Q. I’d like to travel overseas for six months. Do I need to wait until Age Pension age? I’m only 61 and really want to head off now.

That’s the question that Anishka posed a few weeks back. She’s single, 61 and has a strong desire to enjoy extended travel experiences while she’s young enough and fit enough to make the most of them. Born in Sri Lanka, her family emigrated to Adelaide when she was a teenager. She’s keen to go back there and spend time with extended family, learning more about her culture and heritage. Her plan is to go for six months, taking her time travelling through South East Asia starting first in Singapore.

But that all seems a long way off from her current situation where she is working part time. A sense of frustration that she doesn’t want to delay her dreams for years made her reach out to Retirement Essentials adviser Sharon Sheehan recently.

Briefly, Anishka has $540,000 in super and an additional $140,000 in savings outside super (part in a fixed term cash account and some in shareholdings). Her casual work brings in $25,000 a year but she will obviously need to resign if she wants to leave the country. She lives in an apartment which is fully paid off.

On the face of it, Sharon thought that Anishka could afford to resign and travel sooner rather than later. There were a few ways she could approach this. During their 60-minute consultation, this is what they explored.

First off they discussed whether it was wise for Anishka to start a Transition to Retirement (TTR) strategy which would require her to drawdown between 4% and 10% of her super balance each year (i.e. $21,600 – $54,000). Unlike an Account-Based Pension where the investment earnings are tax free, earnings in a TTR are taxed at 15%.

Anishka also had questions about her retirement income needs and average amounts that other people her age needed in retirement. Sharon shared two recent benchmarks for her to consider.

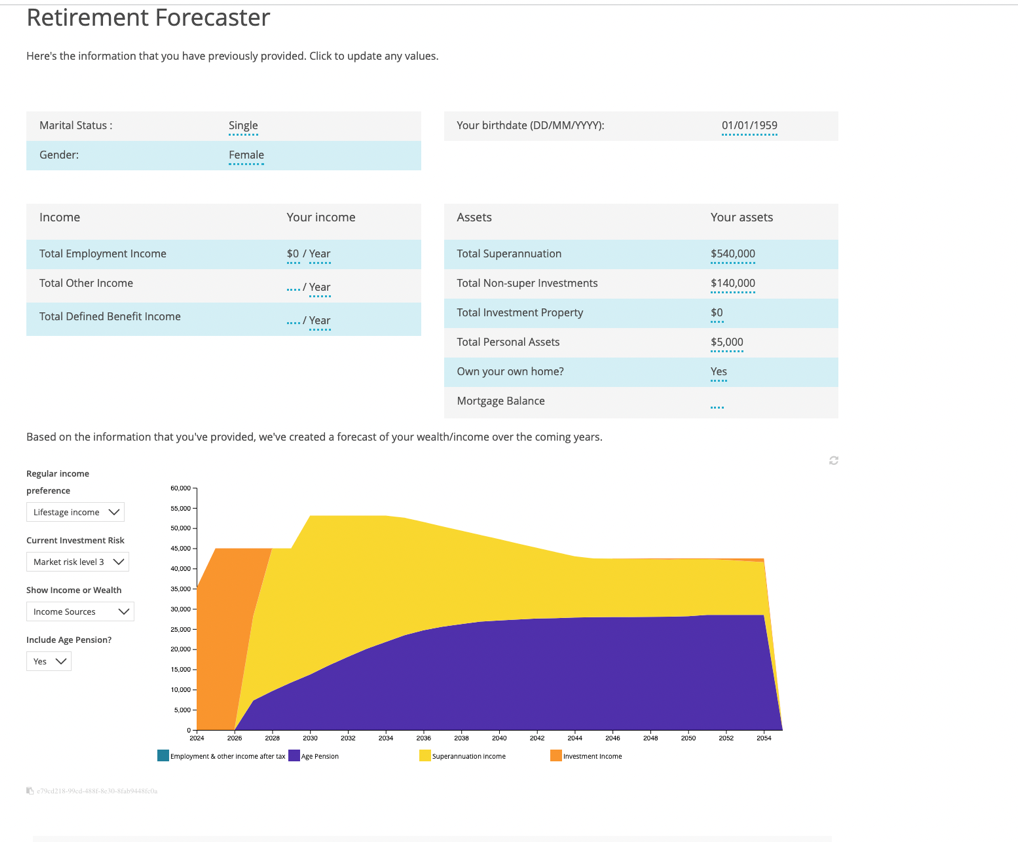

In a consultation she assisted Anishka to enter her basic information into the Retirement Forecaster and they could see that Anishka could live off her savings, drawing down $40,000 per annum quite comfortably. Next they re-ran the sums, looking at annual drawdowns of $50,000 – again this showed that she could increase her annual expenditure to $50,000 without running out of money. This would cover her travel expenses every year until her chosen year of 2035, while still maintaining her desired level of income in retirement. Additionally our Retirement Forecasting tool showed that she was still almost certainly going to continue to maintain some access to liquid capital throughout her retirement years.

After discussing further the rules of the Transition to Retirement, Anishka decided to rule this out.

She had originally thought that might be her only option. But she wanted to know she could fully retire from work and a TTR is really only for those who don’t permanently retire. The additional tax paid and less flexible withdrawal rules were crucial factors. Not only did she reach the conclusion during the meeting that she doesn’t need a TTR, but also that judiciously drawing down her own savings across the years was both doable and sustainable.

Below is the Retirement Forecaster graph which shows how Anishka will initially fund herself from her private savings, then super through an Account-Based Pension before the Age Pension becomes available to her after age 67.

Sharon was really happy she’d managed to assist Anishka’s decision-making and give her the confidence to pursue her dreams sooner rather than later. She feels this is a common challenge for many would-be retirees:

‘Retiring before reaching Age Pension age can be an anxious decision, as you need to use your own funds to provide your desired income until you reach Age Pension age and have some Centrelink pension income to supplement your retirement income.

Wanting to spend your nest egg is an exciting decision but can sometimes fill retirees with trepidation. What if you can better understand the financial position you could be in to help you plan ahead:

Would you continue to save your retirement funds ‘just in case? Or would you reach for the travel brochures?

Our job is to help those who are planning to retire and pursue other activities to more thoroughly understand how their savings can combine with entitlements to ensure they can cover their living expenses and have peace of mind.

The $330 consultation provided peace of mind for Anishka that, instead of continuing to work, or holding on to her savings for a possible rainy day, she can start her adventures in a few short months.’

And one last thing

Because Anishka is expecting to apply for an Age pension in six years’ time when she is turning 67, she needs to bear in mind the residency rules. To successfully apply, she will need to have been an Australian resident for 10 years in total, with no break in at least five years. If she plans to spend long periods of time overseas, it’s handy to know this rule beforehand.

You, too, can explore your own travel dreams and income options using the Retirement Forecaster with Sharon, Megan or Nicole, in a one-hour guided consultation.

What about you?

Are you pining for extended travel adventures as well?

Or have you maybe already enjoyed one?

How did you go about planning your income?

Was it difficult or did you get it right?

I moved to France with my wife when I was 65.

I was not entitled to a pension due to high assets.

I started an engineering business in Brisbane in 1979 and had the business as an asset for retirement…or so I thought..!

In 2020, Covid and other factors forced the liquidation of the company, staff termination and the end of my “superannuation “.

With zero cash and whilst in Australia for the liquidation, I asked Retirement Essentials to help apply for the pension…I was then 72.

After 41 years of employing 100’s of staff, paying taxes both personal and business, and collecting millions of dollars in GST for the ATO, I found that after only one pension payment, my pension was cancelled when I left to return to my wife in France.

A ridiculous ruling that states that I needed to be in Australia for 2 years while being paid the pension, before I could go back to France and continue being paid the pension..!! Who makes ridulous rules like this? Why??

Thousands of Australians are in this situation in France because of politicians on both sides refusing to pay legitimate entitlements.

A disgrace!

Perhaps Retirement Essentials could help with your obvious professional weight in the subject of retirement in Australia…..????

Jack

That’s a great story. I am 63 and looking to buy an apartment that also has management rights but it’s actually just garden maintenance so it comes with an income of $45,000 per year. I would like to know if that will affect me getting the pension, and am I better off just to Keep the apartment I have now which is mortgage free and obtain a pension at 67

Hi Maleta, thank you for sharing your situation! As is usually the case there is no definite yes/no answer. The income you would earn will potentially impact your Age Pension payments if it outweighs the value of your assets. The best thing for you to do would be to LOGIN and enter in both scenarios to our calculator to see if adding in the $45,000 worth of income has an impact on your Age Pension or not.

Hi, does this comment refer to the immediate previous 5 years?

…”To successfully apply, she will need to have been an Australian resident for 10 years in total, with no break in at least five years.”

thank you

Hi Tracey, great question to ask! No it does not have to be the immediately preceding 10/5years, so long as it has been met sometime since you turned 16.

Hi Steve , I will be 68 this Nov and am working part time ( approx 15 hours a week) .

I have $576,000. In my super account and $10.000 in savings.

I am looking at getting the best way to get some additional income.

I do own my unit.

Im not sure if I should open a Choice Acc to draw an income from or to withdraw a lump some ?

Your thoughts would be much appreciated .

Hi Maria, it’s Sharon here. Thanks for your question. You have done well to reach the financial position you can now enjoy.

There are pros and cons in the options available to you; you can commence an income stream to draw an income. Alternatively, as you have reached age 65, you can also withdraw lump sums as you have met a condition of release to access your super. We often see our customers concerned about being forced to withdraw a minimum amount out of their super balance each year, so some prefer to leave their super balance in accumulation phase. There are tax differences between the two options to also consider.

The best way to look at this is to consider how much you want to spend annually in your retirement, and then work out how this will be made up. Some employment income, some Centrelink Age Pension payments, with only a small amount potentially needed from your super each year. We have appointments if you would like us to run the numbers for you, using our Safe Spending Simulator. We can complete some Retirement Forecasting in a Strategy Consultation for you, to help provide some reassurance of how much you can safely spend each year to avoid running out of money. If you would like to book one of these meetings with me, this can be booked here

Hi,

No mention of the 2 year portability rule?

Dose centrelink acknowledge that travelling is different than residing in another country

and therefore allow to travelling again immediately after your Aged Pension as approved?

Thanks

Hi Mark, thanks for bringing up one of the lesser known rules! If you have returned to live in Australia after living in another country within the last 2 years then Centrelink expects you to physically remain in Australia for 2 years from your return date. Holidays and short trips will still cause your pension payments to be suspended for the duration of the trip even if you are not intending to live in the other country. Depending on the circumstances Centrelink will potentially cancel your pension (as opposed to suspending) which means that even if you do return you will need to re-apply and may even have to start your 2 year waiting period again. So the safest way is to just stay put and don’t leave Australia for any reason for 2 years after you return.

Hi Steven,

Thanks for your reply

Are you saying that if Anishka travels to various countries on holiday and

returns to Australia , let’s say 3 months before applying for the pension , she would not be able to travel again for 2 years?

Not residing in another country, just holiday

Thanks again

Hi Mark, as always the devil is in the detail. The 2 year no travel rule only applies if you were living in another country and then returned to live in Australia and applied. In the scenario you have mentioned the no travel rule would not apply because it was only a holiday and not living in another country.

So to clarify this, I’m intending to stop working in April this year and travel, I will have 20 months before I am eligible for aged pension, if I stay away for the 20 months will I have the 2 year rule imposed? What criteria do Centrelink use to determine that someone is a resident, is it the 184 days required by the ATO to determine tax residency?

Hi John, thanks for reaching out! As I mentioned above the application of this rule is tricky and the devil is in the detail. As per the rule, holidays overseas prior to applying do not trigger the 2 year waiting period, only living in another country does. Centrelink have their own criteria to determine holiday vs living and do not go off the same principles as the ATO.

For example, if your 20 month long holiday included visiting multiple countries for 1-2 months each then it is entirely feasible that Centrelink would be happy to classify it as a holiday with the no intention to ‘live’ in any country other then Australia. However, a 20 month holiday to just 1 country only could cause Centrelink to query whether it is indeed a holiday or are you living there and trying to deceive them.

These situations are assessed on a case by case basis, there is no set criteria that says X is a holiday vs Y is living there because there are multiple factors that need to be considered.

Her current income is $25k, but she spends $40k, how is that possible? and she has savings of $140k. How? currently the lady is already living beyond her means.

Can we get realistic scenarios?

Hi Xakia, thank you for your feedback and I am sorry you didn’t find the scenario helpful. Anishka was currently living off her employment income with occasional dips into her savings when need be however she wanted to be able to spend more and live more comfortably which is why Sharon looked at whether Anishka’s money would last if she stopped earning income and started to spend $40-$50K per year.