In the Retirement Essentials April 2024 Retirement Pulse we asked you about your wellbeing in retirement, including your health, happiness and sense of financial security.

This gives us both a better understanding of the lived experience of retirement and the type of information which you may find the most useful. Again, we learned a lot. Here’s a brief rundown of the key points, including a couple of things you may find surprising.

The most useful takeout we have from our many surveys is that no retirement is ever ‘set and forget’. Many retirees are very content and feel financially secure. Others may not feel quite so positive. It’s important to remember that sometimes it’s the small changes that reap the greatest rewards.

In our first question we checked on five key aspects of a satisfying retirement and found our members rank themselves very highly on three statements and slightly lower on another two

The highest ranking was those who have activities, hobbies and interests that they enjoy doing, closely followed by those who consider themselves to be mentally healthy. Having good social connections and relationships came in third.

The two weakest aspects in this question were evidenced by a slightly lower ranking for having a clear sense of meaning and purpose in life, and the lowest ranking was to the statement ‘I consider myself to be physically healthy’. This gives us pause for thought as if you don’t have reasonable health, you are less likely to make the most of your retirement years. There are many aspects of health that we can’t control. Many people are dealt a really bad hand and it can be hard to make the best of it. But research continually points to the factors that most of us can control in order to avoid chronic lifestyle diseases including diabetes and some cancers. Making your health your number one priority is perhaps the greatest favour any retiree can do for themselves.

Your sense of financial security

When we asked if you felt financially secure, the rankings were lower again than the majority of emotional and lifestyle factors above. Financial security was very slightly above physical health which was the lowest performing category.

The value of advice

In many surveys such as this financial security is easily the lowest ranking category. That was certainly the case when we reported on the recent launch of the Challenger Retirement Happiness Index. So it’s interesting that it wasn’t in our survey. One possible explanation is that the answers to these questions may be skewed by the fact that we are asking the questions of readers of our newsletter. So we would hope that reading our newsletter has helped you to keep informed. Also many of our members have used consultations with our advisers and often come back for repeat appointments. Of our overall population, according to the Australians Securities Investment commission (ASIC) only about one tenth of the population has accessed financial advice. More should seek advice as an overwhelming 82% of Retirement Essentials members that felt financially secure have received financial advice.

And 94% of respondents felt financial security was importance to their happiness. It’s very surprising then that so many people don’t get advice. One of our free 10 minute consultations could help determine whether you could benefit from getting advice.

How happy are you?

Again, the Retirement Pulse confirmed the high level of contentment of retirees. When asked’ Are you more or less content since retirement?’ Respondents told us:

- 11% were less content

- 23.5% about the same

- 60% were more content

- And the rest hadn’t yet retired

Which tends to underscore the observation that happiness in later life rests on more than financial independence. Going back to the responses to Question 1, it’s clear that health, social connection, purpose and activities are major factors. And maybe older Australians have gained some wisdom and the ability to take a longer view of life, not stressing the small stuff?

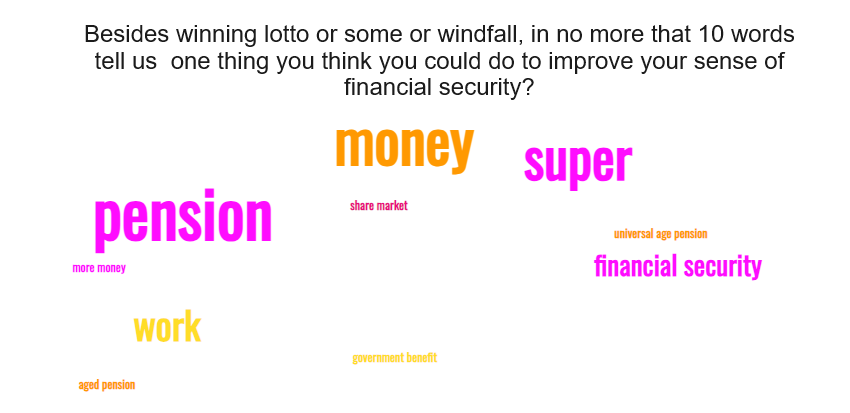

What is the one big thing?

The last question invited members to share (besides a windfall gain) the one thing you believe would help improve your sense of financial security. Interestingly nearly half of the answers were not related to people’s financial actions, but other factors such as lifestyle, emotional or health (13%); work opportunities (6%); government policy (8%) and a significant number said nothing (18%)! Very few respondents suggested downsizing would help – this corroborates the frequent research reporting that most retirees wish to age in place in their own homes. And cost of living barely got a mention, even though we are told it will be the biggest issue in the upcoming election.

Of the 54% of replies that did focus on financial actions, many wanted more certainty in the rules attached to super and the Age Pension. A high proportion felt that more control of spending – knowing where every dollar goes – is key to financial security. Hoping for improvements in the share market were also a common theme as was the need to keep on top of personal finances and make active decisions.

Our advisers receive a lot of great feedback. The biggest compliment of all is a return appointment and these happen frequently as well. Retirement Essentials offers a range of different appointments for different challenges at different stages of your retirement journey. In essence, you will receive bite-sized advice on what you can do now to improve your retirement income situation. Here are some of the ways that we can help:

- Retirement Forecasting (look at what your income, assets and spending could look like over your retirement).

- Understanding more about super (get the most out of your super in retirement).

- Maximising your entitlements (making the most of your financial resources and Centrelink)

- Understand impacts of your home mortgage (assess the benefits of repaying, or maintaining your mortgage?)

Do these results reflect your financial wellbeing?

Or are there more important factors in retirement?

It would be great if you were able to provide a budgeting form for download.