How you surprised us

There’s an old saying used by politicians and their pollsters, ‘Never ask a question to which you don’t already know the answer’.

Not only is that sentiment cynical, it’s also stupid. How will we ever learn if we let our egos get in the way? And this week the Retirement Essentials team has learned a lot from your answers to our Retirement Essentials October 2022 Retirement Pulse survey.

First, we’d like to acknowledge and thank all who have taken part to date; those who have taken five minutes to respond and share their deepest financial needs. We’re very appreciative.

So why are we also surprised? What do we now know that we didn’t before?

It’s one thing to be exposed, anecdotally, through comments and adviser appointments, to members who are unsure about how long their money will last.

But who knew this feeling was so widespread?

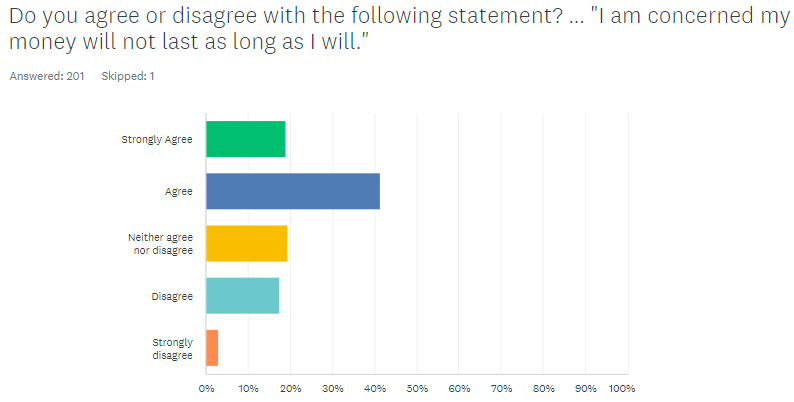

According to responses received to date, the ‘fear of running out’ is one of the major preoccupations of pre and post retirees. A massive 67% answered ‘agree’ or ‘strongly agree’ to the statement ‘I am concerned my money will not last as long as I will’.

By contrast, just 15% disagreed or strongly disagreed, and 18% were neutral.

Source: Retirement Essentials October 2022 Retirement Pulse

Those who have gone in the running to win a one hour consultation with a Retirement Essentials adviser have shared more detail on their money worries, which tend to centre on concerns about the management of superannuation, mixing the Age Pension, super and super drawdowns, and how work income fits with all of these needs.

Close to three quarters of respondents worried about running out suggests high levels of financial anxiety at a time of life when kicking back and relaxing should be the plan. Such concern is partly due to the inherent complexity of Australia’s retirement income rules; a dense web of tax, super, pension and investment regulations and settings.

But also exacerbating this need for an understanding of all these rules, is a lack of basic understanding of how our money might be expected to grow over long periods of time and at what rate we can draw it down without exhausting it.

In a sense this is the main question coming to us from most of Retirement Essentials’ members. Or series of questions if you like: what have I got, how long will it last – and is there a way of maximising it?

Over the next few weeks we will release more results from the Retirement Pulse as it will help you and us to focus on the financial issues that matter most in retirement.

And if you have a major money worry that can’t wait, find out more about our tailored advice consultations here. In this meeting you will be able to work with an adviser, using the Retirement Essentials Retirement Forecaster, to see exactly how long your money can be expected to last. You can access one-on-one consultations to discuss your retirement income planning needs and review your goals with qualified support.