Your Retirement

Life Check

Retirement Life Check

It is hard to know how much you will be able to safely spend in retirement and how much you need to put aside when you don’t know for sure how long your money needs to last. You might live longer or shorter than average, investment markets will go up and down and unexpected events can send our well laid plans off track.

Maximising your entitlements comes with so many complex rules that many retirees find that they are currently underpaid in retirement. Understanding your money options could provide you with many things you can do differently to feel in control of your finances and possibly maximise your entitlements during your journey to retirement. After the Age Pension, superannuation is the most important source of income in retirement for most Australians. There are many things you can do with your super that can improve your income in retirement. It can help to have access to someone that knows the rules, tips and tricks.

Whether you are about to start your retirement journey or planning for the future, our advisers believe these seven simple steps can help to achieve success both now and ongoing for your best retirement.

Step 1: What do you want to do during retirement?

Step 2: What will it cost?

Step 3: Plan for a long life in retirement!

Step 4: Understand what your current situation will provide.

Step 5: What options are available that you could use to maximise your retirement?

Step 6: Get a financial picture of your retirement journey?

Step 7: Do you need to close the gap or maybe not!

This is where a Retirement Life Check with a Retirement Essentials adviser can help. The goal of a 55 minute consultation is to discuss your most important goals and help you to understand your options and the rules to better enjoy your retirement including providing answers to the big questions that worry most retirees.

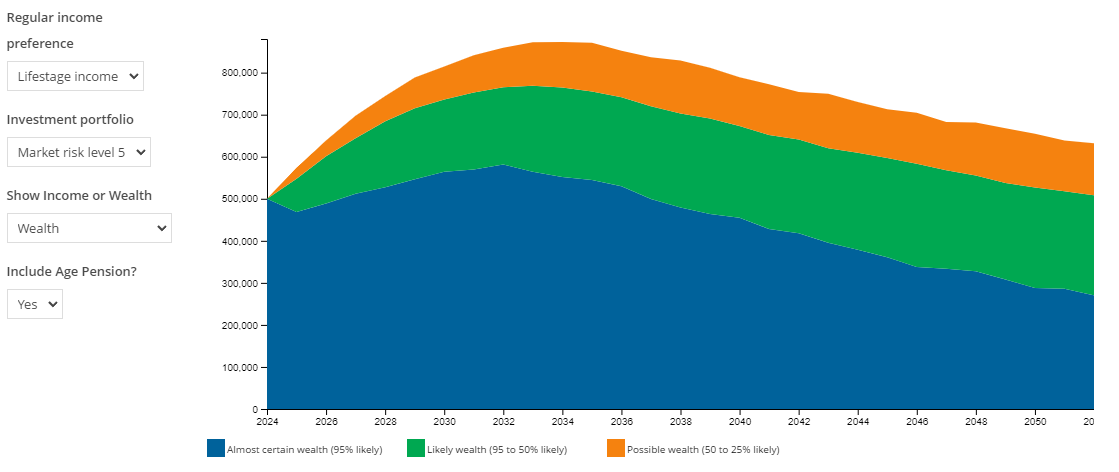

Based on the information that you provide, we will show you your current forecast of your wealth/income over the coming years and provide you with additional information to assist you with your decisions.

Book a consultation with Retirement Essentials to check your Retirement Life Health

Consultation – $330

Talking with our Specialists on a 55 minute video call consultation will:

- Assess what is most important to you for your retirement needs.

- Show you your Forecast and how your retirement situation is tracking in relation to your expectations.

- Help you to understand and consider alternatives or changes that can improve your retirement.

- Help you to understand how organising your assets might improve your entitlements.

- Provide you with confidence that you understand the Centrelink and Superannuation rules and their impact on you.

Act now

Simply select a date and time that suits you and book in a consultation!

Book Now

Areas that customers speak with our financial advisers about

- Reviewing assets

- Aligning investments to your comfort level

- Understanding how to make the most of the options available

- Supplementing your age pension income

- Downsizing your house and what you can do with the money

Our financial advisers can provide you with information, options and possible strategies to help you feel in control both now and in the future.

Our consultation will help you answer some of the most common questions about super in retirement, including:

- When can I access my superannuation?

- How do I maximise my Age Pension when I also have super?

- Should I use my super to pay off my mortgage?

- How much should I draw down from my super?

- How can I make my super last longer?

- Are there any tips and tricks that could get me more Age Pension or other entitlements?

- What are the tax advantages of super when I have retired?

Why use a Financial Adviser?

Empowerment – piece of mind you are in control of your finances

Comfort – You know you have someone to speak to

Clarity – you understand the rules and how they apply to you.

Confidence – you understand how your super and investments work.

Reassurance – you have the support to plan the future you envisage.

Financial Wellbeing – options to maximise your entitlements.

“Retirement Essentials is proud to serve the needs of senior Australians by making financial advice more accessible and affordable. Our financial advice consultations are designed purely to help our clients better understand their needs and goals in retirement and some of the actions they can consider to help them achieve those goals. “

Getting a Retirement Life Check

Whether you are in retirement or still planning your journey, getting the right advice and guidance can help you take control of your future, and give you peace-of-mind that you are making the best decisions for you.

Our fully qualified Financial Advisers are available to provide you help and guidance during our online Retirement Life Check-Up for $330 (55 minute consultation).

Book a consultation with Retirement Essentials to check your Retirement Life Health

Consultation – $330

Talking with our Specialists on a 55 minute video call consultation will:

- Assess what is most important to you to understand your retirement needs.

- Show you your Forecast and how your retirement health situation is tracking in relation to your expectations.

- Help you to understand and consider alternatives or changes that can improve your retirement health situation.

- Help you to understand how organising your assets might improve your entitlements.

- Provide you with confidence that you understand the Centrelink and Superannuation rules and their impact on you.

Act now

Simply select a date and time that suits you and book in a consultation!