Keeping Retirement Simple – Part 5

Even if you don’t get it yet, the Age Pension is key to retirement planning for most people in Australia. Over half of older Australians get more than half their retirement income from the Age Pension. And 80% of people are expected to be on at least a part Age Pension by the time they’re 80. It’s a reliable safety net and a guarantee that there’ll always be a basic level of income to support your spending in retirement.

So, Principle #5 of our retirement spending guide is Pay attention to your Age Pension and other government entitlements.

How valuable is the Age Pension?

Well for someone on the full Age Pension from 67 to say 92, it might pay out $725,000 for a single person and $1,092,500 for a couple over that 25 year span. And for part pensioners, it’s also very valuable. Even someone who’s not getting it yet can have the expectation that they might get it later, or it’s there if they get into difficulty.

Let’s take a look at our 4 “typical” retiree groups and see how they benefit from the Age Pension.

| Full Age Pension | Part Age Pension | Age Pension in the Future | Age Pension ineligible | |

| Total assets | $100,000 | $500,000 | $1,200,000 | $2,000,000 |

| Lifetime Age Pension payouts to 92 – single | $725,000 | $654,300 | $327,900 | $172,500 |

| Lifetime Age Pension payouts to 92 – couple | $1,092,500 | $1,085,100 | $849,300 | $436,700 |

| When might Age Pension begin | At 67 | At 67, | A bit later as they spend down their assets or stop working | In their 80s as they spend down their assets |

*Couples can actually qualify for a part Age Pension with as much as $1,012,499 if they are home owners and $1,254,499 if they don’t own their home.

Don’t apply late & keep checking

It’s so valuable and such an important part of your retirement income. You really need to apply on time. However, we find over and over again that people are delaying applying. They miss out because there is no “backpay” on the Age Pension. The government doesn’t say “oh well, we’ll just make up for it.” Instead, you’ve got to have your application in to get payment on time.

If you’re late to apply then you may cost yourself tens of thousands of dollars, which puts a dent in your retirement. Our surveys tell us that only 44% of people say they’re applying on time. That’s why we constantly remind our clients to “check their entitlements” and use our eligibility calculator. We’re on a mission to get people to get the Age Pension they deserve.

Many people won’t qualify right away at age 67 for the Age Pension, and the valuable Age Pension Concession Card, because they’ve got too much in assets, so fail the Assets Test, and even more often because they’re still working and not qualifying under the Income Test.

For these people, there’s a very important “consolation prize” in the Commonwealth Seniors Health Card (CSHC). The CSHC offers important benefits on medical services and medication, as well as other concessions (such as utility, or car registration discounts), which vary by state. If you’re over 67 and unless you have a high income (currently $95,400 for a single and $152,640 for a couple), you’ll qualify and you should apply. We estimate the Card might be worth $2-3,000 per year in savings, more in some states.

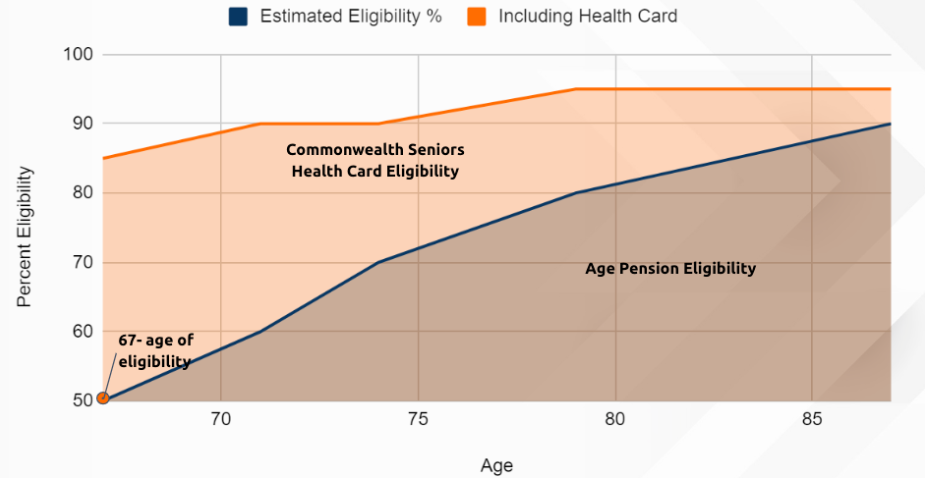

And if you’re on the CSHC or haven’t qualified initially, it pays to keep checking your eligibility. We find that more people qualify as they get older – either because they stop working or because they’re spending down their assets to fund retirement. This chart shows an estimate of what percentage of people are eligible for the Age Pension and the Seniors Health Card by age. You can see how Age Pension eligibility rises as people get older.

Some great things about the Age Pension

We’ve already shown how valuable the Age Pension can be over your lifetime. There are some other really nice features:

- It’s a great inflation hedge. The government adjusts the rates twice a year, in March and September. Over time, the rates have grown a little faster than inflation. There aren’t many other sources of retirement income that are as dependable for inflation protection.

- It’s a great source of protection if you live a long time. The Age Pension keeps going as long as you do. It’s for life as long as you continue to qualify.

- Part pensioners usually find that it increases in importance to them as they get older. As they spend down their assets, they qualify for a higher payout. They may start on a modest pension at 67, but by the time they’re 75 it could be a full Age Pension. Again, it pays to check your entitlements to ensure that you’re getting what you deserve. We find that many people come back regularly to check what they should be getting.

- Part pensioners can find that it protects them if their assets take a tumble. For example, due to the so-called taper rate applying to part pensioners, your Age Pension payout reduces/increases $78 per year for each $1000 more/less you have in assets. Part pensioners will find their entitlements are higher if their assets have declined. So, in the market decline during the Covid onset in 2020, most people suffered losses on their investments. But part pensioners had the impact moderated by a rise in pension payments.

While it’s great in so many ways, we all would like it to be more or more available. And it still remains an incredibly complex government entitlement. And Centrelink continues to be frustrating to deal with. We hope to help people make the most out of their entitlements with the least pain possible. If you need help with applying for the Age Pension or CSHC a great first step is to check what you are eligible to receive.

Coming up next time: Retirement Principle #6: You need to be prepared for a range of outcomes.

Hello,

Our investment property has just been revalued by Local Council and risen from $300k to $500k, thus increasing our assets by $200k.

6 months ago we were offered $390k by a tenant who had it valued but we declined the offer

It is noted that Centrelink suggests you submit a valuation which reflects a “fair price if required to sell immediately”

So, as a part Pension Couple could we confidently adjust the valuation to $400K which we believe is fair as the property is in a remote country area

Thank you

Hi Martin, great question and the good news is that yes you can declare the value being a little lower because there are obviously many factors that go into a sale price and even if others in your area are valued higher, yours could have legitimate disadvantages which make it worth less.

why as australians accept that centrelink is difficult to deal with as you say

quite frankly some of the directions they give you are pathic .

The local centre link office in toronto nsw has two security personel

directing you to a person who then gives you information or directions .

The area is quite big heaps of desks ,with no one in sight .In my view a total

waste of resources including the security personel

My husband aged 74 currently in receipt of aged pension and myself 66. When I turn 67 he/we will no longer be eligible for aged pension through failing the asset test . We will be eligible for the CSHC card. At what point should my husband apply for a transfer to the new seniors health card.

I currently have a Low Income Health Care which will also need to be changed, I assume for me once I turn 67 I simply re-apply for Seniors Health Care card .

Hi Marina, well done getting on top of things ahead of time to minimise the impact! Once you turn Age Pension age, your husband should call Centrelink on 132 300 to notify them that with your super now assessable he is not eligible for any Age Pension and to please cancel his payments so he is not over-paid. Then you can lodge just the 1 claim for the Commonwealth Seniors Health Card which will cover both of you.

I am thinking of retiring at end of this year 10/12/24 at age 73.

I have $300,000.00 super, A total of $80,000 cash and assets car ect.

it’s a bit of a scary thought for me as i still love my job.

when should i start the application process and

will i be eligible for a part pension and health care card

Hi Al, based on those assets you will be eligible for the Age Pension. In terms of when to apply you might be able to apply now and receive a small pension whilst working that then goes up when you retire. If your income exceeds the allowable amount for the moment then we recommend getting the ball rolling 2 weeks prior to retirement so that your claim should be ready to lodge as close to your retirement as possible.

My wife will reach the age pension age of 67 before me. Am wondering how she will be assessed for pension.

Will her Super and half of joined assets be used for her pension assessment?

If this is the case, do you agree I should no longer move 80% of my annual Super contribution into my wife’s super account?

Thank you

Hi Mark, we’d be happy to help you understand what the best option for you would be. Please CLICK HERE to book a consultation with one of our specialists.