The regular Retirement Essentials Retirement Pulse surveys reveal two interesting things about retirees.

The first is that the majority say they are much more content in retirement than they were when they were working.

And a similar number tell us that this is because they are in charge of their own daily destiny, with control over where they will go and how they will spend their time.

Freedom!

Put simply, when you retire, you become the boss.

But as is usually the case, with rights come responsibilities.

And one of the main responsibilities is to pay yourself an adequate retirement salary.

What does this mean? And who will be the best judge of what represents adequate? And how can you ensure that this is achievable?

This week we spoke with Retirement Essentials’ director, Jeremy Duffield. It was Jeremy who first coined the term ‘retirement salary’. And it seems that this concept is now becoming more of a talking point as policy makers switch their attention from the accumulation to the decumulation phase of superannuation. But our goal is not the policy-driven theoretical use of retirement savings. We are much more interested in explaining in practical terms how you can create your own ‘retirement salary’ with as little stress as possible.

Says Jeremy:

‘Essentially, when you retire, you will face the challenge of switching from getting a ‘working’ salary during your working life, to a ‘retirement salary’ when you’ve stopped full-time work.

The ‘working salary’ had the advantages of being known and hopefully reliable.

The ‘retirement salary’ is one you basically have to pay yourself. You’re the boss. So you are the one who will need to work out:

- Where’s it going to come from?

- How much can it be?…if I want it to last my(our) lifetime(s)?

- How can I even know that?

This forces you to deal with the two other big challenges:

- How long am I going to live? and

- How much will my investments earn?

Such questions can make the creation of a ‘retirement salary’ a difficult problem. That’s why retirement income forecasts are so important and why you’re likely to need a little professional help.

Everyone will set their ‘retirement salary’ differently…because we are all different.

Some people want to spend more when they stop working and reduce their spend over time. Others will want to keep their salary steady. Others will scrimp and spend less than they could because they’re nervous about it. In fact, previously cited evidence from the Retirement Income Review 2020 says such frugality is the usual pattern.’

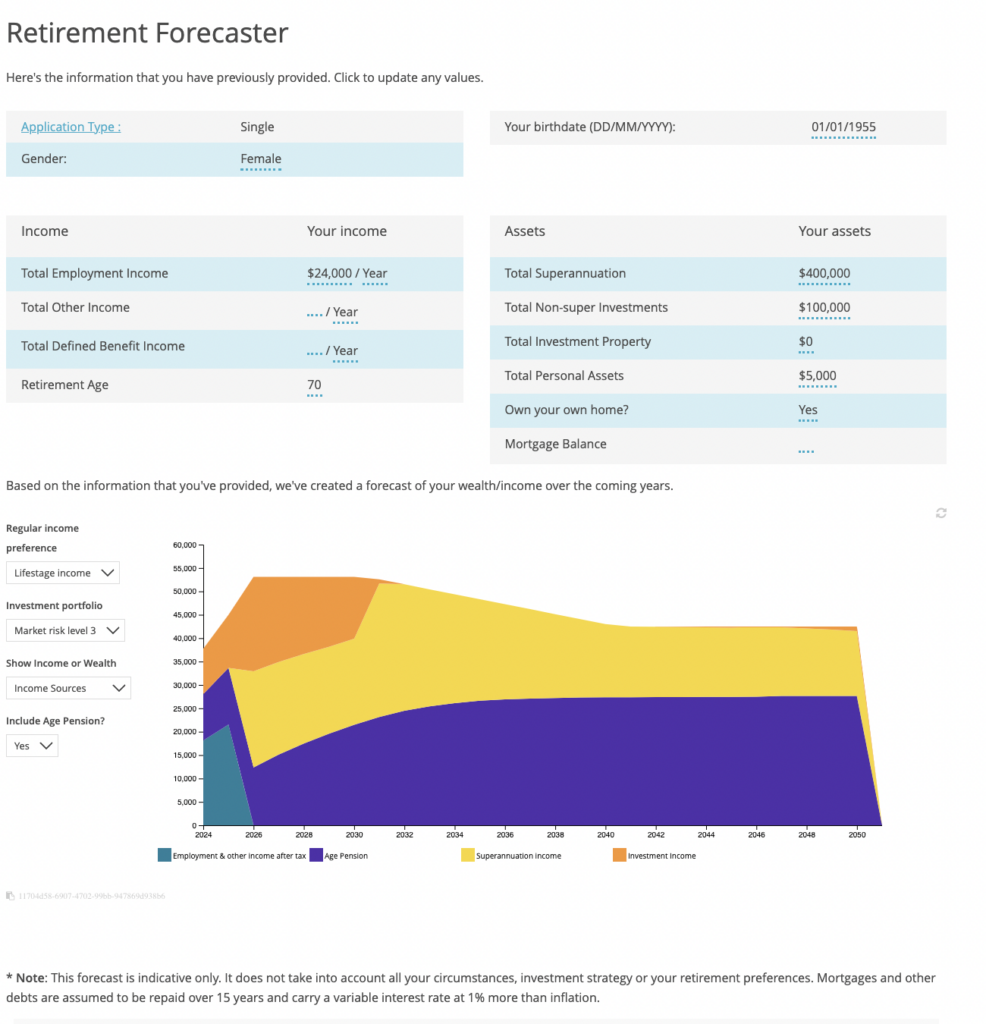

In order to share the rules in action, while answering the questions that Jeremy has posed above, we created the following forecast for Sinead, a single female aged 68, who is still working part time.

Here’s a snapshot of her financial situation and how the three possible income streams from an Age Pension, super and savings can create a ‘retirement salary’ of over $45,000 p/a (and adjusting for inflation) from day one of her retirement.

Running the numbers for Sinead

There are two ways to get started. If you are a member of Retirement Essentials you can log in to your account and try using the calculator in your own time, as the necessary information is already uploaded.

But if you would prefer to be guided through the way your ‘retirement salary’ can be created and see all options changed ‘in real time’ then a consultation with one of our trusted advisers is probably the best way to get started.

Does this make sense?

Does the concept of a ‘retirement salary’ make sense to you? Does using a calculator like the Retirement Forecaster make this look easier?

What about those who are single with no family own a small home have no debt but super under $200,000 no other investment but on full pension

Hi Diana, you might be surprised just how long your super might last in retirement if it is structured effectively and you are maximising Government Support where possible. We would be happy to talk through your situation, provide potential options for any areas of improvement and explain all the rules associated in one of our General Advice Consultations which can be booked here. We look forward to meeting you. Thanks, Megan

Hi , just wondering how much super you need to be a self funded male retiree

Hi David, this is a great question and very important if you aren’t eligible for Age Pension benefits in the early stages of your retirement. However, Age Pension may become a part of your ‘retirement salary’ at some point in time, as your situation will change over time and you may find that you start to qualify for some Age Pension benefits in the future. If you would like to take a look at how long your wealth might last during retirement and what your income sources might look like, to achieve your retirement income goals, this can be analysed in our Strategy Consultation meetings. We look forward to meeting you – Thanks, Megan

We didn’t know until today that your income from super pension counted if you had it before 2015

What does this graph look like if you have a part state pension (non indexed) from overseas? And reduced super amount here due to less years accumulating?