What if you had a crystal ball? Would that help you eliminate your FORO – the fear of running out?

I’ve been writing about retirement income for nearly 25 years now (yes, let’s agree that I started when I was a teenager, NOT!). But all jokes aside, there are two observations that haven’t changed over time. These are two related, but very different, research findings:

- Almost 50% of retirees do not know if their money will last across retirement or whether they will outlive their savings (most recently reported by Vanguard in How Australia Retires, 2024)

- Those who have received financial advice are twice as likely to be confident they will have enough money across their retirement (from The Value of Advice, CPA, 2020)

Over the years I have been covering retirement income, these two findings have remained consistent across diverse sources of research which cover all socio-economic groups.

So it’s worth posing the question whether there is a useful link to be made between the two.

Can we reconcile the enhanced confidence of those who have received advice with a much lower level of the fear of running out?

Connecting the dots

You may think it’s quite simple to connect the dots here. If people are so afraid of running out, and financial advice leads to greater confidence, then why don’t they just get on with it and make an appointment, right?

Well, yes, this action might offer a solution, but financial advice comes in many shapes and sizes – and has a range of price tags – so it’s important for retirees to be able to get just enough of the necessary advice, at the right stage in their retirement journey – at a cost that fits their budget.

Barriers to seeking advice

It would be misleading to fail to acknowledge the reasons many people have been reluctant to seek advice. This reluctance tends to be due to one of three main barriers:

- Lack of trust

- Affordability

- Uncertainty about how to start.

Let’s consider the first two before exploring whether specifically tailored advice can be used to address any FORO that may be worrying you.

Can planners be trusted with your savings?

A few years ago the popular sentiment towards the financial planning sector was one of distrust. But since the final report of the Royal Commission into Banking and Finance (2019), the industry has undergone a major transformation, with many planners (about 12,000) leaving the sector, down from a peak of 26,500. Financial planning is now much more tightly regulated and the regulator, ASIC, is now much faster to pursue any concerns. So it is fair to say that the issue of trust is now much less prevalent.

Is advice affordable?

The short answer is yes. But there is a reason why many retirees still think it is out of their reach. Traditionally most retirees were encouraged to engage a planner to create and manage a comprehensive ‘whole-of-life’ plan on their behalf. Such plans are still available and will typically cost between $4,000- $6,000. This type of advice, categorised as personal advice, takes into account the very particular circumstances of the client, and results in a lengthy document (called a Statement of Advice or SoA) that recommends how the client can save, invest, and structure their affairs over the long-term.

Financial advice can also be accessed through super funds. The funds typically provide factual information, general advice, and limited forms of ‘intra-fund’ advice at no cost. More personalised advice on specific topics is usually priced from about $200 to $900, while the cost of comprehensive advice offered by funds may range from $2,000 to $4,000, depending on the fund.

Retirement Essentials believes that many more everyday Australians can be served by affordable, bite-sized advice, where the member’s needs – ranging across Centrelink entitlements, super strategies, mortgage consideration and more – can be addressed in manageable 55-minute consultations. The wider industry refers to such appointments (which also fall into the category of general advice) as ‘episodic’, meaning the advice is needed at certain trigger points brought on by reaching an age or life stage such as Preservation Age, Age Pension entitlement, leaving work or downsizing. These advice consultations are conducted as a video call and priced at $375.

What’s this got to do with running out?

Where’s the crystal ball that will help?

It’s not quite a crystal ball, but a specially designed calculator can help you tackle any fears you have about the longevity of your savings. This is the Retirement Forecasting tool, designed by Retirement Essentials, to fully address your own individual situation, needs and goals. In short, the tool combines your superannuation savings, your private savings, your age and calculates likely Age Pension entitlements and the ways in which part-time work will alter your outcomes. The forecast delivers a graph that shows you a mix of your different retirement income streams, and how they will combine and vary over your full retirement income journey.

No more FORO for Dianne

Here’s an example using the Retirement Forecaster, prepared by Retirement Essentials adviser, Nicole Bell, for Dianne who hopes to achieve a retirement income of $40,000 per annum until she reaches 85 after which she believes that $35,000 will be sufficient.

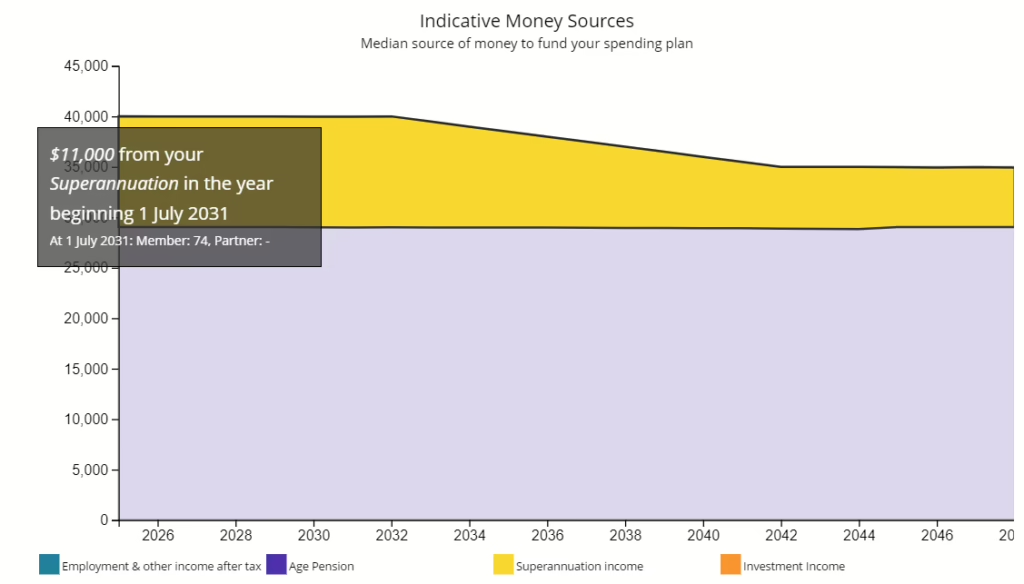

The first graph shows the way her super savings (drawing down $10,997 per year) can supplement a projected Age Pension entitlement of $29,023. Dianne does not need to have a fear of running out as she now has a clear idea of how her funds will last.

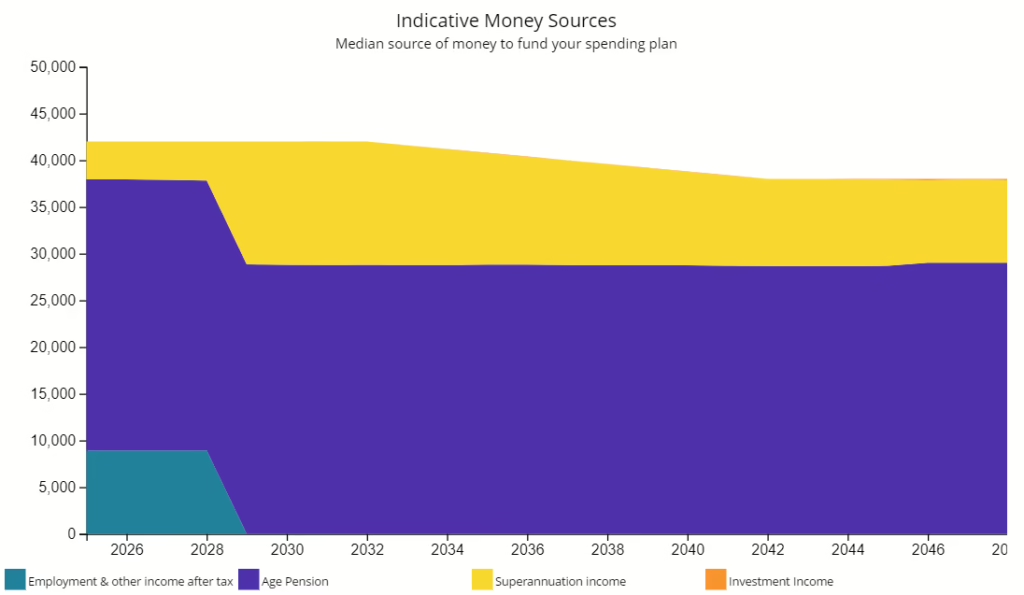

Dianne also wondered if she worked a little longer (until age 72), how this might bolster her income. Nicole used the Retirement Forecaster to share the following scenario. Dianne will now have the work income, plus an expected $2000-$3000 over the later years of her retirement. (You can read Dianne’s full forecasts here).

So while the Retirement Forecaster is not exactly a crystal ball, it does remove the guesswork from the longevity of your savings by estimating:

- How much you have

- How much income it may convert to in retirement

- How your funds may continue to grow based on some reasonable assumptions (inflation adjusted)

It also provides reassurance on the way your money can make the distance and supports your decision-making by allowing you to compare different scenarios as demonstrated by the calculations for Dianne.

Two ways forward

You can check with our advisers in a free 10-minute consultation to ascertain the most useful advice consultation for your own particular needs and concerns.

OR

You can book a Retirement Forecasting consultation and run the numbers to see how your money can stretch to cover your full retirement journey.

Do you suffer from FORO?

Or have you completed projections which have given you financial peace of mind?

This article is provided by Retirement Essentials Representative Number: 001260855. We are an authorised representative of SuperEd Pty Ltd ABN 88 118 480 907 AFSL #468859. This information is not intended as financial product advice, legal advice or taxation advice. It does not take into account your personal situation, goals or needs and you should assess your own financial situation, consider if the information is suitable for you and ensure you read the relevant Product Disclosure Statement (PDS) if you choose to make any changes to your financial situation. It is always advisable to consult a financial adviser before making financial decisions.

I whole heartedly agree, from experience financial advice for us was a blessing.

Wish we had thought of it. It was friends looking towards their future retirement that set us on our own path. It was the best advice we ever got.

The best thing we ever did was get financial advice to plan for our future retirement.

We started 10 years prior to retiring, at the time we thought wow… that’s a lot of money!

Without that advice I don’t beleive we would be as financially secure as we are today.

It made us take a hard look at our finances. Made us more aware of what we did with our earnings. What we spent on living and bills, what we could save. Adding any saving no matter how small into our super basically made us more aware of our budget and what we could do and do without. Looking back we have managed to save many times the financial advice cost. Worth every penny in the long run. When asked how we manage now we are retired we advise all our friends to get financial advice as they are coming to their own retirement age. Peace of mind… you really can’t put a price on it.

Hi, firstly let me say l enjoy reading all your articles on Money and have forwarded many of your Emails to friends. So Thank you! Now l would like to know how to make an appointment with your FA and how much would this cost. I currently have my money in ABP and have left minimum in my Supa Acc. l currently am still working with a very some income. l feel l can do better with the finds l have and would like some help in doing the right thing to get Max Centrelink and better strategy for my ABP. I have just on $500.000 in ABP. Are you able to help? ps I would like to still stay in my industry super. Sincerely Jane

Hi Jane, we’d be happy to help you review your options and understand the pros/cons of each to get yourself set up as best as possible. The consultation would cost $375 and you can make a booking HERE.

Hi,

Another reason for FORO :

I have spoken to 2 different professional retirement advisors in the past and both have merely wanted to move my super into their own investment funds with no guarantee of any returns – so the same as super.

That explains my reason for no longer trusting these advisors.

Unfortunately none of your articles can assist me in my circumstances as I have chosen to retire in France and therefore am not entitled to any government pension so must rely only on my Super savings.

I’d love to see an article on how to manage without any government aid.

Thanks Patricia