Centrelink have announced changes to Age Pension income and asset thresholds. This could mean more Australians will now qualify for at least a part pension and those already on a part pension could receive more. A couple of weeks ago we wrote about what a difference a dollar makes. Just $1 of age pension can give people access to thousands of dollars in supplements and concessions.

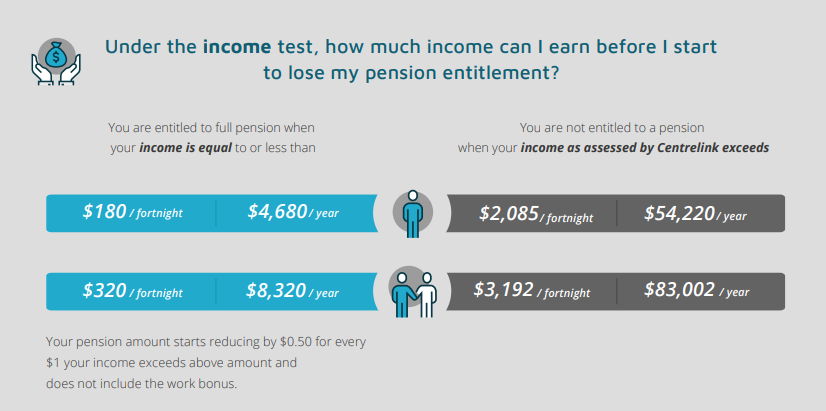

Income thresholds

- Singles can now earn up to $180 a fortnight before their Age Pension is affected while couples can earn $320.

- The upper limit for a single has increased to $2,085.40 and for a couple to a combined $3,192.40

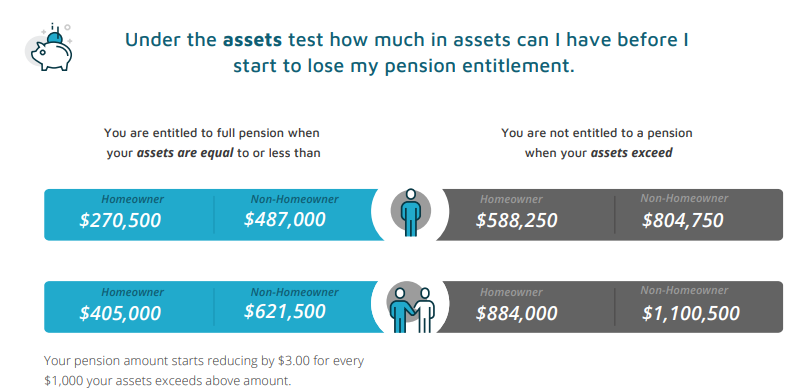

Asset thresholds

The upper limits on the assets test have increased as follows:

- A couple that don’t own their own home now have an upper threshold on their assets of $1,100,500, an increase of $5,500 while a non home owning single has a limit of $804,750.

- A home owning couple have an upper limit of $884,000 and a single of $588,250.

The new limits will be effective from 1st July. Our age pension eligibility calculator has been updated with the new thresholds. You can check what you are eligible to receive here.

is the pension reduced by $3.00 per fortnight or per year for very 1000 exceeding the entitled amount? Your site does not make this clear.

Hi. Under the assets test, your age pension does decrease by $3 for every $1000 above the lower threshold and ceases entirely when your assets exceed the higher threshold. You can read more about how this works here.

Hi There

Following on from the query from Les

We are nearing pension age and planning our retirement.

At 67, If we have $600K in assets (say $100K in car, caravan, savings and personal belongings and $500K in superannuation in an account based pension) is the $500K counted in the assets test. If it is then do we lose the $3 per $1000 for the $200K over the approx $405K full pension thresh hold. Is that then $600 per fortnight which equates to an annual age pension for a couple of approx $21,400 instead of the full pension of approx $37000 if we were below the $400K thresh hold

Hi Stephen, you are definitely on the right track! Whether your super is in accumulation or pension phase it still counts as an asset and so combines with your other assets to make up $600,000 in total. To calculate the impact accurately and confirm how much pension you would receive in this and potentially other possible scenarios, I recommend using our free online calculator which you can find HERE

Hi there

How much money can a pensioner gift to grandchildren ?

Hi Effy, thanks for your comment! We’ve actually written an article about gifting HERE. The thresholds stated are still correct today.