With last week’s headline inflation announcement of 5.1% per annum, it has become a matter of time before the Reserve Bank (RBA) responds by increasing the underlying cash rate of 0.1%. It’s no longer a question of if, but when. Rates will almost certainly rise at the RBA meeting on May 2nd or else at the following meeting on June 7th. If the decision is to delay it is likely that the rise in June will be significant with commentators speculating it could be as high as 0.4%.

This is good and bad news for those in retirement.

For retirees with loans, home or otherwise, they will be facing increased repayments at a time when the CPI is reaching 20 year highs.

For retirees with cash invested (and some will also have loans), the news is better assuming that their cash investments deliver a higher return.

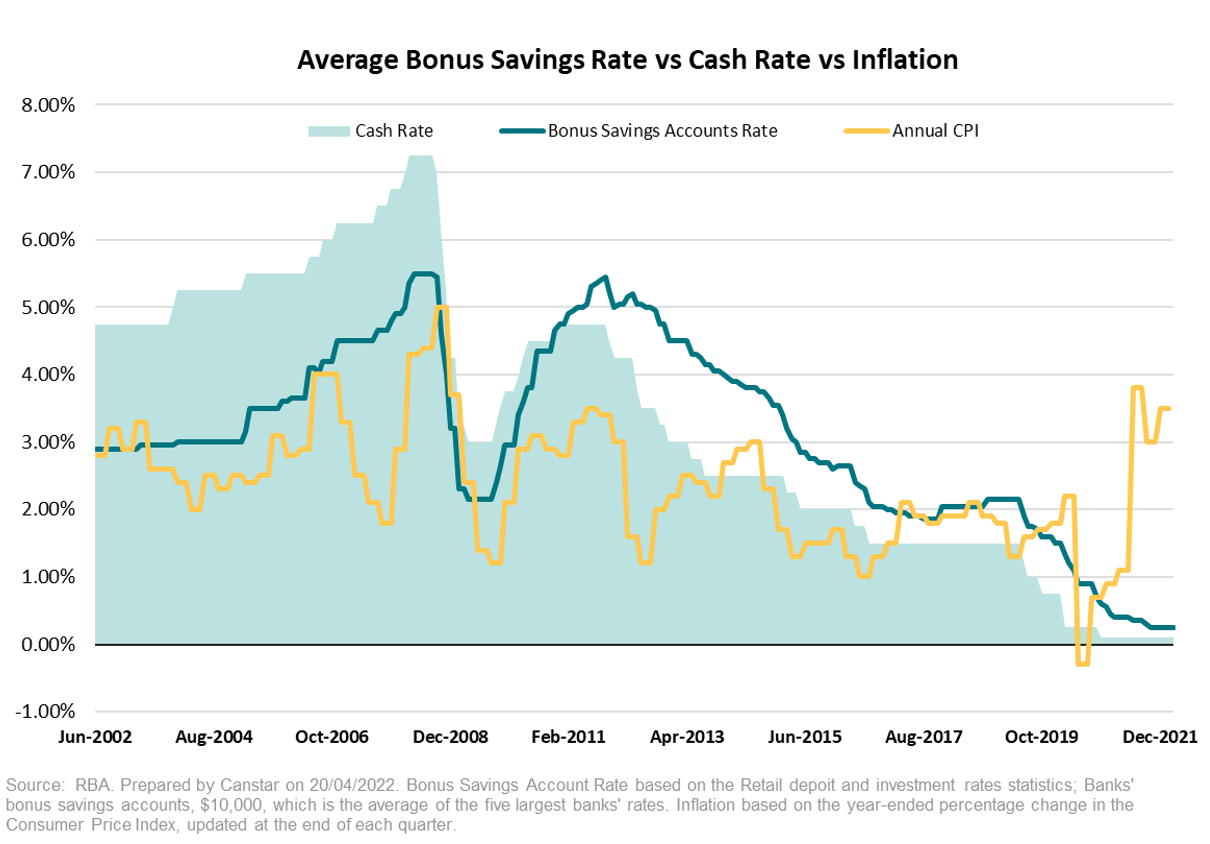

But this may not necessarily follow, with a report from Canstar suggesting that banks will not pass on the full rate increase to investors, so cash returns may still lag well behind inflation as shown in the chart below.

More to the point, the report reveals how far investor savings returns are lagging behind inflation – represented by the yellow line in this chart.

The analysis by Canstar show the average bonus interest savings rate has declined by 4.05% over the past 10 years – falling from 4.60% in 2013 to just 0.55% currently.

Using the median savings amount of $5000 that Australians have invested outside super and other assets, the analysis show the average account was earning $192.17 in bonus interest in 2013, compared to $28.38 today. Self funded retirees with substantial cash balances are missing out on even more.

What does this mean for retirees and what can you do?

Those in retirement will often have more money invested in cash than the broader population, so doing these sums across say $20,000 or $40,000 cash investments is very disheartening.

The upside of the chart is that the savings interest rate does tend to follow the trajectory of the cash rate, so a Reserve Bank increase in the cash rate would be expected to lead to higher interest rates on savings accounts.

That said, in recent years the major banks have not tended to pass on full increases, so increased returns are automatically reduced by this action.

It is hard to foresee how any cash returns will reach the lofty heights of the 5.1% CPI increase announced last week. It’s also worth thinking about how long you are prepared to tie up your funds as term deposits will usually provide a higher return than regular savings accounts. A third option is to review the extent of cash you have invested and if there are other forms of investment or strategies which can deliver more ‘bang for buck’.

If you are struggling with best next steps when it comes to managing your retirement income, a 45 minute consultation with one of our experienced financial advice team could help you better understand the rules and how you can improve your current cashflow.

Finally, you can’t control interest rates but you can ensure you get your Centrelink entitlements sorted out. You can get started by checking yours below.

Thanks for this helpful information. My wife and I are retiring in July so I thought it pretty smart to put our Super fund investments into Diversified Fixed Interest as a defensive play and maybe look at things post retirement. If I am not mistaken this is now a losing move as this allocation means that the fixed interest investments eg bonds, will suffer a drop in price thereby creating loss of capital. I would hope the fund manager has strategies around managing this risk. Interest rates are set to rise further so does that mean further loss of capital? Australian Super have a planning service with a free consult. If further planning required, I may well consult you guys. There are also age pension considerations.