With seven out of 10 older Australians currently on an Age Pension you would think the rules would be relatively easy to understand.

Unfortunately complexity is a feature of our retirement income system – another feature is the frequency of changes to rules and rates. It’s also really important for all retirees to both understand these rules and to stay up to date with any all changes, as your entitlement status can alter before you know it. So here is an income and assets test refresher.

Unlike other countries, our Age Pension is not universal. It is subject to a means test and has other requirements which must be met before it is granted. It currently provides a secure, government guaranteed stream of income for all citizens who qualify. This income stream is indexed twice yearly to ensure that the Age Pension remains in touch with ‘ordinary’ work earnings as well as any fluctuations in the Consumer Price Index and/or the Pensioner and Beneficiary Living Cost Index (PBLCI).

Means testing is used to make sure that Age Pension entitlement is targeted to those who need it the most. The means test relies upon income and assets tests in order to assess applicants.

But first up, you must be of Age Pension age and you must meet all residency requirements.

Your income and assets are assessed independently. Whichever assessment delivers the lower Age Pension entitlement is the one which Centrelink will follow in determining your fortnightly payments.

The following information offers a brief overview of the current thresholds for both the income and asset tests. The links provided will take you to longer articles which explain the different aspects in more detail.

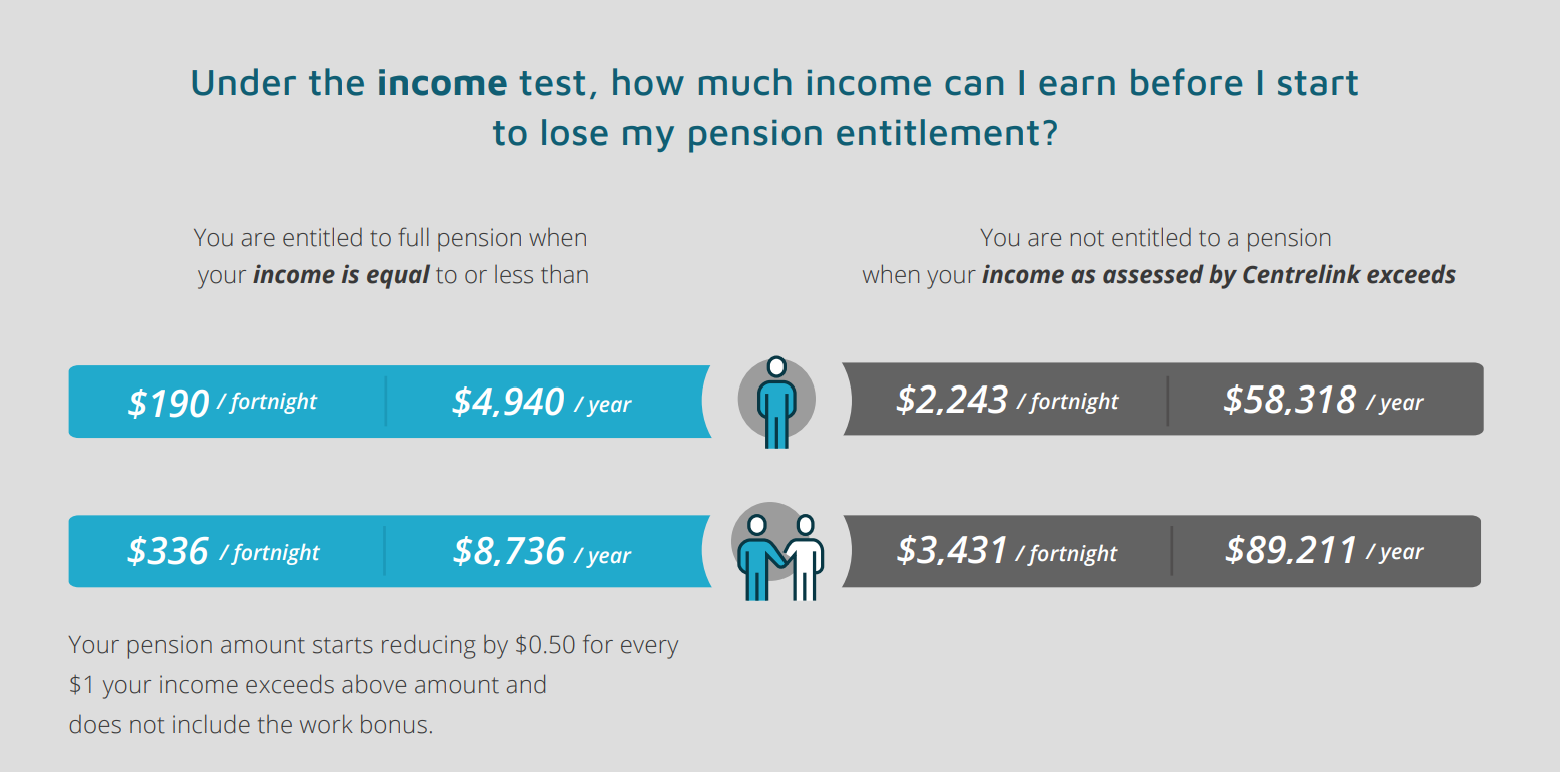

Income test – How much can you earn?

Read more on how income is defined and deemed here

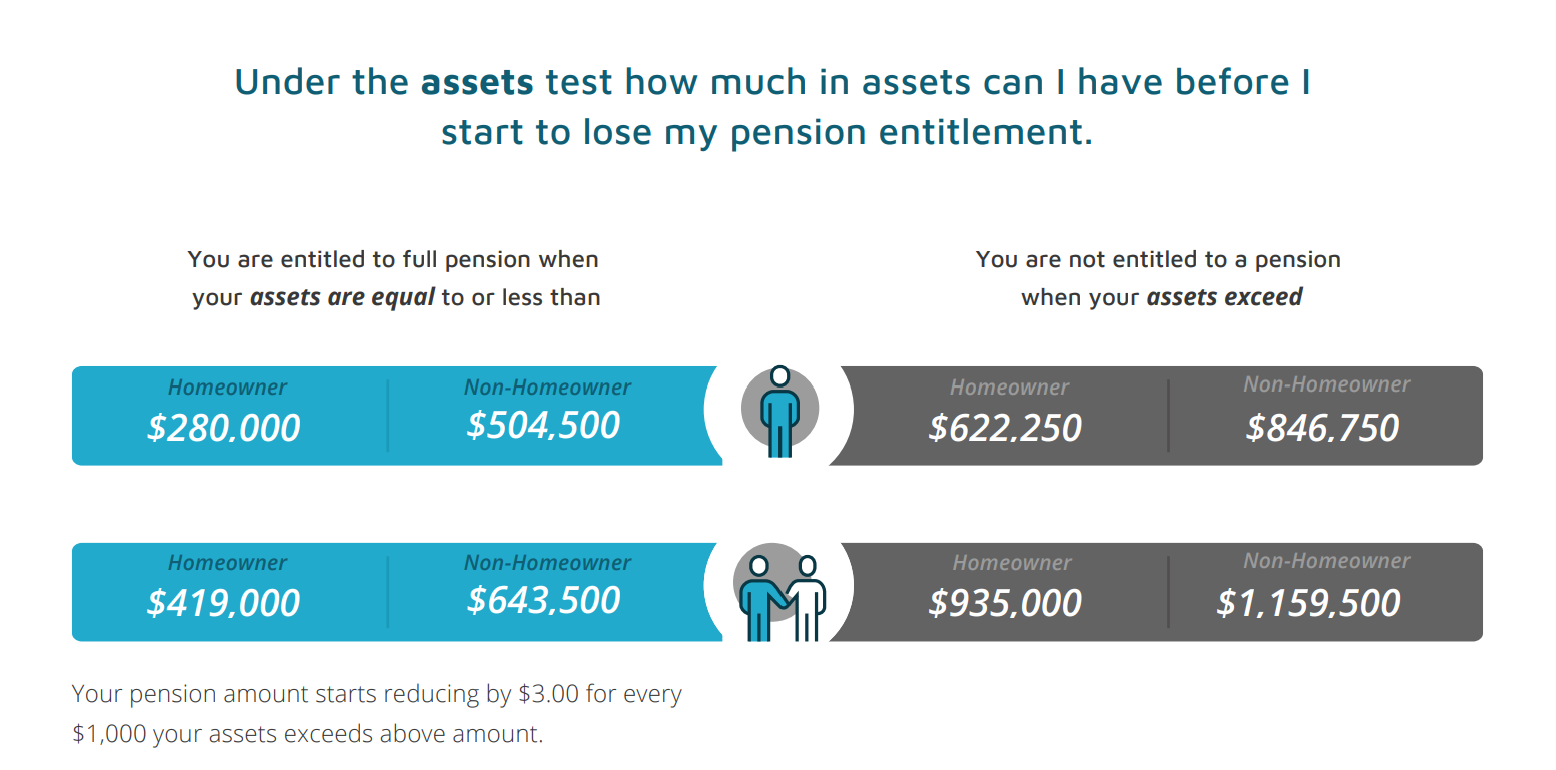

Assets test – How much can you have and still qualify?

Further detail on the definition of assets and those which are deemed can be found here.

It’s entirely fair to wonder whether Is reducing assets a legitimate way to qualify for an Age Pension? There are upsides and downsides to reducing assets and this strategy does not necessarily mean you will then qualify for the Age Pension. Read more about this here.

Need to know:

In summary, it’s important to remember the following things about the Age Pension.

Whilst the indexing of the base rate of the Age Pension is updated every March 20 and September 20, there are many other aspects of entitlement that can also change on these dates, but sometimes don’t. Additionally, ad hoc policy changes, such as the increase to the Work Bonus [ https://retirementessentials.com.au/work-bonus-extension/ ]or the recently announced Energy Rebate. [ https://retirementessentials.com.au/energy-rebates-for-retirees/ ] can occur without notice. It is important if you have qualified for an Age Pension (or hope to), to keep on top of the rules so that you don’t lose precious income by not starting or resubmitting an application as soon as you are able to.

Here’s a link to a free calculator which allows you to see your own assets and income assessments and will calculate any deemed income on your assets. If you do not qualify for an Age Pension, this calculator will also advise you if you are eligible to apply for a Commonwealth Seniors Health Card instead.

Lastly, whilst we can all try diligently to follow all the rules, sometimes it helps to touch base to ensure that your understanding and interpretations are correct. For this reason an appointment with one of our Customer Service Team may provide the information and support to ensure you are comfortable with your decision-making. You can also check what you might be entitled to receive on our free eligibility calculator

IMPORTANT NOTE: all information is accurate from 20 September 2022.

I thought the new work Income test level was $11,800 / annum for a retired couple before any pension amount is reduced? (Not $8,736)

Hi Peter, thanks for keeping us on our toes! I can confirm that as of today (28/12/22) $336/fn or $8,736/yr is correct. CLICK HERE to see Centrelink’s website confirming it.

Hi folks. Have much appreciated your information on retirement. My DOB is 15/03/1958 and will likely look for some assistance when getting closer to the age pension commencement date as unfortunately I will need it. Thanks again.

Hi Joe, thanks for the feedback! We look forward to helping you when you are ready to apply.

I think there seems to be some confusion about “Income Test” (as per your figures for income from various sources, including passive income from investments) v. “Work Bonus” (which is in addition to the Income Test amounts: I think $7800 per year extra for ACTIVE work, with a boost for calendar 2023 of an additional $4000, making a total of $11800 for 2023 only, at this stage). Perhaps you could clarify that detail somewhere (you probably have in previous articles!)

Hi there, thank you for highlighting your concern! We have discussed the work bonus and it’s impact in another article which can be found HERE.

As I understand the income level for the CSHC has increased to a realistic level. Several of my friends are confused as to the income assessment rules. The main area of confusion is actual income earned as opposed to deemed, the question being is income from employment or even a capital gain treated as income per se or is deeming the only concern.

It is time the federal government adopted the same income system as New Zealand and the UK. Does not matter what you earn your pension stays the same because you are paying tax on the additional income. This would help the worker shortages as well. Happy and engaged older people also means healthier older people thus reducing the drain on the medical system. WIN WIN!!!!!