Retirement Healthcheck

It is hard to know how much you can safely spend and how much you need to put aside when you don’t know for sure how long your money needs to last. You might live longer or shorter than average, investment markets will go up and down and unexpected events can send our well laid plans off track. Whether you are in retirement or still planning your journey, getting the right advice and guidance can help you take control of your future, and give you peace-of-mind that you are making the best decisions for you.

Maximising your entitlements comes with so many complex rules that many retirees find that they are currently underpaid in retirement. Understanding your money options could provide you with many things you can do differently to feel in control of your finances and possibly maximise your entitlements during your retirement journey. After the Age Pension, superannuation is the most important source of income in retirement for most Australians. There are many things you can do with your super that can improve your income in retirement. It can help to have access to someone that knows the rules, tips and tricks.

Our advisers can help you understand your situation by following the five step checklist to help you assess your retirement health.

- Step 1. Determining your net worth.

- Step 2. Reviewing those non-negotiable expenses and spending needs.

- Step 3. Thinking about those spending wants (like a holiday).

- Step 4. Understanding what your retirement spending looks like.

- Step 5. Understanding how Age Pension contributes to your spending.

You will leave the consultation informed, including:

- How to identify any existing opportunities to maximise entitlements

- What options may help to afford a better retirement

- Steps you could take to improve your retirement.

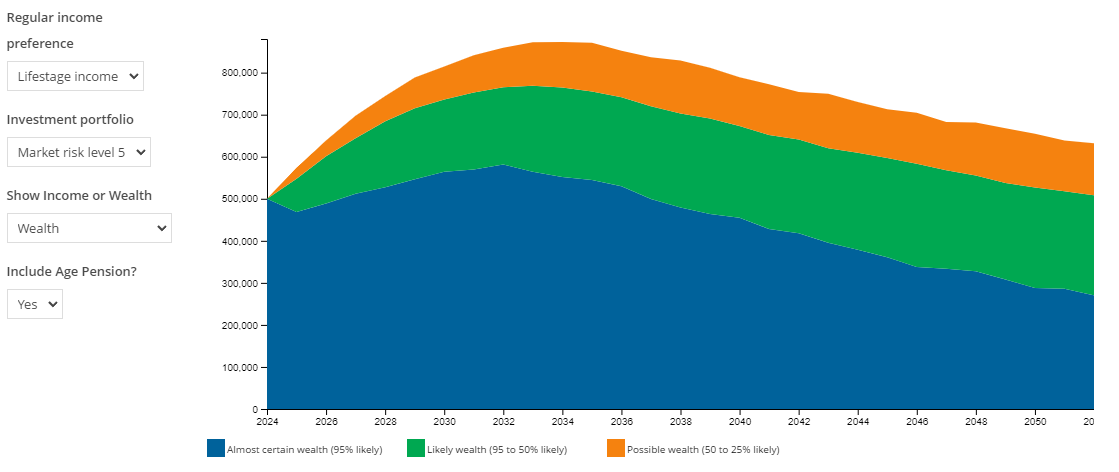

Forecasting your future

Based on the information that you provide, we will show you your current forecast of your wealth/income over the coming years and provide you with additional information to assist you with your decisions.

Meet our Financial Advisers

Why use a Financial Adviser?

Empowerment – piece of mind you are in control of your finances

Comfort – You know you have someone to speak to

Clarity – you understand the rules and how they apply to you.

Confidence – you understand how your super and investments work.

Reassurance – you have the support to plan the future you envisage.

Financial Wellbeing – options to maximise your entitlements.

“Retirement Essentials is proud to serve the needs of senior Australians by making financial advice more accessible and affordable. Our financial advice consultations are designed purely to help our clients better understand their needs and goals in retirement and some of the actions they can consider to help them achieve those goals. “

Getting a Retirement Healthcheck

Whether you are in retirement or still planning your journey, getting the right advice and guidance can help you take control of your future, and give you peace-of-mind that you are making the best decisions for you.

Our fully qualified Financial Advisers are available to provide you help and guidance during our online Retirement Health Check for $375 (55 minute overview consultation).