All you need to know in 2023

The Age Pension provides core funding for about seven out of 10 Australian retirees.

The stated intention of this entitlement, according to the responsible department, the Department of Social Services, is to to support the basic living standards of older Australians who meet age and residency requirements.

Yet many of those who receive a pension can find it difficult to keep up with frequent annual changes to rates and entitlements, whilst the timing of these changes can also seem unexpected. Additionally, those who miss out on an Age Pension are sometimes left in the dark as to why.

Today we share an overview of the rates, dates and main rules so that you can keep on top of your own entitlements, share this information with loved ones and friends, and follow-up if you have any concerns that the rules have been mis-applied in your own situation. This article will give you an overview of:

- How the Age Pension is calculated

- The income thresholds – How much you can earn before your pension is affected

- The asset thresholds

- The current Age Pension rates

- When Age Pension rates change each year

- When the asset and income thresholds change each year

- Oher changes that could occur in 2023 that could impact the Age Pension including the end of the work bonus extension.

How is the Age Pension Calculated?

Centrelink, as the delivery agency for Services Australia, calculates your entitlement based upon a means test. There are two separate parts to this assessment, which uses both an

- Income test and

- Assets test.

Should you fail either test, then you are not eligible. Whichever test awards the lower rate of the Age Pension is the one which will be used to calculate your fortnightly payments.

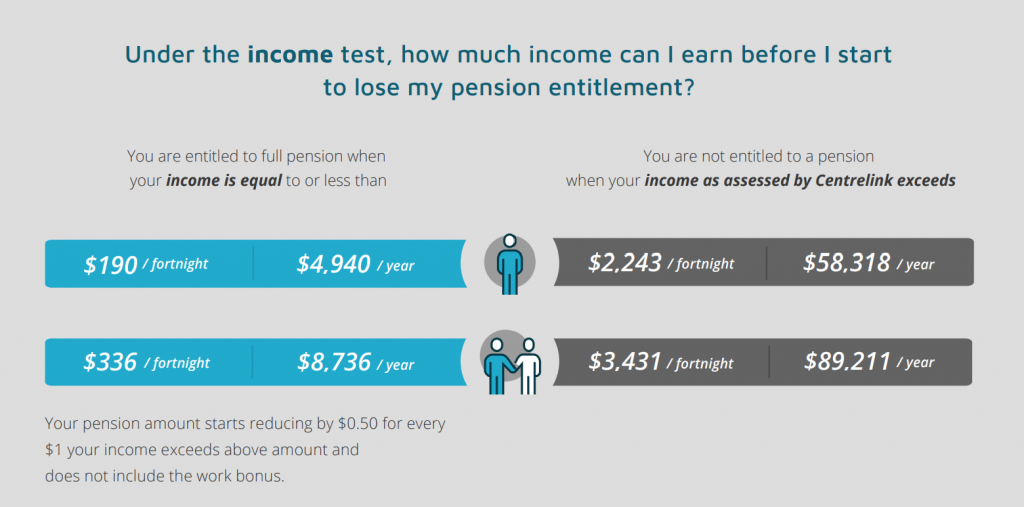

How much income can you earn?

Centrelink assesses a list of different forms of ‘effort-based’ income which is assessed directly. It also has a calculation applied to financial assets which deems an income from these assets regardless of how much you are actually earning. The resultant balance is added to the deemed earnings on financial assets in order to achieve a total, which is then matched to the thresholds.

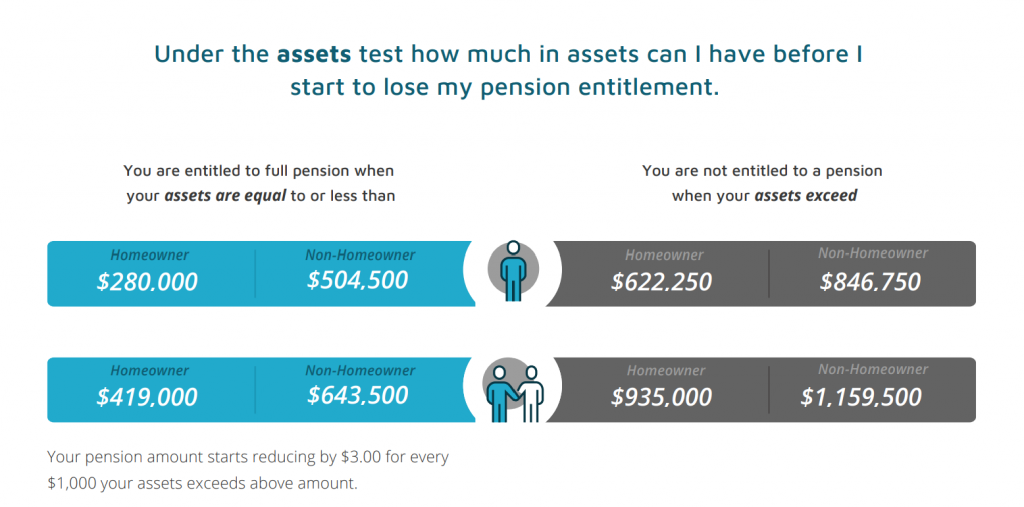

How much in assets will entitle you to a full or part Age Pension?

Centrelink uses different thresholds to assess assets for single homeowners, single non-homeowners, couple homeowners, and couple non-homeowners as well as those separated by illness or certain other reasons.

Here are the current thresholds

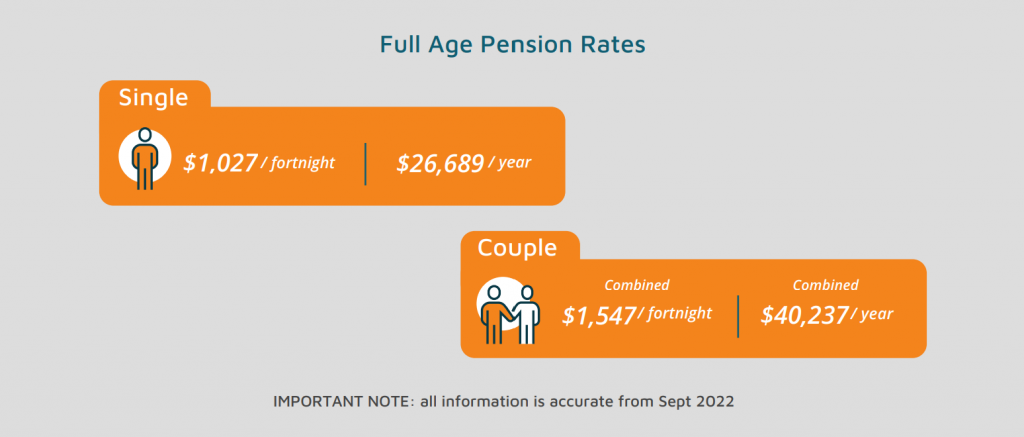

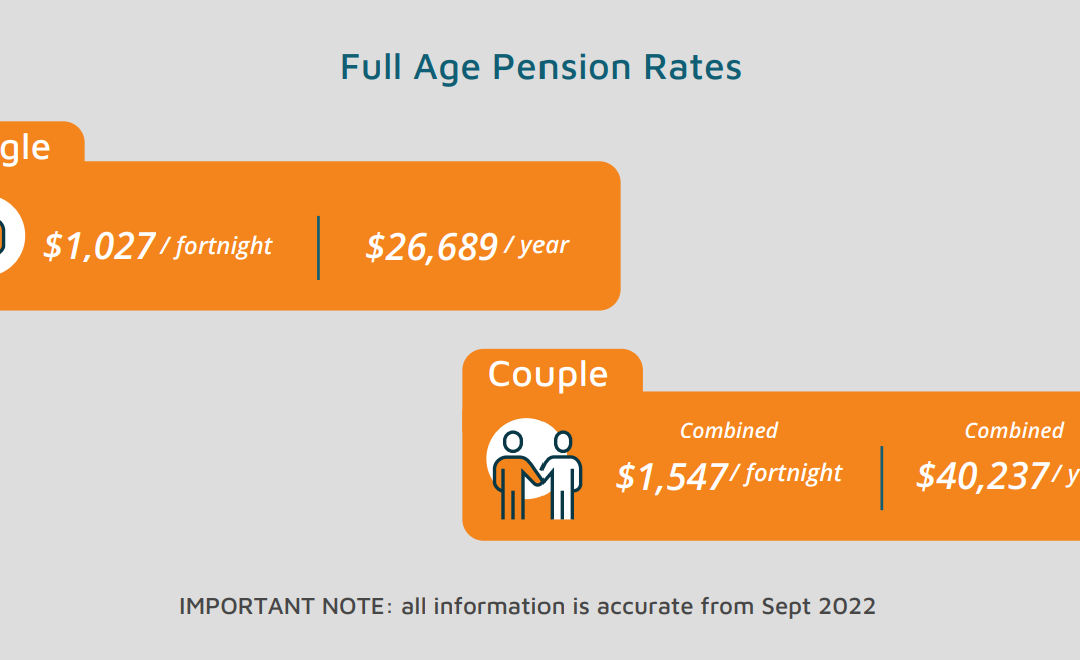

What are the current Age Pension rates?

When will Age Pension rates change in 2023?

The base rate of the Age Pension is recalculated every March and September. The new rates are published on or about the 20th of March and September. The base rate is indexed using a mix of three different measures; Consumer Price Index, Pensioner Beneficiary Living Cost Index and the Male Total Average Weekly Earnings. Here’s how indexation works.

When will Age Pension thresholds change in 2023?

The thresholds for the income and assets test are indexed and adjusted along with the rates in March and September each year. There is also an additional indexed adjustment in July.

When do the Deeming rates change?

These rates are reviewed by the Minister for Social Services and can change without warning. However this is unlikely to happen until July 2024.

Deeming rates have been frozen until June 30, 2024 due to the volatile economic climate during the Covid Pandemic, coupled with interest rate uncertainty. This was seen as a way of giving Australians on the Age Pension some security in the way their income will be deemed.

The current deeming rates are:

- 0.25% on your financial assets up to $56,400 (Singles) or $93,600 (Couples)

- and 2.25% on your financial assets over these thresholds.

What other changes might be made to the Age Pension this year?

1 July Qualification for Age Pension

Since 1 July 2017, the minimum age for both men and women to qualify for the Age Pension began to increase. For men and women born on or after 1 July 1952 the pension age will reach 67 on 1 July 2023. No further age increases are currently legislated.

Increased Work Bonus ends 31 December

From 4 November last year, the Work Bonus credit for those on an Age Pension was lifted to $11,800 from $7,800. Originally this extra amount was to expire on 30 June 2023, but as it took a while to shepherd the legislation through a crowded parliamentary schedule, the new expiry date for the extra amount is December 31, 2023.

The above offers a brief summary of the main detail of the Age Pension.

Below are some helpful links to further information and definitions.

And whilst we cannot guess which other aspects of this important retirement income pillar might be altered during the year, you can rest assured that we will report on every detail, as it happens, in the weekly Retirement Essentials e-newsletters.

General overview of the rules and rates

Struggling to get on top of how the rules are applied in your particular situation? You’re not alone. Many Retirement Essentials members have been relieved to share their questions and concerns in one-on-one entitlement consultations with our friendly Customer Service Team or advisers.

Keep up the great work very informative