by James Coyle | Oct 10, 2022 | Centrelink Age Pension

Reporting Income Reporting income can be a minefield for those on an Age Pension or those who may be entitled to one in the near future. The difficulty for many is that it is less than clear which income is reportable to Centrelink – and how and when you need to do...

by James Coyle | Oct 10, 2022 | Investing

Managing shares: What you need to know? Retirement income stress has been greatly exacerbated by the volatility of share markets around the world. Today’s ‘Plain English’ guide to shares examines the key aspects of this asset class. Whether you are a long term...

by James Coyle | Oct 3, 2022 | Retirement Income

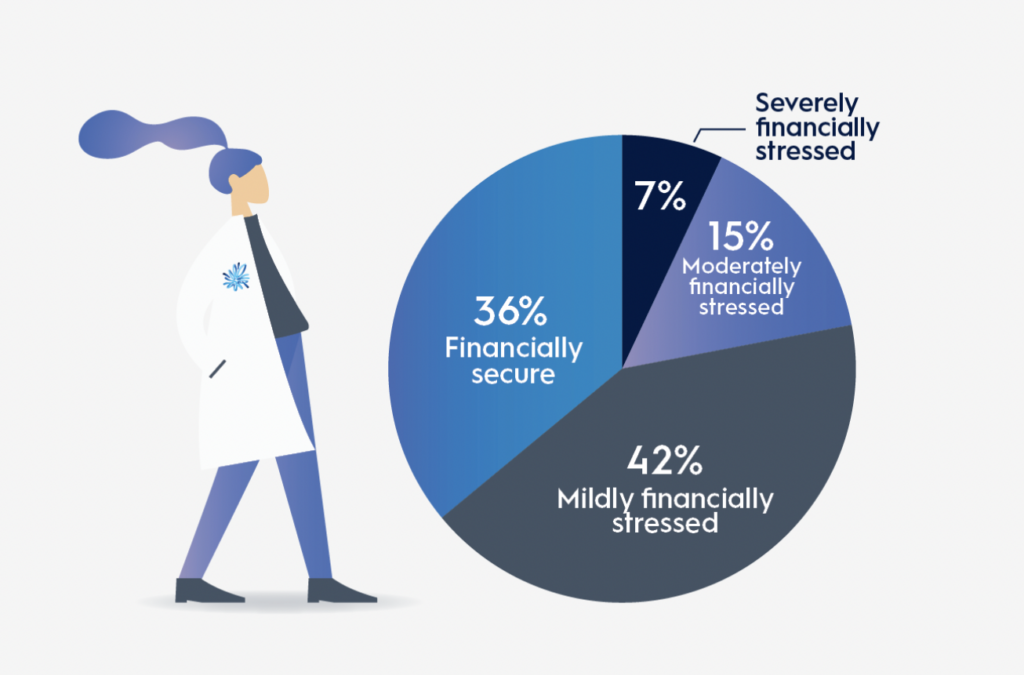

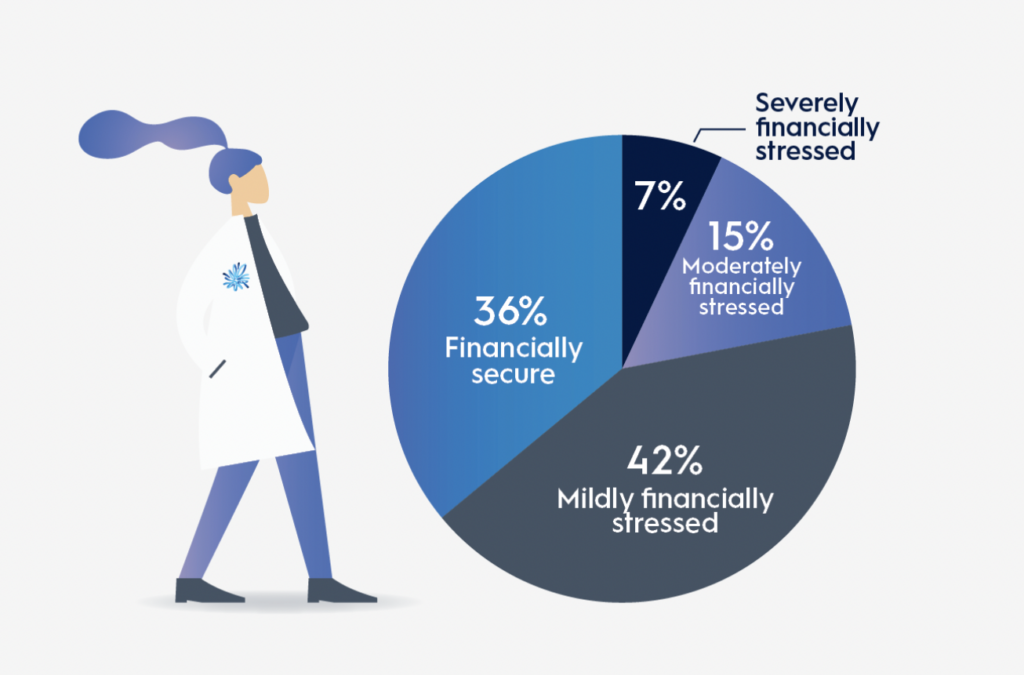

Source: AMP Financial Wellness Study 2022 New financial wellbeing research has revealed an increase in stress and uncertainty about retirement income. The findings, released by wealth management group, AMP, are the latest in the bi-annual Financial Wellness report,...

by James Coyle | Oct 3, 2022 | Superannuation

What do retirees need to know? Rules covering contributions to super can be challenging to understand. The following overview looks at the two broad categories of contributions and then focuses on those rules that affect retirees the most. What are the different types...

by James Coyle | Oct 3, 2022 | Retirement Income

When should you restructure? Arguably the most important thing to understand in retirement is your assets. At one level it’s easy to think that assets are simple things – they’re just the things you own. But when it comes to managing retirement income, there are...

by James Coyle | Sep 26, 2022 | Retirement Spending

Price hike on fuel about to occur Most car owners are bracing themselves for a price hike in fuel on September 29. After this time, it is expected that the average price for unleaded fuel will begin to rise above the $2.00 mark for the first time since July. Those...

by James Coyle | Sep 26, 2022 | Retirement Income

Top 10 money mistakes Retirement danger zones revealed International investment bank, Natixis, last week revealed the results from its survey on the 10 retirement planning mistakes. These mistakes were in the Global Retirement Index , first published by Natixis in...

by James Coyle | Sep 26, 2022 | Centrelink Age Pension

When is an asset treated as income? And when isn’t it? Australia’s Age Pension is a main source of income for 70% of retirees. Of those who are eligible, nearly 60% are on the full Age Pension. As they reach their 80s, 80% are on the Age Pension. We call this...

by James Coyle | Sep 19, 2022 | Superannuation

My super is tanking: Should I withdraw my super? This question arrived at the end of last week. And it’s easy to see why. The ASX All Ordinaries index dropped by 2.51% in a single day, recovered by 0.15% on Thursday and then dropped again by 1.51% on Friday. This...

by James Coyle | Sep 19, 2022 | Retirement Income

How can you earn extra in retirement? Even we were surprised at the strong response to our update on the new work bonus rules. It seems that there is no shortage of pent-up demand for retirees to work more to earn extra in retirement. But despite the announcement of...