Barry, Ben and Mary are ‘freaking out’. Here’s why they shouldn’t

Barry told us that he was ‘freaking out’ with the tariff changes and subsequent market fall. Sharon’s clients, Ben and Mary had similar views. They told her that they had watched their super savings ‘collapse’ over the past 10 days and were thinking of moving more money from super to their bank accounts.

We asked Sharon whether she was able to help Ben and Mary and, if so, what information and support they needed before deciding if it really would be smart to take a lump sum out of super and put it into a term deposit, which they viewed as a safer option.

Here are the particulars of their situation (we have not used their real names):

Ben is aged 68 and currently receiving an Age Pension. Mary is 60 and her super remains in accumulation. Their assets are:

- Term Deposit (due September) $60,000

- Ben’s super $300,000 (ABP)

- Mary’s super $250,000 (accumulation account)

- Joint personal assets $20,000

They are worried most about what they perceive to be an alarming drop in their super and feel if this continues, they won’t have the necessary savings to enjoy a full and productive retirement. They are both concerned they will ‘end up on a full Age Pension with very little money to top it up’.

Sharon saw the situation differently. She understood that what was at the core of their concerns was ‘longevity risk’ or the worry of running out of money over the course of their retirement. Longevity risk is one of about 15 types of risk which can affect returns on your investments. It’s probably the most common worry for retirees – and sometimes it’s not founded upon the reality of their situation. It became clear early in the Retirement Advice Consultation with Sharon that working through the Risk Tolerance Questionnaire would be helpful.

In brief, this is a tool our advisers can use with members to help them understand the way their super (and other savings) are invested, the level of risk associated and the ‘sleep at night’ factor – how comfortable members are with the way their money is invested. (You can read the detail of this type of risk assessment here).

What quickly emerged from taking Ben and Mary through the questionnaire was that their preferred risk level was one which Retirement Essentials labels a Market Risk Level 5, where they would hold 56% of their super in growth and 44% in defensive stocks. Sharon defines growth assets as international or domestic shares and property, while defensive assets are cash, term deposits and bonds. At the end of the questionnaire they received a report that confirmed Market Risk Level 5 to be their ‘sleep at night level’.

The next steps

There are quite a few options open to Ben and Mary to ease their discomfort with the drop in value in their super funds. The first one suggested by Sharon, they were able to do on the spot during their consultation. And that was to look ‘under the hood’ of their super fund to see how they are currently invested. Both are with the same major fund and both were surprised to see the ‘balanced’ option they had selected was 70% growth assets and 30% defensive. ‘No wonder our total balance has dropped so much’ commented Ben. Sharon then suggested Ben and Mary consider whether they would be happier to change their investment setting to one with higher defensive stocks so that their exposure to ‘growth’ and defensive is closer to 50/50.

Sharon was also able to provide Ben and Mary with wider context regarding their assets. Their total ‘pool’ of money (when the term deposit is included) is $610,000. This means that even though they feel their ‘balanced’ option is too heavy on growth, they currently have a total exposure to growth of 63% and defensive 37%. So stock market ups and downs are affecting just below 2/3 of their savings, not the entire amount.

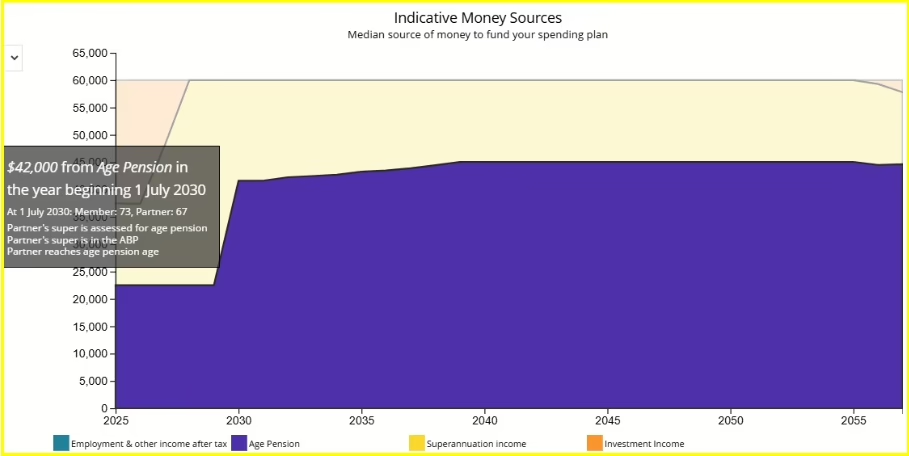

The real issue, says Sharon, is how much people actually need to cover their expenses and feel they are living a comfortable life. So she did some projections for Ben and Mary based upon their current and likely future Age Pension entitlements as well as money kept in super but moved to a Market Risk Level 5 investment setting (56% growth, 44% defensive). Here’s what their future income (indicative money source) will look like if they do change to this more comfortable investment setting:

Ben and Mary

Ben and Mary are both retired and will be able to achieve a $60,000 spending goal per annum to age 95, using a Market Risk Level 5 projection.

Mary’s super remains in accumulation phase until age 67. Initially the couple’s income will be made up of $23,000 annual Age Pension and approximately $37,000 per annum super or savings top ups. When Mary reaches 67, their income is estimated to be $42,000 Age Pension (combined) and $18,000 of their own savings (or super) to reach their spending goal of $60,000 per annum.

Let’s give Sharon the last word:

The most important thing I try to stress with clients is what is most important to them. Nothing is risk free, but we can run through the Risk Tolerance Questionnaire and determine the investment settings that will hit the sweet spot; the ability to stop worrying about longevity risk combined with an adequate sustainable income.

Have you, too, been alarmed by changes to your super?

Or are you quite happy to take a long view and wait for a market correction?

Do you know your own investment settings? Or are these still ‘under the hood’?

How can we help you?

Circumstances vary enormously for older Australians. The majority of retirees and pre-retirees will need to interact with government services well before they retire. Retirement Essentials provides a suite of affordable, bite-sized advice consultations for such members. Here’s some of what we can do for you in a guided review of your income possibilities:

- Maximising your entitlements – Assess any changes you might be able to make to maximise your Centrelink entitlements.

- Retirement Forecasting – Compare two scenarios of how your assets and income will look during your retirement journey.

- Understanding more about super – Assess the options to help make your super work better for you).

- Retirement Health Check – Identify opportunities to ensure your savings are on track to live your best possible retirement.

- Understand impacts of your home mortgage – look at the benefits of repaying or maintaining your mortgage in retirement.

This article is provided by Retirement Essentials Representative Number: 001260855. We are an authorised representative of SuperEd Pty Ltd ABN 88 118 480 907 AFSL #468859. This information is not intended as financial product advice, legal advice or taxation advice. It does not take into account your personal situation, goals or needs and you should assess your own financial situation, consider if the information is suitable for you and ensure you read the relevant Product Disclosure Statement (PDS) if you choose to make any changes to your financial situation. It is always advisable to consult a financial adviser before making financial decisions.

What a great article a Sharon ? thanks – we used RE to process both of our Centrelink applications at different eligibility dates and with their advice and strategies resulted in higher part pensions than we expected – was a nice surprise- we are in a similar situation as Ben n Mary, except we are both now on part pensions – has been very stressful watching our super balances fall as well and not knowing what to do this article by Sharon has made me stop n think before i do anything rash but i think ill be booking a consultation with RE as well – it was money well spent during the pension application process and should be again

Hi Rod, thank you for the compliment, it’s great to hear that whilst you are concerned you are also being mindful! You can book another consultation with us HERE.

How does a defined benifits pension differ from other pensions.

John – that’s a great question! A Defined Benefit Pension gives you a guaranteed income for life, usually based on your salary and years of service. That’s different from an Account-Based Pension, which depends on your super balance and investment performance. Centrelink also treats them differently — Defined Benefit Pension income is counted under the income test with specific rules applying, but it’s generally exempt from the assets test. There are some grandfathered provisions which may apply if your pension started before 1 July 2007.