Are you optimising your super?

Last week research house, SuperRatings, released the annual returns for Australian super funds in Calendar Year 2024. The funds posted positive returns in 10 of the 12 months in 2024. The results are very positive and are good news for retirees who retain money in super accounts. The following is a top level breakdown of these returns.

Overall returns for Accumulation funds (i.e. those funds still in the savings phase)

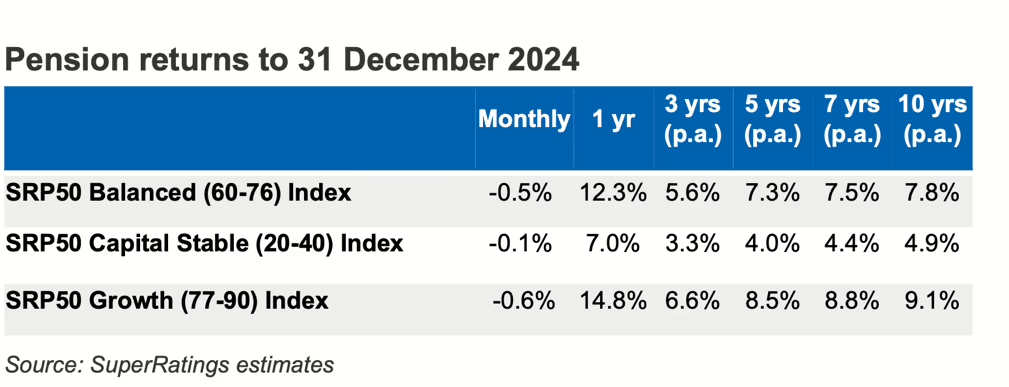

Overall returns for ‘retirement’ or ‘pension’ funds (i.e. those funds which have investments in decumulation or ‘spending’ mode)

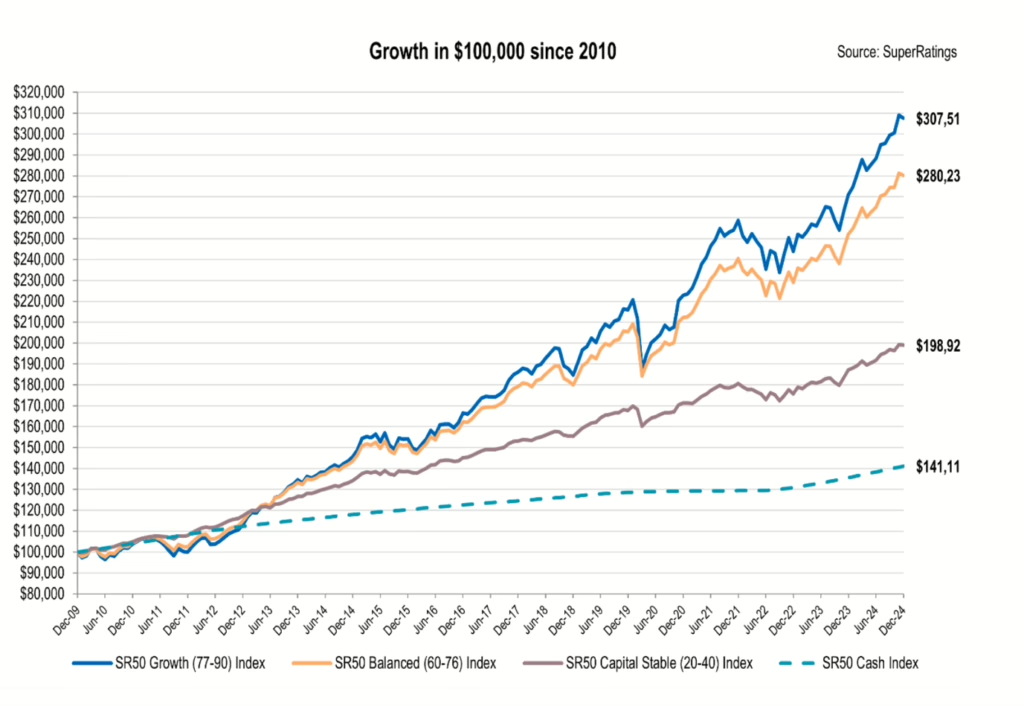

The SuperRatings team notes that International shares were the ‘stand out’ performer (led by strong growth in US shares). But Australian shares also achieved high returns across the year. The following table shows the longer term investment performances of Australian super funds (across capital stable, balanced and growth settings) compared to that of cash. It illustrates how AUD $100,000 would have performed, if invested in one of these four ways.

In summary, the invested $100,000 would now be worth:

- Cash, $141,117

- Capital stable option, $198,920

- Median balanced option, $280,237

- Median growth option, $307,519

Super Ratings also published a list of the top 10 funds by performance over the last 12 months:

This makes for an interesting comparison with the top 10 funds by performance over the last 10 years, which is largely dominated by Industry Funds.

What does this mean for retirees?

Australia’s retirement income system has attracted a lot of criticism as more and more people retire daily and genuinely struggle with the complexity of decision-making required.

But it’s fair to say that this past year’s returns are very robust and that many retirees will be enjoying a more comfortable retirement as a result. Yes, it’s important to continually review and refine your investments and investment settings. Needs in retirement change over the years and the way your money is invested should also change to match your income needs.

One common strategy for those reaching retirement is to withdraw most of their savings and invest them in cash (usually term deposits) because it seems more ‘accessible’ or ‘tangible’. (This perception is also arguable with super able to be accessed relatively easily as well.) But the table above shows that cash deposits have increased at about half the rate of money left in super in balanced or growth options. Money in ‘retirement’ or decumulation funds attracts no tax at all. This is why a very broad view of retirement funding options is helpful – not just at the point of retirement, but as your life evolves towards a later life stage.

SuperRatings suggests that the new year is an ideal time for members to consider the levels of ups and downs that they are willing to tolerate and to do a health check on their fund across three key indicators; performance, fees and insurance. While SuperRatings does not have a crystal ball, it notes that the outlook in Australia remains uncertain, with lower interest rates unlikely in the short term. According to SuperRatings Executive Director, Kirby Rappell:

“Despite the uncertainty in markets, funds have consistently delivered positive outcomes for members over 2024. With a strong double digit return for most funds, members can be reassured their retirement savings continue to grow. However, 2025 could bring many potential pitfalls and sticking to a long-term strategy is important should we start to see balances falling. High levels of diversification continue to insulate members over time, resulting in impressive long-term performance by those managing our retirement savings.”

Next steps?

Why not log in to your super account and see the performance of your own fund during 2024, if you don’t already know this. If you are happy this money is performing well, perhaps review, using the Retirement Forecaster, to ensure you are still on track with the income you believe you will need for the duration of your retirement. If you are not, consider making contact with one of the highly experienced Retirement Essentials advisers for a Retirement Health Check in which you can:

- Plan ahead by viewing how your current savings may last

- Learn how you can maximise your income, by optimising your super or other savings, or by gaining more government entitlements

- Reward yourself with greater financial peace of mind by having a much clearer idea of your investments, savings and options.

How did your fund perform in 2024?

While SuperRatings publishes the top 10 funds on its website if you are interested in how your own fund performed (and it isn’t on the list), the easiest way to obtain your return is to check your fund website. Almost all funds have an investment performance page that will display the one year return.

Do these results encourage you to rethink your investment settings?

How often do you review these settings?

As always, some wonderful advice. Australia has one of the best retirement income systems in the world. World class super with a supplementary safety-net pension system. But, advice such as yours is needed to make the most of it.

Thank you Gary, hopefully fellow readers are able to learn and make the most of their retirement too!