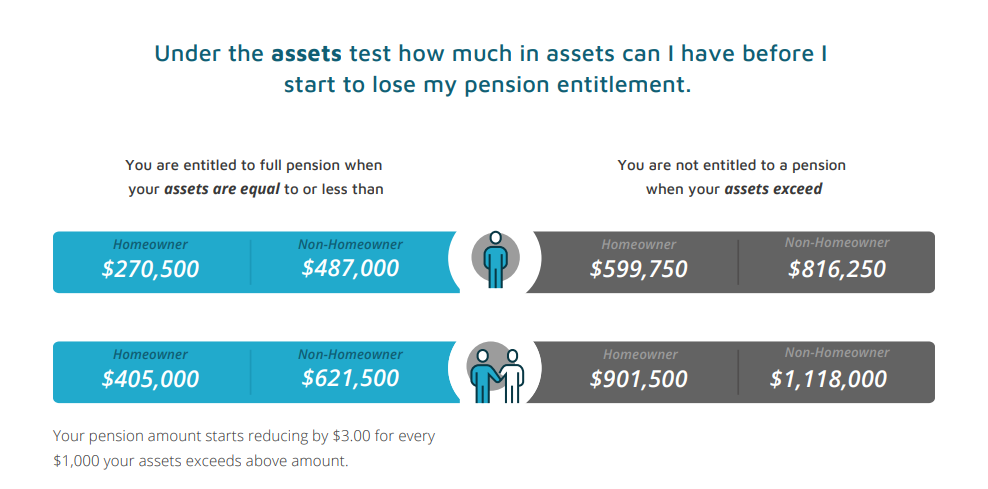

As you are no doubt aware, qualification for the Age Pension is dependent upon meeting both the income and assets tests, and whichever test delivers the worse outcome – the lowest amount of pension – is the one upon which your Age Pension entitlement will be based. When applying, more people fail to meet the assets test than the income test. So the uplift in the assets test thresholds by $6,750 for singles and $10,000 for couples is a significant change. It means that you may now qualify for an Age Pension, and the associated Pension Concession Card. Reviewing your eligibility is easy – simply click through to the Retirement Essentials Age Pension Eligibility Calculator and enter your assets and income to see if your entitlement has indeed changed.

You may also be able to restructure some of your assets to improve your eligibility status. Our advisers can talk to you about this if you would like to book a consultation.

Here to help

Age Pension entitlement rules are complex. Understanding which assets to include, and how your assets are deemed to add to your income, can be plain confusing. That’s why the customer service team at Retirement Essentials is on hand to step you through the rules that relate to your particular situation, and how you can maximise your entitlements whilst always complying with Centrelink regulations. If you need financial planning advice we also offer affordable adviser consultations to discuss the bigger issues associated with your retirement income.

And if you would like to check how the changes to the asset threshold have impacted you check out Retirement Essential’s Age Pension Eligibility Calculator to get the answers you need.

Our place of residence is in my name and my daughter and has been for 20years. My partner has no property for asset purposes therefore are we still classed as home owners

Hi Owen, always good to confirm something like this as it has big impacts on the asset threshold. Yes you will be considered homeowners in Centrelink’s eyes as one of your names is on the title for the property you currently reside in. As the house is exempt form the assets test, it’s total value or your percentage of ownership with your daughter do not come into the equation.

We are both 65 and have retired. We will not qualify for the pension until we are 67. We are currently drawing from our super funds for living expenses. Our Super is in defensive but we are loosing money. Are we doing the right leaving it in Super. We have not changed it to a pension account yet. Should we do this?

Hi sir/madam, thank you for reaching out for help understanding the pros and cons of your options regarding super. We do offer financial advice consultations which can help you better understand your needs and goals as well as some of the actions you can consider to help you achieve those goals. The consultation can be either online or via phone call, goes for up to 45 minutes and costs $150.

CLICK HERE to book now.

How is the granny flat being calculated in relation to the asset? My son and his 2 children are living in there free- we feel bad if we collect rent from our son

Hi David, thanks for your question. If it is all on the same title with no rent being received and the people living there are family then there will not be any impact to your pension claim. This is because the granny flat improves the value of your house but as your house is not counted as an asset the improved value is of no consequence.

sold a rental- capital gains of $450000 over 20 years how can i keep my cshc as i normally only earn $40000-00 / annum

Hi Kevin, thanks for reaching out! The best thing for you to do is provide Centrelink with a copy of your FY21/22 Tax Return and Notice of Assessment (once completed and received) so that they can update your details and review your eligibility for the CSHC.