As we reported last week, the qualifying limits for the Age Pension will change on 1 July. These changes are significant and therefore are likely to have a major impact upon your pension eligibility, as well as the amount of your fortnightly entitlements.

The good news is that the Retirement Essentials team has worked hard to ensure that all the detail in our retirement income and spending calculators is totally up to date with the new rates and thresholds.

As all Age Pension applications take some time to prepare and substantiate (including the required documents), we’ve ensured that our calculators are set to go now with the new amounts. So you can get started early, without needing to worry about how you’ll be affected.

So why not visit our Age Pension Entitlements Calculator today, submit your up-to-date income and asset details and learn within minutes how these changes could affect you?

And if you need further support or explanation about your particular financial situation, our experienced advisers are available for one-on-one consultations.

Meanwhile, here is a link to last week’s update on the detail of the changes to income and asset thresholds and deeming rate increases.

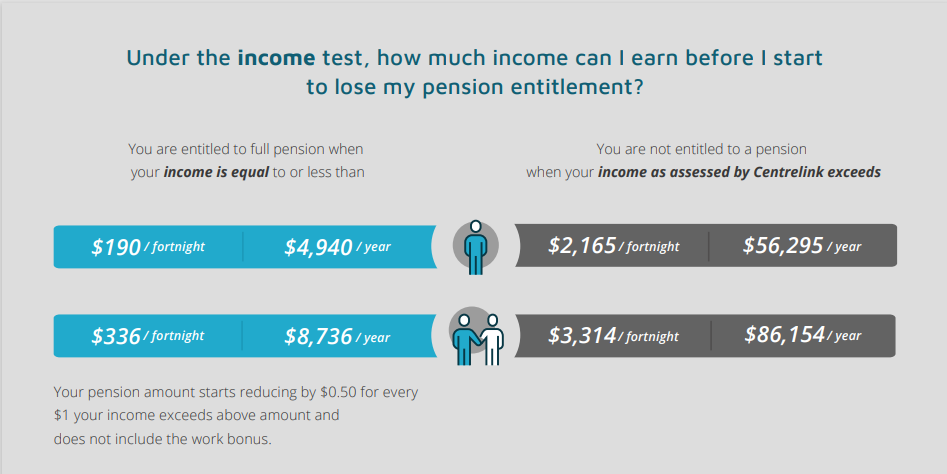

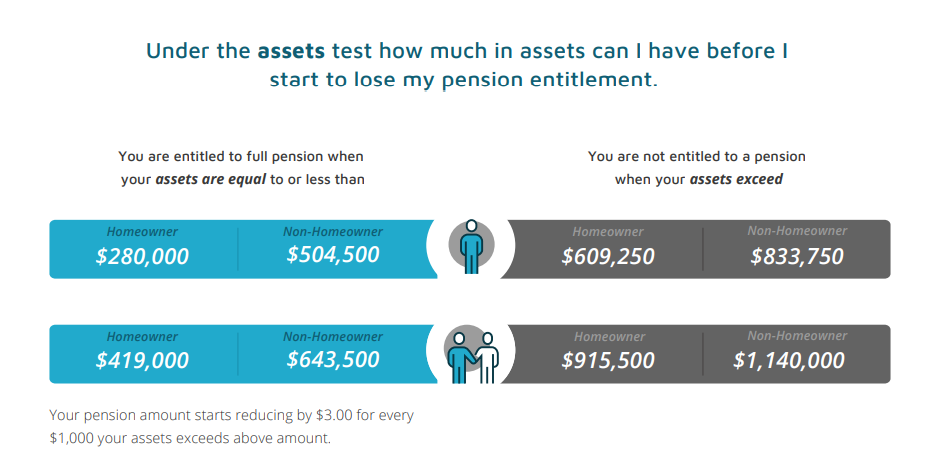

The tables below have the full income and asset test thresholds outlined.

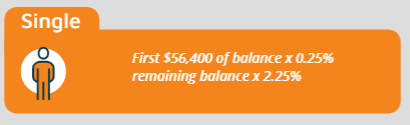

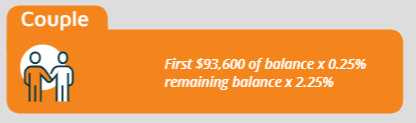

Deeming Rates

Deeming rates have been frozen for the next two years. In a period of rising interest rates this is good news for older Australians.

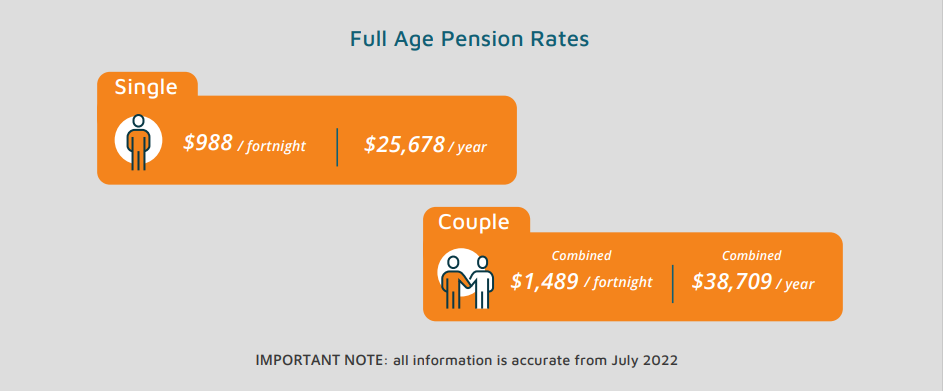

Age Pension rates

The new thresholds mean many people who were previously ineligible will now find they could be eligible to receive at least a part pension, and many part pensioners will be eligible for more. Our free entitlements calculator has been updated with all the new thresholds and deeming rates so why not check your entitlements now

I am currently out of work

Hi Maria, sorry to hear of your employment situation. If you’d like to email us a more personal explanation of your situation we would be happy to let you know how we can potentially assist you moving forward.

How does the $300 per fortnight bonus work and do I qualify so I need to apply

Hi Rob thanks for reaching out! We’ve actually covered off the work bonus in a previous newsletter. CLICK HERE to read about it in more detail.

I really enjoy your articles that are very informative. However, I would like to make a request. As you are targeting mainly older people, could you make iyour information easier to read by using black fonts rather than grey fonts – and by using fonts that are not smaller than 12 or 14 pts.

Thank you.

Thanks for you feedback and suggestion Allyson. We do review ways to make our articles more accessible so I’ll add this to our list of issues to review. If it is a concern for you it will also be for others. Again, thank you.

Hello, I am 58 years old and have very little in superannuation and savings. I am currently on Newstart (with ongoing medical certificates because of my injuries and Complex PTSD).

Is there any way that I can be put on the aged pension?

If not, what other options do I have?

I have been advised that I am a high insurance risk for an employer. Therefore I don’t hold any hope of being able to work again.

Please advise me if you can help.

It is my understanding that I would be better off being on the aged pension or disability pension.

Hi Martin, thank you for reaching out and I am sorry to hear of your injuries and PTSD. The Age Pension is not an option for you at this stage as you must of of age before you can apply. There is no exception to this requirement. The disability pension may be a better option for you however we are not thoroughly across it so could not advise you. I recommend you call Centrelink to see if there is another/better option for your situation.

I am a single aged pensioner. I’ve retired early. I have been in my restaurant businesses for 15 years, prior to that I’ve worked as a PA for the mayor of my local city in South Africa. I have good computer skills, travelled extensively throughout the world and have so much to offer. I would like to get into the job market once again even if I have to volunteer!!! Please Help!

I receive $310 per fortnight from a Super pension fund. Is that acceptable under current guidelines or do I need to reduce it so my pension is not reduced?

Hi Pat, thanks for reaching out! In terms of how much pension you receive, it actually does not matter how much you draw down from your super pension account. Centrelink treat the account as an asset (not income) and assess it based on the total balance in the account. There may be tax or other pros/cons for drawing down more/less but from Centrelink’s perspective they are looking at the total balance, not how much you are drawing down.

What happen to the age pension from centrelink or DVA service pension if one choose to live overseas for 3 to 5 months during the colder winter months

Hi Victor, great question, it would be nice to escape the winter chill! Generally speaking you can leave the country and continue to receive the Age Pension. The amount you receive will be reduced depending on how long you are out of the country for and how long have been an Australian Citizen/Permanent Resident prior to leaving. CLICK HERE to read up on the potential impact.

Is the $300 work bonus per fortnight Gross or Net?

Hi Margaret, thanks for seeking clarity! Centrelink assess your gross income earnings and that is what the work bonus is taken off of.