How Centrelink calculates the Age Pension

New Rates: September 2023

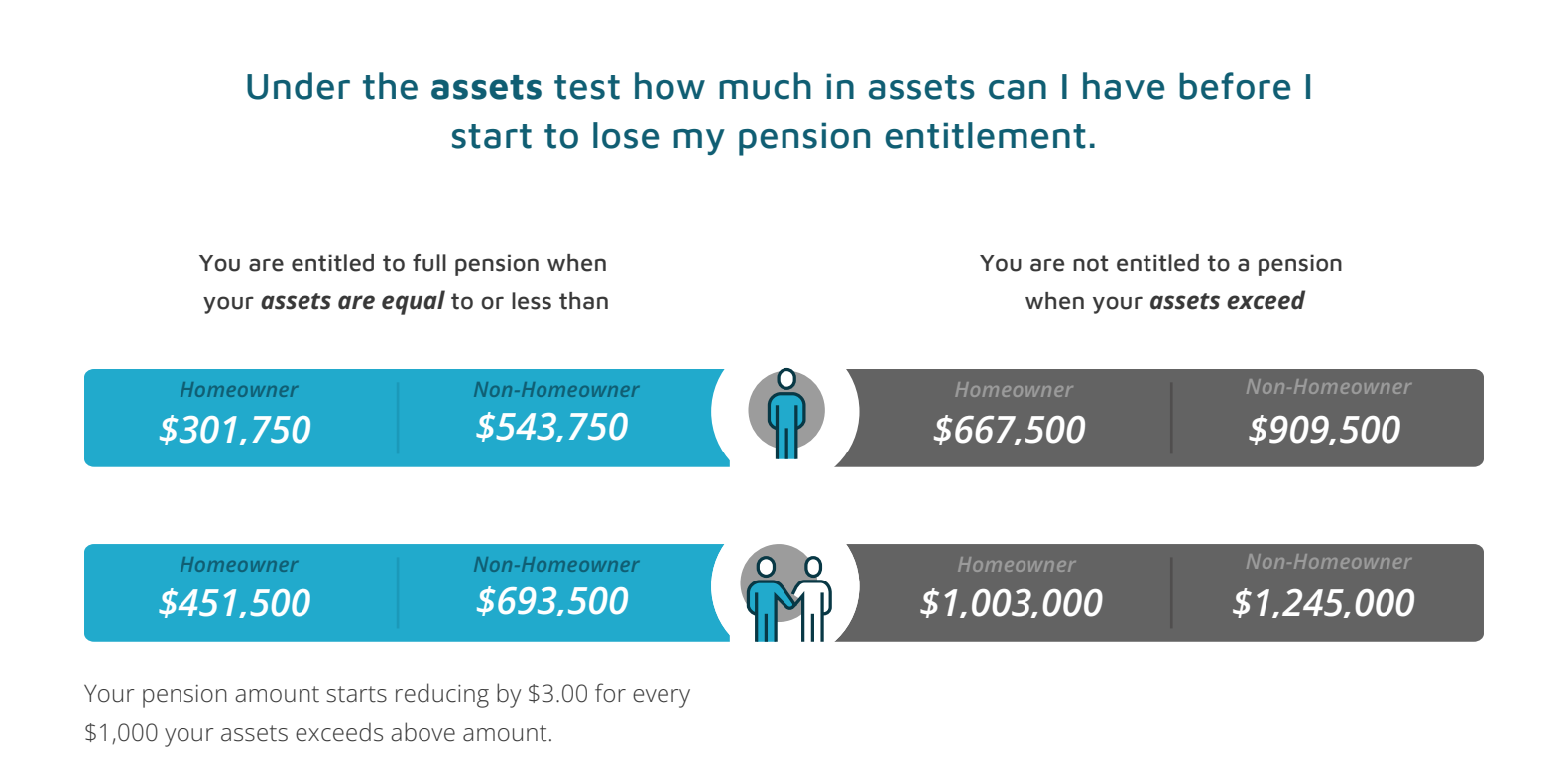

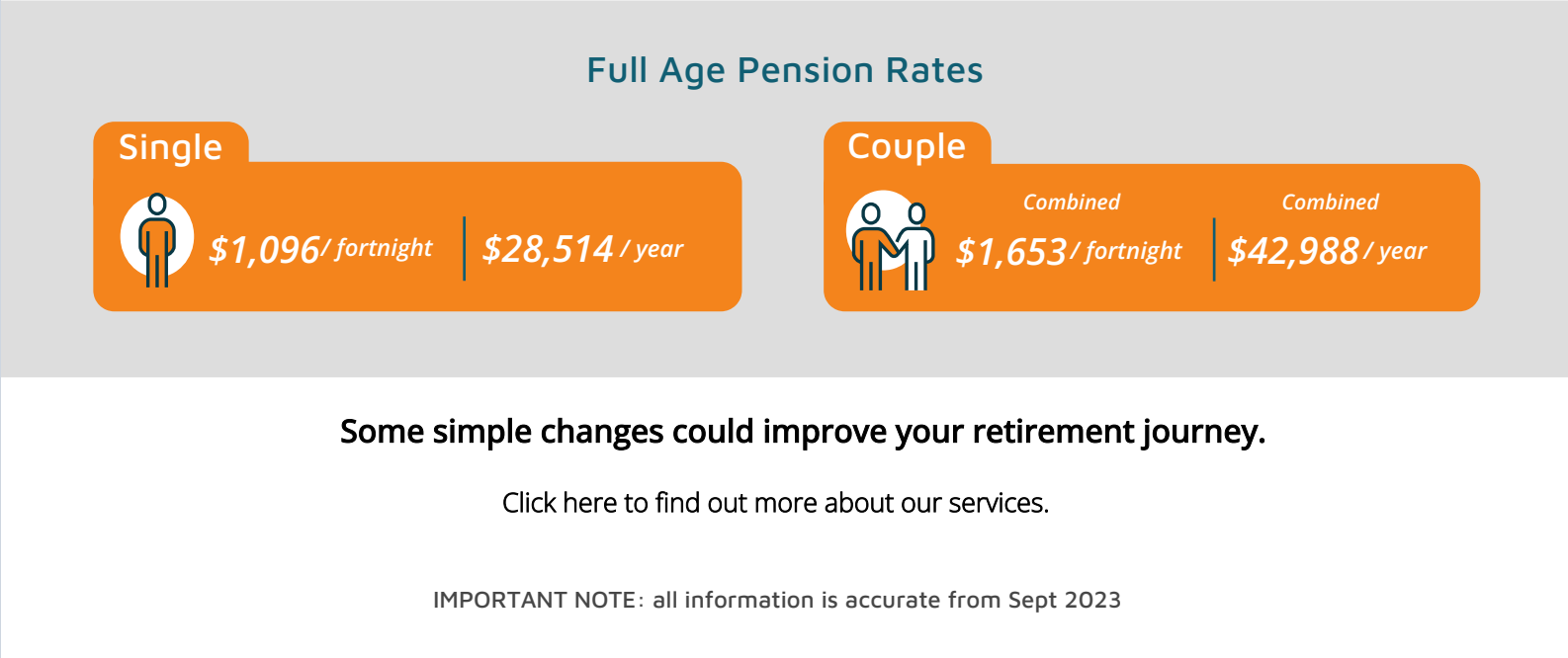

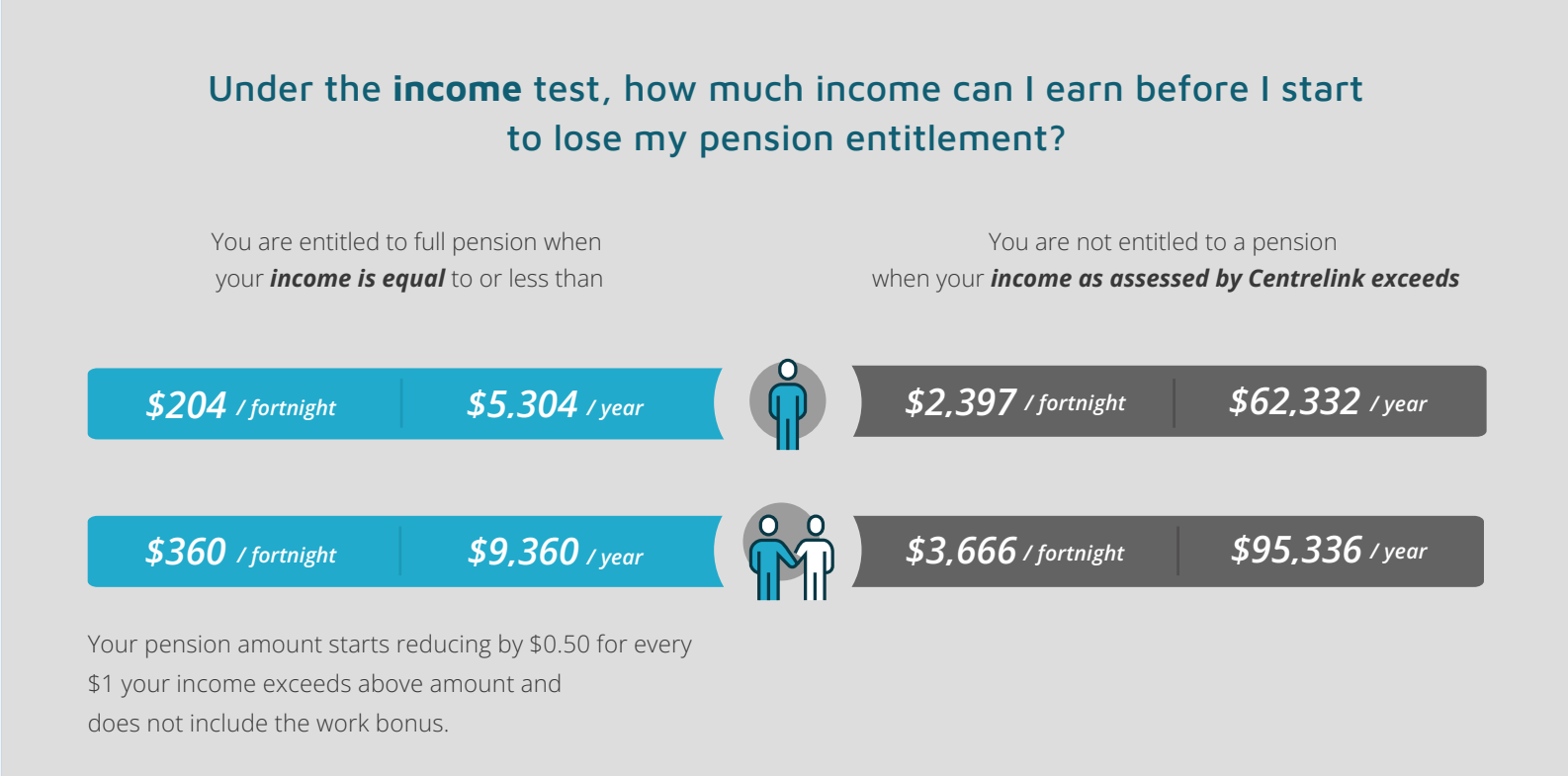

Knowing how Centrelink calculates the Age Pension will help you to understand the questions they ask and why they need the information. Centrelink determines your Age Pension entitlement by assessing your income and your assets independently, which is referred to as the Means Tests. The Means Tests are there to ensure the Age Pension is targeted to those who need it most. Currently around 7 in every 10 people over the age of 65 receive some level of age pension.

Centrelink assesses the income you generate anywhere in the world from:

- Employment, including part time, casual or seasonal work

- Rental property income

- Business incomes or profits

- Pensions or social security style benefits from other authorities

However, Centrelink does NOT assess the income you actually receive on your financial assets (e.g. bank accounts, shares, bonds, loans, superannuation, etc). To make the assessment process simpler Centrelink ‘deems’ (calculates) the income they include in the Income Test from your financial assets. The current deeming rates are 0.25% on your financial assets up to $60,400 (Singles) or $100,200 (Couples) and 2.25% on your financial assets over these thresholds.

IMPORTANT NOTE: all information is accurate from September 2023.