During our Pillars of Retirement series we have received lots of feedback and commentary on the first of the pillars – The Age Pension. Many of our members find dealing with Centrelink extremely frustrating and many others find the system extremely unfair. We often receive comments such as:

- Why doesn’t each member in a couple get the same as a single? After all there are two people to feed, cloth and medical expenses aren’t shared?

- Why don’t single people get more? After all rent, electricity, rates etc are just as expensive for a single as a couple?

- Renters are much worse off than homeowners, so shouldn’t they get more Age Pension?

- Isn’t the home exempt so why do renters get an additional allowance?

- Why am I punished for earning extra income?

- Shouldn’t I be assessed on what I actually earn, not what I am deemed to earn?

Everyone has their own perspective and there isn’t a single right or wrong answer. What the comments do have in common is frustration at the system, particularly around the means testing rules. It is an absolute nightmare for some people to navigate.

It may surprise you to learn that the means testing in our system – the assets and income tests – are unusual in most countries. Some countries have much simpler systems offering what is often known as a Universal Age Pension. Essentially everyone that meets the age and residency requirements gets a pension. We have written about this before and many of our members have suggested this would be a much better system. So why don’t we do it in Australia?

A bit of history

The Age Pension in Australia was first legislated in 1908 and came into operation in July 1909 for men and November 1910 for women. Initially it was paid to men at age 65 and women at age 60. The Australian pension system was unusual in that it didn’t rely on contributions and also that it was means tested. These cornerstone principles are still in place.

Alternative models around the world include:

- Denmark where everyone gets half the age pension and the second half is means tested

- The U.K. where everyone that has at least 10 years on their National Insurance record qualifies for at least the minimum pension and it increases based on how long you have been contributing.

- The U.S.A where your contributions to the Social Security system determine how much you get.

Unlike in Australia where the Age Pension is means tested, some countries such as the Netherlands and New Zealand, pay an age pension to everyone that meets their residency requirements. Everyone gets the same amount regardless of how wealthy you are – a universal Age Pension.

Why don’t we do that in Australia?

As we mentioned In Australia eligibility for the Age Pension is means tested. The rationale for this is two-fold. Firstly it helps ensure that Government entitlements go to those who need them most and secondly by putting a limit on the number of people that are eligible, the Age Pension becomes more affordable for the Government.

Why pay an Age Pension to everyone?

Paying an Age Pension to everyone might not at first seem very equitable. After all, shouldn’t those that need it most be prioritised? Isn’t the pension there to help people that can’t fund their own retirement? And wouldn’t offering an Age Pension to everyone mean a ballooning cost to government (taxpayers) or would it be funded by reducing the overall level of pensions?

There are some alternative arguments in favour of a universal Age Pension though. Here are just a few:

- The current system is complicated and costly to administer so the Government could save a lot of money.

- It would create more incentive for people to save for their own retirement. At present some people are reluctant to save as they fear it will reduce their pension entitlements. Many of our members are frustrated by this.

- It could also provide stronger incentives for people to downsize the family home if they were able to do so without impacting their Age Pension. Even with the provisions to allow more of the proceeds to go into super there could still be pension impacts.

What do you think?

It’s an issue with strong arguments on both sides and there will be lots of opinions. .

And if you would like to make a comment or add your perspective you can do below.

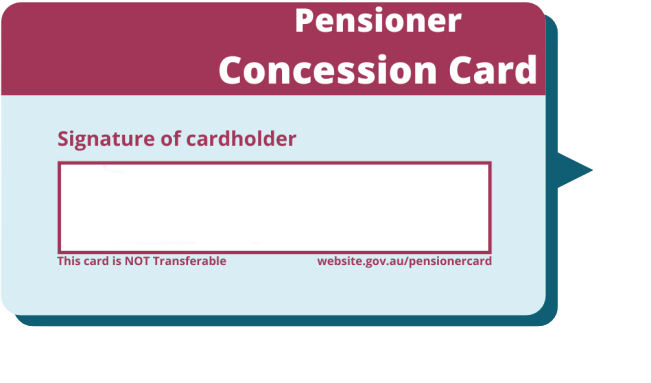

And finally, while not everyone can get the Age Pension in this country, those that can don’t want to miss out.

You can check if you are eligible below.

I’m a part pensioner and my wife’s gross wage is reported to Centrelink every fortnight.

So I’m peanilized for that.

More over every month she gets commission and that is taxed with her wage when received.

I after reporting the gross amount of wage plus commission have to report the commission again which is taxed against my pension for next two weeks.

Disgusting double dipping by our governments.

My wife is going to finish work as she has had enough of being rooted by government for trying to help us have a better life in retirement.

Absolutely correct, 100% agree,

We are in the same situation and my wife is going to stop work for the same reasons.

The system is inequitable and unfair.

Why do taxpayers have to subsidise Politicians to the tune of 100K when they loose their seats at an election.

Yet Pensioners get penalised and loose money for doing extra work.

Both my wife and I have been employed since we were 16 years old raised two children and led a conservative life style.We have never been unemployed with me retiring at 70 and my wife still working at 71 years old.

We have never had boats or caravans or ecpensive holidays and now we are not eligible for the pension or any government benefits because we conserved our funds to look after ourselves while others have spent what they earned.

We feel we have been penalised for being conservative.

If you have worked all your life and contributed taxes then you should get a pension plus the added benefits. Our current system discriminates against those that try to better themselves. If you purchase a rental property, ie providing rental accommodation and saving the government the cost of providing such accommodation you are penalised by both capital gains tax and the pension means test. How is this fair? Other people spend like there is no tomorrow enjoy life without any sacrafice to ensure they get a pension. We should adopt a system similar to Sweden where the government puts money aside for you if you work and pay taxes, if you don’t work then there is nothing for you.

You talk about the cost to government if everyone was paid a pension. What about the cost to us taxpayers for the parliamentary pensions and office rentals paid to our politicians after they finish their term (no age restriction or means test) and transferrable to spouses. How is our system fair?

Definately a universal payment for all retirees. I would like to know the government costs to assess every individuals eligibility for a pension or part pension. I’ve had a look at the asset test documentation and it is the most ridiculous document I’ve ever seen asking you to specify even the cost of your curtains etc etc…just onerous and ridiculous that older people have to fill this out. Also my friends have told me waiting period to get any money is very long obviously due to Clink staff having to go though each individuals asset documentation and in the main I believe people don’t even put correct values of their possessions. Therefore what is the purpose. I hope this information goes to our new Prime Minister. I’m 71 and cannot get a cent because my wife 66 has to work. It’s shameful that the elderly whovhave worked all their life and psid taxes are subjected to this scrutiny and treated this way. MAKE IT UNIVERSAL PLEASE

After working in the same job as a casual working 3 days per week for 21 years as a Medical Secretary my employer retired which left me without paid employment. My husband has been retired for 9 years and was not eligible to receive a pension until he was 66 and 6 months (and getting that was no walk in the park because of our self managed superannuation fund) dealing with Centrelink to access a pension for him was an absolute nightmare and took a year longer than it should have, so we have used quite a bit of our super to supplement our income, getting the pension has made a huge difference in our quality of life and the balance on our super. Due to the ridiculous age tiers the government has placed on access to the age pension, which I cannot apply for until I am 67 (I will be 66 this year) I am on Job Seeker. This is not a joyful experience I am expected to apply for employment, which I have done and am more than qualified for the positions I have applied for and they have been Casual jobs. I have only had one interview (not surprising at my age). I have applied to Centrelink to do volunteer work, I have to do 15hrs per week. I am happy to do volunteer work within the community that isn’t my grievance. My grievance is having worked since I was 15 (less 12 years staying at home when the children were born), becoming redundant at 65 and 8 months, why do I have to jump through hoops to receive a pension I am rightfully entitled to. why do I have to wait until I am 67, being penalised because you happened to have been born in the wrong month of the wrong year seems extremely unfair. Just make it 65 for all not this silly toss of the dice age bracket system.

The age pension is very unfair for people who save and contributed for their retirement, sacrificing early years income to save for retirement. But when they retire and have accumulated above the threshold they no longer entitled . Why is that fair. Apart from that the income they get from their savings is even less that the pension income of those who rely on the government pension.

I think everyone who contributed who st least get the minimum pension and the concession. The system doesn’t encourage people to save for their retirement age, like there should be a compulsory contribution to super from their own income.

I think the universal pension is a great idea. Non home ideas to get rent relief as well. Each individual or couple to receive the same amount at the higher rate to cover expenses.

I think it is so unfair that I worked until I was 68 and because my husband works his income stops me getting a pension so I have to ask him for everything I need to buy personally even medically. I have no superannuation which was $28k all gone. Why am not treated as an individual. Even if they won’t pay me an income why can I not have a pension card which qualifies me for extras. I am 70. Lucky enough I do get £129 per week paid in uk so subject to exchange rates but I can’t live off it. Australian pension is twice that. If I leave my husband I guess I would qualify for one then. I would at least be happy to have a pension card why can’t I qualify for that. I have a senior card but you qualify more with a pension card.

The tax office should administer pensions not centre link as they have all financial records of an individual tax payer if someone is a resident and paid taxes all their life it is an entitlement to receive a universal pension

A universal pension will be fair as it’s the educated n rich are able to manage the numbers to get full pension while others are impacted . Administratively it’s costly n people may save more n not depend on other government hand out if given a universal pension .

Yes means tested but allow pensioners that want to work beyond pension age and are capable to earn extra without penalties, after all a lot of experience is being wasted.

Age pension should be provided to all those who qualify irrespective of their means. It is unfair to penalize people who have worked hard all their lives, made sacrifices, contributed to the economy and paid taxes right through their working lives and managed to save for their old age.

The Australian system rewards the grasshoppers and penalizes the ants who work hard, live prudent and pragmatic lives and are significant contributors to the economy. Further the system is complicated, allows for manipulation and is simply unfair. Australia should adopt the same system as New Zealand where everyone who qualifies gets the age pension. There is clear evidence that it is sustainable.

It is for the Government to work out the amount of the Universal pension but it is time for Australia to move to Universal pension. The savings from the current system alone would be huge where it is replaced with a simple cost effective system and the savings can be used to help those who do not have adequate savings.

I agree whole heartedly every Australian Citizen who worked and paid taxes all their life should be paid a pension and benefits. My husband 71 can’t get anything because I work and we are not rich people. The New Zealand system is very fair and should definately be adopted here. I know rich people fudge the system by hiding their money to get the pension. Just make it universal and Now

I agree, as I am still having to work @ 70yrs due to another factor, where we are let down by Centrelink, as my Husband hasn’t worked the past 7yrs due to his health but doesn’t qualify for a Disability Pension after 3 x Heart Attacks, Triple Bypass Surgery, suffered a Stroke, they said he doesn’t meet the POINT SYSTEM!!. This is a man who has worked and paid taxes & done the right thing, and when he, an Aust.Citizen needs help, the door is closed. He has now become of age to obtain his Pension, but will be discriminated against once again, as I am having to still work, to pay Debts!!, as we have lost the past 7yrs of his contribution, if he had still been earning a wage. Yes so totally agree we should take a note from New Zealand, who appear to work for their people.

Absolutely agree. Do the time get the prime!! Instead of penalizing older people how about some reward, encouragement and support!!

I support a Universal aged pension for all age eligible persons. Other income earned on top of this can be taxed accordingly and overcomes the Centrelink limit on earnings that should be abolished.

We should follow New Zealand. They treat all the same, no second class citizens.

My wife and I weren’t the sharpest tools in the box. I worked 10 years in two jobs and my wife packed shelves at woolies till midnight so that we didn’t have to rely on the pension. We were lifters, not leaners.

Now at 70, we don’t qualify for the aged pension because of the assets test. Our joint income is about K$12/15 per annum thanks to the Genius at the RBA on his million dollar salary. So we’re burning huge amounts of capital to just pay the bills.

If we would have spent every dollar we earned on a good time, overseas trips, cars, u name it, we’d be on $1400 a fortnight.

Go figure.

I would like the universal pension or at least the Denmark model should be considered where 50% is given without any strings attached and the other 50% could be means tested.

Also if we have the super as the alternative source of income, the deeming rate will be in our favour if the markets are doing well and performing above the deeming rate applied by Centrlink. If the markets are down the return could be less than the deeming rate in which case the pension will be unfairly affected. It will be the case if the money is deposited in the bank as well where the bank interest is guaranteed to be lower than the Cenrelink deeming rate which will affect the pension unfairly. They should introduce a system that is fair to everyone

I belive the all ‘pension’ system is always going to be ‘unfair’ for the John Citizen and whuch way you look at it, some large group of society are penalised either for working “too hard and conservative” or for being born “well off” or for trying to have a more miningful life until they can.

If you have earned too much, you wont get pension till you spend it all and get in the circle of the ‘living on penuts’ . But, if you try to get out the circle of penuts and leave a bit more decent in your last decade before to be ready for Ospice, you can not!

The Politicians seams to be the only category of persons who will get money and benefit regardless of their bank account or income: till this is in place we, John Citizen pple, can forget fairness and / or nice ageing. Now try to fix THIS issue is the only way out from my point of view.

In the UK where every one that has contributed to National Insurance ( an amount that is determined by the amount you earn) for 10 years or more is entitled to an aged pension. Those who in conjunction with their pension have an income over the tax threshold then pay income tax on the whole of their income including the pension. Generally speaking those on higher incomes or incomes marginally above the income tax threshold tend not to apply for the pension in order to avoid the risk of having to pay an amount of income tax equal to or more than the pension. It is notable that under the UK system where income tax is usually PAYE, and deductions are not as generous as under Australia’s tax system, income tax tends to be a bit more equitable, each “wage earner” having to pay a pre-determined rate of tax. Under this system for those in high incomes it is not as easy as it is in Australia to avoid paying tax each person being required to register to pay tax at a rate consistent with their income.

Under the UK system if a person does apply for, and is paid a pension, much of the inequity in providing a universal pension is mitigated by the requirement to pay income tax on the whole of a person’s income thus at least some of the cost of providing high income earners with a pension is recovered through the tax system.

It is also noteworthy that VAT ( value added tax) is policed much more stringently than GST is here with many businesses being caught out by random VAT face to face inspections. Thus the opportunity to avoid this means of taxation, as unfair as it may be, is considerably less than the rorts that exist in Aus in regard to the non payment of GST.

All should get the age pension. After working for 45 years full time followed by 8 years part time in retirement, Thats 53 years of contributing to the Aust economy and society. But by being cautious and saving I’m not eligible for the pension.

Hi all.

My main bug bare is that if one partner does some part time work that uses up all their work bonuses the other partner is also penalized . If that is the case then surly they should be able to share their work bonuses.

This would encourage those pensioners who would like to do some part time work to do so. This would not only help fill the skills shortage but would generate revenue through taxation.

I believe there should be a “modified” form of universal pension. Those people who have worked all their lives and contributed to the economy for a minimum period – perhaps 40 years (as proven through ATO records) should receive the maximum universal age pension regardless of supplementary income.

Those people who cannot show a full working history – perhaps from overseas employment or having chosen cash in hand to dodge paying taxes whatever, would receive a proportionally reduced pension in the ration of years worked divided by 40 years as proven by tax records.

This might also be an incentive for people who have dodged lodging tax returns to do so.

I agree to exactly what John says above…there should be a “modified “form of universal pension. People who have worked so hard…paid their taxes and done the right thing…saved for a living…yet , when they age they are not eligible for a pension…Dont think this is right.

Why don’t you start a petition for a universal age pension and take it to the Government,you will get 10,000 signatures easy

I agree with the last statement,those people who have not paid the correct level of tax would bepenalised at the end of their life

Everyone, regardless of how much money they have saved throughout a lifetime (tax paid throughout), should be entitled to a full universal pension. Period. I would also go so far to say that Pensioners shouldn’t pay tax until a certain threshold is reached ie. earnings over $50,000. With universal pension access, many people would voluntarily downsize thus freeing up housing stock. More money would flow through the economy.

A universal pension would be far more cost effective for the government. Imagine all pensioners who work a few hours have to report to Clink then Clink has to waste more time on every person to work out how much to give them its utterly ridiculous the amount it costs the government. Just streamline!!! give a universal payment and stop stressing our already stressed out older generation who have contributed to the Australian economy for so many years. I’m 66 and still have to work my husband is 71 and cannot get a cent because I work. It’s just disgusting especially when this is the age we also get sick and have to deal with the cost of illness aswell.

We need to go to a universal system like the uk and maybe keep the rental assistance as we don’t have public housing like we use to it would more tax efficient

Could you please confirm this fact, please excuse the story!

I worked for the UK MOD (Civil Service) the pension was the envy of the country totally inflation proof and in excess of any other pension! Maggie Thatcher tried to kill it until they pointed out she would be without a pension if she did! She strangely NEVER mentioned it again and it was not touched. It was pointed out at the time that although it was non contributory, it was totally self funding with No Tax payers input! Talking about pension with an Australian born friend one day he pointed out, that is how the Australian pension had been!!!??? This was due to the fact that the original population were either government employed or deportees! Apparently one of our infamous governments needed funding for a questionable project or propping up a failing National(?) industry? That government couldn’t resist the huge pension fund and “borrowed” it for their project! The project failed dismally and the money was lost, instead of making the profit they greedily expected! They obviously could not afford to return the funds! So they rewrote the Australian National pension to the sad feeble thing that it is!!!???

There are very good reasons why the UK Civil Service pension is what it is, the same as why Fictional Immortals become infinitely wealthy corrupt or not! If it exists over hundreds of years it can not fail if invested safely!!!???

This e-mail with all the comments should be forwarded to every politician in australia.

I am 85 and have been paying tax all my working life, and at the start was told that includes a pension, so this pension has been paid for and should be received without any meddling from the centre link, and to call the people at centre link public servants is a monumental misnomer, most are the most miserable sour-faced intimidating people I have ever had the misfortune to come across, but I hasten to add the young lad who served us was politeness personified

I have been emailing the government departments for years about a universal pension.

Have always got replies…saying aged pension is welfare, not connected on how much one has worked and paid tax.

The current system is open to so much fraud, as we all know… plenty of people hide their money in kids names, etc just to get full pension, while the honest ones, get part pensions or nothing at all.

It must change.

I believe that we should have a universal pension for all , equal rates for all individuals, that is married and single rates the same, all rates treated as taxable income , administered by the tax office , under the common rule of parliament

Personally, I would like to see a universal base income for everyone, not just retirees.

There’s no disincentive to work to earn extra wealth/comfort/satisfaction and mammoth govt structures like Centrelink would not be needed. All that administration dealing with multiple benefits, eligibility etc could be eliminated.

It’s an idea that’s being kicked around and is worthy of real consideration.

Why don’t they get rid of part pension as that would relieve the burden on the welfare budget if you get a pension else where and it’s above the pension say about 40 thousand for a couple then you don’t receive anything same for singles above 35 thousand

A universal aged pension similar to the NZ pension is sensible and fair. The aged pension should be universal and equal to the tax free threshold. All income above that should be subject to income tax like every tax payer. By doing this then income from super or other investments would be taxed but you get the pension and pay tax on other income, that’s fair. People with very large super funds would pay tax but would receive a pension like everyone else. That’s fair. You could choose between downsizing your home and have more disposable income versus keeping it in your home without affecting your pension. You would think that the extra revenue from taxing other income would offset the extra pension payments.

In the Netherlands there is a Universal Age Pension – provided by the government. It is not means tested. The whole idea of means testing is considered unfair and plain evil – as everyone pays taxes. Besides the government pensions, everyone who is employed must also pay into a private fund. This is all managed by the employer and regulated by the government. Whether you are employed or self-employed, anyone can join up to a private pension, or multiple private pension funds. The private pension funds usually match or exceed the government pension. All pensions – government or private – pay out in annuities from commencement to death. Optionally, you can get a lump sum payment, but this is usually a bad idea as this will be taxed heavily. Some people will have only the government pension, but this is still significantly more than the Australian government pension. Once you reach pension age in the Netherlands you are financially secure until you die – unless you have done something spectacularly stupid.

The only problem with this system is the taxes. People pay at least 30% of their income in taxes and on average it is 42%. So, I think we can forget about this in Australia.

Even third world countries pay their pension at age of 60, not 65. In Australia young people should be pushed out of dole and put to work , instead they are asking senior citizens to keep working , die working never get to enjoy their retirement. Politicians have made the rules to suit themselves, if they do not correct this, next time more independent candidates and new parties will come into power. So I hope the labour party is fair else in three years it will be the end to single party rule in Australia. The politicians have been taking care of themselves, salary increases and can retire on huge pension they too should not get any entitlements till age 67 like all others. They can not ruin peoples life and have a good time themselves.

I started planning for retirement when women got the aged pension at 60. It changed to 65 with equal wages and I agree with that…but now at 65 and some months I am tired and not healthy yet I have to go for another year and 9 months…. I think the Danish model of everyone getting half the pension then the other half means tested is a great idea and I also think that pensioners who want to work should not be so constrained by the levels set by the government so that you start losing pension… maybe 150000 or 20000 should be the limit rather than 7800(or just for this year 11800).

Everything about the system is appalling, other than that there is a safety net for those who have never been able to work or had opportunity to accumulate super – though that safety net is a pittance, For those of us who have worked and saved, sometimes missing out on other things to do so, we then have to watch our super dwindle away with no additional assistance until our own pittance kicks in, meaning that people either quit early to allow for an earlier entitlement, or keep working until 70 to ensure a decent income for the remainder of our lives. Everyone should get a baseline decent amount. It would make for a more equitable system, with less anxiety, greater wellbeing and less stress on our health systems. Many other advantages – more money for people to pay individual carers rather than relying on aged care institutions, for instance, far less costs in admin and more money going into the economy for those that stay in Australia. This would be the majority BUT why can the current pension not be taken overseas? Another dismal aspect. If you have worked, contributed and paid taxes in this country you should be able to do whatever you like with the reward, include using it to live back with family elsewhere if that is your choice. I will join any lobby group, FB site or other advocacy group working to change the ridiculous Aus pension issue

My husband and I have worked all our lives, paid taxes and have just retired. We are however, but not entitled to anything, even the Commonwealth Senior’s card. It appears that we have worked and paid taxes to assist the people who have never worked or probably worked and spent their money. I believe an age pension should be considered even if we have to continue to pay some form of tax because as good citizens who have worked hard we could feel inclusive and not discriminated against.

We hope, that in the future the Government will consider adopting the New Zealand strategy.

I started work in 1975 and was forced to contribute to superannuation , in the late 80’s compulsory super contributions by the employer (and encouraged by the employee) commenced by the Government to reduce the number of people needing the pension. Now at least 30 years later we still have a large minority or retirees complaining about the pension. I think 30 years is enough warning that you should be responsible for your own retirement and only the unfortunate few need help

I seem to recall that at least 1 former PM was eligible for an OAP because he turned 70(Billy McMahon?)

If they were to bring a universal pension in the government would have claw back all the taxation free kicks given to people who contributed tax reduced amounts of money into super(including some really big amounts). Unfortunately the flat tax of only 15% on money going in penalised the poor but rewarded the rich, becoming a tax minimisation rort.

I thought that was the design of the super system, so that both OAPensioners and self supported superannuantes were helped out but by different methods

Yes, it’s a travesty that Australian citizens of pension age are assets & income tested after a life of work & contribution to the tax system. It is counterproductive in constraining Senior citizens inclination to engage in work & in addition, I gather the management of the aged pension is also very costly to manage.

It seems obvious that all Australian citizens of qualifying age should receive the aged pension without assets & income testing & simply have that included in taxable income.

I am age 74, a reasonably comfortably self funded retiree & recently was lucky to have found a new partner in life & remarried. She was a lady pensioner aged 72 who has no significant assets after catastrophic past relationship failure some years ago.

The result of our marrying is that the lady loses her aged pension & is now entirely dependent on my resources, ie ; the government saves the aged pension & I make up the difference. This took us some time to assimilate but didn’t stop us proceeding with marriage, we only wish it weren’t so as we are effectively penalized nominally $25,000pa to put a roof over the ladys head & denies us her prior pension funds from our budget.

The situation;

1. required extensive exposition of my assets & income, possibly tantamount to invasion of my privacy by government, & possibly a breech of privacy the governments own privacy laws,

2. removes the ladys dignity making her totally dependent on my resources with resultant overall reduced means.

The net result of such situations would be that many single seniors would not reengage in repartnering as it reduces their personal & financial status instead of improving it.

Everyone over 65 or 67 must be entitled to at least a minimum universal age pension.

It is not a gift, it is something that we’ve deserved by paying taxes over decades of hard work.

I feel disadvantaged for working hard all these years.

I have chosen to put away enough superannuation so as not to be a burden on the taxpayer through the provision of a pension following my retirement. Whilst I would like to see a universal pension adopted, I think that the provision of the benefits provided in addition to the aged pension, ie. Rates reductions, car rego etc should definately be available through an age related criteria only. It is disappointing to me that I don’t receive these benefits as a thankyou for not being a burden on the taxpayer.

I’am 68 yrs old,retired no longer working,born in Australia 1954,parents born in

Australia,centrelink tell me I’am not entitled to government pension because my

assets exceed the threshold,I’ve been working since 17 years old,paid all my

Taxes contributed to state and federal outgoings, centrelink tell me that I’am

Priveledge should be proud of myself,why do I feel cheated ?,why did I get out

of bed at 0300 in the morning and go to work when my friends were going to

The beach or attending family functions,yes I was a shift worker, what a fool I

have been,what an idiot spent my working life contributing but receiving

nothing in return, but I should be proud of myself ,

Are you SERIOUS!

Yes, an unfair system for those who have worked all of their life, paid tax, reared a family, educated children at home in the bush (another job for mum, but unpaid) owned our first new car aged 68. Saved money for our old age and built a home. Now at the tail end of our mortgage with one of us still working at 73 and the other losing her job of 18 years service via a phone call (being one of many people) when the COVID cloud blew in. Apparently we have too many assets to apply for a pension or even a part pension, now that one of us (also aged 73) is out of paid work: our assets were achieved by working (sill working), saving and living within our means. No boats, caravans or trips overseas are on our agenda. We own heavy machinery, acreage, a few head of cattle and a second vehicle for work, they would be classed as assets and so it go on… a Universal Age Pension would be fair, especially for the people who have truly earned it! We are not wealthy and old just weary and old but still prepared in doing our bit for as long as we can.

Yes, an unfair system for those who have worked all of their life, paid tax, reared a family, educated children at home in the bush (another job for mum, but unpaid) owned our first new car aged 68. Saved money for our old age and built a home. Now at the tail end of our mortgage with one of us still working at 73 and the other losing her job of 18 years service via a phone call (being one of many people) when the COVID cloud blew in. Apparently we have too many assets to apply for a pension or even a part pension, now that one of us (also aged 73) is out of paid work: our assets were achieved by working (sill working), saving and living within our means. No boats, caravans or trips overseas are on our agenda. We own heavy machinery, acreage, a few head of cattle and a second vehicle for work, they would be classed as assets and so it go on… a Universal Age Pension would be fair, especially for the people who have truly earned it! We are not wealthy and old just weary and old but still prepared in doing our bit for as long as we can.

I’m 82 and still can’t get a pension. Yes my wife (71) still works because she has to as my Superannuation Fund collapsed when I was 60. I have spent years trying to get government to introduce a “Universal Pension” but without success. Two years ago I received the astonishing statement from the then Federal Minister responsible for pensions that pensions are NOT paid from tax receipts!! Oh really….so where do pension funds come from? Interesting to see in today’s news (15th June) that Federal Politicians have received a substantial pay increase. Ridiculous – wake up Australia and amend our archaic and totally unfair pension program.

I think there should only be one pension. This would be the aged pension available at the age of 65. Politician pensions, veteran,disability etc after the age of 65 become null and void. The only pension should be asset tested to a universal rate of $5,000,000. People having more than this would receive $0. People have less than this would receive the full pension. This would remove all ongoing politician pensions that are paid to people that have too much already. This would be a simple way to set up a pension scheme that would be fair to all. Each individual person would be entitled to a pension, not a couple.

I am all for a Universal Pension for every Australian irrespective of status, be it single or couple. Under the present tax system every Australian is treated individually. If you are a couple the ATO doesn’t add up the income for both people and divides it by two so why are couple treated jointly for aged pension access? It seems discriminatory and I wonder if there is anything under the Constitution and or existing laws that a challenge could be taken up through the High Court.

I am all for a universal pension scheme.

Regardless of assets and income, all qualifying aged members of our Australian society should be eligible for an equal and liveable age pension.

Consider the couple who have contributed to society by working hard and have gained assets to live a comfortable retirement. Due to their assets, they may well have a reduced pension, if not, no pension at all because of means testing.

As things stand, they could relinquish there assets and buy a million dollar primary place of residence and, as such, claim a full pension. How stupid is this.

Older members of society are not hoarders of money. If assets and income can be retained, the pension and any other income would most probably be returned to the economy. Thus, jobs and businesses would be sustained and a good standard of living would be had commensurate with the pensioners holdings.

By giving a full pension regardless of status, this money would be almost immediately put back in and boost the economy as well as providing the pensioner with a more diverse lifestyle.

It appears, through assets and income testing, the government is determined to make those vast number of pensioners unable to live independently survive at the lowest possible ebb.

If we have a universal pension does it mean that politicians & government employees would get the same amount as the rest of us, that would help fund the scheme.

Agree 100%, so they should

Yep. Have a universal pension which is non discriminatory. The lower costs from less bureaucracy and the revenue from much more tax will outweigh the forgone savings for the govt.

I AGREE 1000% WITH ALLAN DEACON ( on February 6, 2023 ). THIS CURRENT SYSTEM IS SO SCREWED UP THAT A DEAD MONKEY COULD SEE THAT.A UNIVERSAL AGE PENSION SYSTEM MUST PREVAIL!

My wife and I are self funded retirees, if I withdrew a large sum of money from my super fund and used it to buy a nicer home would I be able to access the age pension if I got the super below the maximum allowed ?

Hi Paul, yes this is a strategy that could work for you as your primary place of residence is exempt from assessment.