asset like a new car then the car will be assessable or if you leave the money in your bank account then it is assessable there too. If however, you use the funds to renovate your house, then there is no impact to your pension because your house is exempt so increasing it’s value with renovations is of no consequence.

I like the idea of reverse mortgage, as I don’t have a lot of super. I am concerned however that as I get older and frailer and need a higher level of care, the asset of my home will have reduced and be inadequate to fund a reasonably nice place in some retirement facility..

Hi Geoff, Aged Care Bonds and fees are means tested at the time of entry. No matter what you pay(even if it is nothing or very little) you will still get the same standard of room and care in a residential facility of your choice. Some facilities charge ‘extra service fees’ but these may include things like a glass of wine or a hand massage etc In general they are a marketing too that don’t mean that much in reality.

With regard to Liza’s comment on 16/07/2024

Can you both rent out your home and claim it as your primary place of residence?

Hi Kerry, I can’t comment on the rules from an ATO perspective as Tax Law is not our specialty however from Centrelink’s POV yes you can. Many people live in a home but rent out part of it via Air BnB (as an example). For Centrelink purposes you would need to be physically living in the home though, if you are not then they will not consider it your primary residence and the value of the property will be counted as an asset because if you are not living there then you could presumably sell the property and support yourself with the settlement.

My daughter and I bought our house together mortgage is in both our names but I live in it alone and I will still have a mortgage to pay in my retirement, how will Centrelink see this arrangement, will it be deemed as my family home?

Hi Marinda, yes Centrelink will assess you as a homeowner because you live in a home that you own (even though ownership is shared).

May I know if money received from “reverse mortgages of primary residence” considered as income for tax purpose ? and for centrelink pension assessment ?

Hi Hanh, no the money received from reverse mortgages is not counted as taxable income and not considered income by Centrelink either.

Can you apply for the Govt. reverse mortgage when you still have a bank mortgage.

We are retired and I live off my super, my wife has no super but we still have about a $300k mortgage.

Hi Sam, it is technically possible but it is harder to do. Most people would usually use the reverse mortgage to payout the existing one plus whatever extra funds they require rather then have both running concurrently.

I am single , never married and own 50% of the home . I live with a friend who is also single never married, we have a joint tenancy. Does Centrelink take into account I only own half the property and can receive a single aged pension?

Hi Elizabeth, great question as these situations can get messy! Based on how you have explained it Centrelink would be happy to assess you as a single home-owner however they will likely ask you and your joint tenant to fill in some extra forms to formally declare the living arrangement and that there is no romantic relationship.

Can you get a reverse mortgage on an investment property? Or is it only for owner occupied properties? Liz

HI Liz, one of the requirements is you must be living in the property that you are using.

We have not yet retired , I’ve just turned 67 and my wife is 65, we consider ourselves lucky as we own our home , two cars, caravan and camper, have a moderate super of over $400k combined and personal savings, I try to keep up to date with all the Centrelink wants and needs and by our calculations will receive a full pension, The mandatory 5% drawdown is more than enough to cover our yearly outgoings, for which I’ve been keeping records for the past five years, so survival on the pension should be fine. We have a Line of Credit of $100k that was from when we had our business, except you pay interest monthly on amount used, and doesn’t accrue like a Reverse Mortage, My question is would i be wise to keep this LOC active with a Zero balance for those “just in case” moments or close it down completely.

Hi Garry, LOC accounts are not assessed as assets by Centrelink because they are like a credit card, it’s the bank’s money not yours. So you can keep it open and Centrelink will not count it as an asset of yours however this also means that if you were to go into a negative balance on the LOC you cannot use that to offset other assets. So from a Centrelink perspective it is up to you if you wish to keep it open or not, it will not have any bearing on your eligibility.

My partner and I both receive the full aged pension. Can we both apply for the governments Home Equity Access Scheme to supplement our aged pension income when our superannuation runs out ? If so, does our house have to be in joint names.

Hi Rick, based on a quick bit of research it does not appear the property MUST be in joint names to utilise the HEAS scheme so you should be fine.