Annuity rules explained

When we talk about retirement income, Account-Based Pensions (ABPs) often take centre stage because they’re the most common retirement income streams. But they’re not the only option.

Lifetime income streams, such as annuities provide guaranteed income for life, protecting against the risk of outliving savings. Yet very few Australians retirees choose them – only 3.5% of pension assets are in annuities, compared to 84% in ABPs. (APRA, 2023 as cited in Treasury, 2023)

Why don’t more retirees choose annuities?

The Treasury’s 2023 discussion paper on superannuation in retirement noted several key factors which contribute to the low uptake:

- Pricing and longevity risk: Australians are living longer than expected, making annuities more expensive to purchase and provide.

- Lack of flexibility: Many retirees worry about locking up their savings and not having access to funds for unexpected expenses.

- Upfront cost: The one-time purchase price can seem high, even though it guarantees lifelong income.

The ‘annuity puzzle’

This reluctance to purchase annuities isn’t unique to Australia. Economists call it the ‘annuity puzzle’ – the paradox where retirees consistently cite longevity risk as a major concern but are hesitant to buy products that protect against it. (Treasury, Superannuation in Retirement, 2023)

Making annuities more accessible

As Australia’s population ages, the superannuation industry faces pressure to offer innovative retirement products that balance flexibility with longevity protection, despite challenges such as development costs and limited demand. More and more of these products are coming onto the market, some offered by super funds, others usually sold through financial planners.

How does an annuity affect your Age Pension?

Depending upon Centrelink’s income and assets test (and other specific rules) annuities can affect your Age Pension. The assessment varies on the type, term, purchase date and any withdrawals or commutations. Each type of annuity is subject to different asset and income test rules.

How does Centrelink assess new lifetime income streams now?

Today’s lifetime annuity products are now usually called ‘lifetime income streams’. New lifetime income streams (purchased after 1 July 2019) – are assessed as follows:

Assets test: 60% of the purchase price is assessed until the life expectancy of a 65-year-old male (currently 84) or a minimum of five years if purchased at age 84 or older. After this period, 30% of the purchase price is assessed for life.

Income test: 60% of the annual payment is assessed as income.

But how does this work in practice?

How would Centrelink assess John’s lifetime income stream

Background

John, 68, recently retired and is reviewing his Age Pension eligibility, and wondering if he can afford a comfortable retirement income spending $1,000 a week. He has:

- $250,000 in super, using $150,000 of it to purchase a lifetime annuity paying $10,000 a year

- $50,000 in a bank account

- A modest home, which he owns outright

Centrelink assessment:

Income test: 60% of John’s annuity payment ($6,000 per year) is counted as income.

Centrelink will add this to the deemed income of $2,123 from his remaining super and cash savings.

Assets test: 60% of the purchase price ($90,000 of the $150,000) is assessed as an asset. This drops to 30% ($45,000) once he reaches the threshold day in 2042.

Centrelink will add this amount (i.e. either $90,000 or $45,000) to his super and savings balances.

Would John be better off with an Account-Based Pension (ABP)?

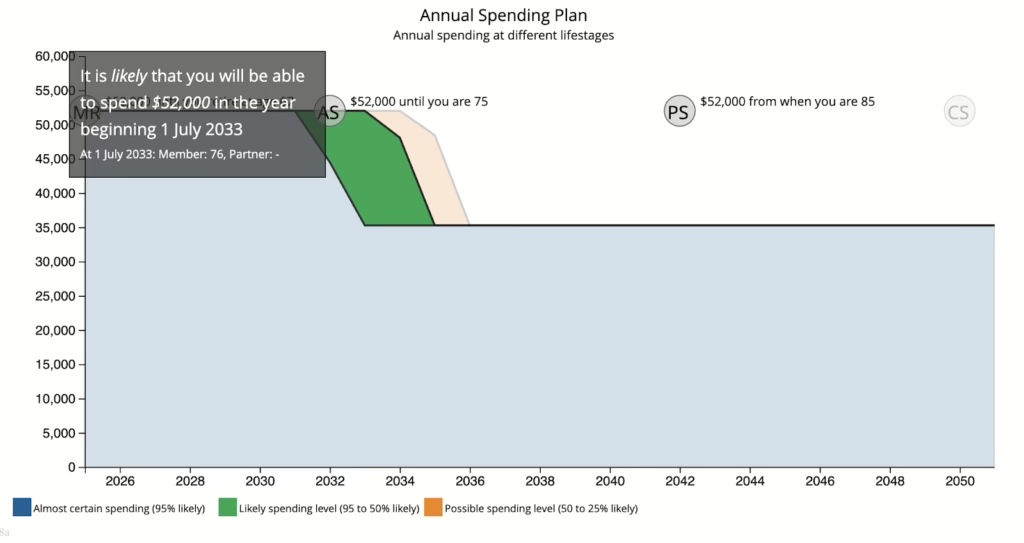

With an annuity: John can safely draw $1,000 a week, ($52,000 per year) from his super and savings until around age 75. After that, he would rely primarily on the Age Pension and his annuity income.

He will see a reduction of around $50 per fortnight in Age Pension payments due to his income being above the minimum threshold of $5,512. As well as the assessed $6,000 from the lifetime income stream, John’s remaining super balance and cash savings are deemed to earn income of $2,123.

With an Account-based Pension (ABP):

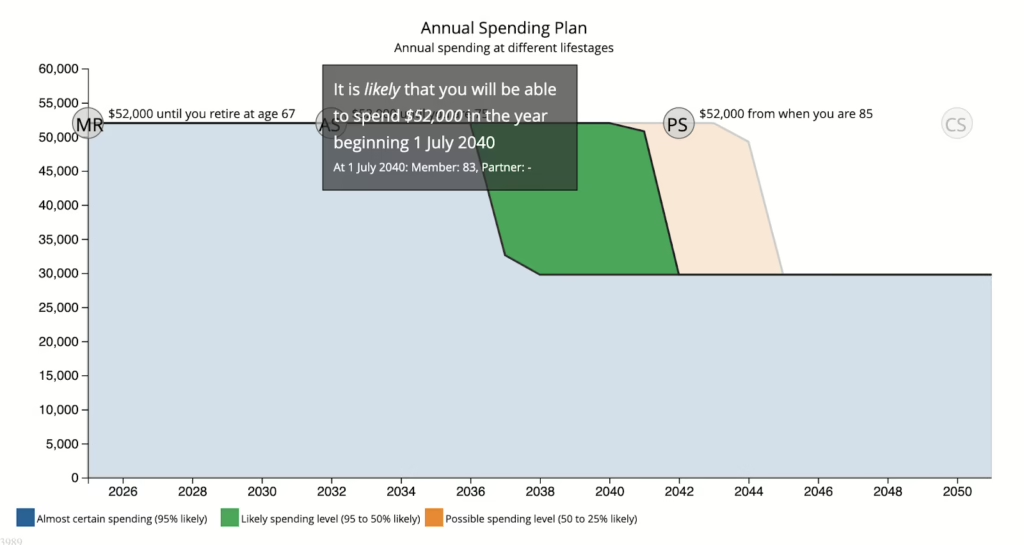

If John used his full $250,000 super balance to start an ABP, investing 60% in growth assets, our forecasting shows his funds are likely to last until around age 83 if he spends $52,000 a year.

The ABP is more flexible, allowing John to adjust his income according to his spending needs and make lump-sum withdrawals.

In this scenario, John is also eligible for the full Age Pension of $29,754, as the deemed income of $5,498 from his ABP and cash savings is below the singles annual minimum income test threshold of $5,512. His assets remain below the minimum asset test threshold for a single homeowner.

If he exhausts his savings, he would rely solely on the Age Pension for income in later years.

Ultimately, the right choice depends on John’s priorities. An annuity provides security and guaranteed lifetime income, while an ABP offers greater flexibility to manage spending and investment risk over time.

Choosing the right annuity for you

When considering an annuity, it’s important to balance:

? Longevity protection – Do you want income for life or a fixed term?

? Flexibility – Will you need access to your money later?

? Age Pension impact – How will it affect your entitlements?

You can learn more about annuities and lifetime income streams.

How did John view these considerations?

John’s lifetime annuity gives him a guaranteed income for life, but locks away part of his super. While it didn’t increase his Age Pension entitlement (it actually resulted in a small reduction), it provides certainty. John knows that, no matter what happens, he will always have at least $10,000 per year in annuity income on top of his Age Pension payments.

For other retirees, a shorter term or deferred annuity might be a better fit, depending on their retirement goals and Age Pension entitlement.

Final thoughts

Annuities and other structured income streams can be valuable retirement tools, offering security and stability. But because Centrelink assesses them differently from account-based pensions, they can have unexpected effects on Age Pension eligibility.

How to take the next step in your retirement planning

Retirement planning doesn’t have to be overwhelming. Whether you’re deciding between an annuity and an Account Based Pension,calculating how much you can safely spend or maximising your Age Pension, expert guidance can help you make confident choices.

Our fully qualified advisers are available for online retirement income consultations, to help you sort your earnings, spending and all the rules that guide your options.

What about you – Do either of the following statements resonate?

I’m worried about outliving my savings – how can I make sure I have enough income for life?

I want financial security, but I also need flexibility, what are my options?

How does Centrelink treat an annuity that is purchased from an inheritance and not the account based pension?

Hi Sally, annuities are tricky to clarify as there are a number of factors that Centrelink take into account when they assess annuities. It wouldn’t be appropriate to discuss the specifics in this forum so I recommend you book a consultation with one of our specialists HERE.

Annuities are too big of a risk because if you die your beneficiaries don’t get

the remaining balance so not a good idea better off just opening a pension stream

account and pull weekly pay out of your super financial advisers are not needed for this

they are a cost for nothing they are only ok if you move money around, superannuation

is complex enough and it shouldn’t be we are forced into it by government body

i am not a fan of super in hind site real-estate would have been a better option

Hi Paul, Thankyou for your comments. It’s always interesting to hear different perspectives from our members on retirement income strategies. Annuities aren’t for everyone, that’s true. But they do offer a guaranteed income stream which can be the right fit for some. Some modern annuities allow for death benefits, meaning any remaining balance can be passed on to beneficiaries. The different types of options are outlined here

There may also be more innovative products developed in the future – which might better meet both income and estate planning needs.