How to respond to 12-month returns

Superannuation research house SuperRatings has released the financial year returns for Australian super funds – and Account-Based Pensions. These rankings are useful in many ways. First and foremost, we have a clear idea of the top performing funds. And how much they returned to members over the past 12 months.

We can also measure whether our own funds are performing in a respectable way, by comparison, or whether they might be lagging behind.

It’s also instructive to see the overall performance of all funds – the annual, 3-year, 5-year, 7-year and 10-year returns according to assets under investment.

But even more important than highlighting rankings and increases, Kirby Rappell, Executive Director of SuperRatings, suggests how retirees might respond to these findings.

What was the annual return?

The annual return of super funds (July 1 2022 – June 30 2023) was 8.5%. This was a dramatic reversal of the annual loss of -3.4% in Financial Year 2021-22, meaning a 12% turnaround. Kirby Rappell notes:

“While there are significant conversations about interest rate rises, inflation and global uncertainty front and centre within the economy, it is reassuring to see superannuation funds’ ability to deliver a competitive outcome for everyday Australians.”

How should retirees view this almost 12% turnaround?

“While the current Cost of Living is certainly putting pressure on many Australians, superannuation continues to play its part for people’s longer term financial outcomes.

Economic pressures can be hard to ignore. But superannuation continues to perform well on a long-term basis with most funds managing to keep performance in line with the typical CPI+3.0% investment objective over 10 and 30 years. We expect funds may struggle to meet their inflation plus objectives over the short term, particularly as inflation remains elevated; however, super funds have done well to capitalise on the opportunities available to ensure members’ super account balances continue to grow.”

Does this offer reasonable expectations for future returns?

It depends. Not all super is the same – even within your own fund. The SuperRatings report also measures the different returns from Balanced, Capital Stable and Growth indexes. As you can see in the table below, there was a marked difference in performance with balanced settings returning 8.5%, capital stable (holding traditionally defensive assets such as cash and bonds) returning 4.5% and the Growth index showing an 11.1% increase over the Financial Year.

Accumulation returns to June 2023

| Monthly | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

| SR50 Balanced (60-76) Index | 1.2% | 9.0% | 7.5% | 5.8% | 6.9% | 7.4% |

| SR50 Capital Stable (20-40) Index | 0.3% | 4.6% | 3.1% | 3.1% | 3.7% | 4.5% |

| SR50 Growth (77-90) Index | 1.4% | 11.2% | 9.1% | 6.9% | 8.3% | 8.7% |

Source: SuperRatings estimates

What does this mean for you?

It’s a timely reminder at the beginning of a new Financial Year to check your settings. This means where and how are you invested. Let’s say you are 65. In all likelihood, you will live to 90 and beyond. So if you need your super to fund another 25 or more years, holding only defensive assets may not keep pace with inflation, resulting in faster drawdowns.

But wait, there’s more

Another handy piece of information released by SuperRatings is the performance of Account-Based Pensions, based upon the returns of some 170 funds. Again, these returns were categorised as Balanced, Capital Stable or Growth. And again, there was a significant difference in performance as evidenced in the table below. Whilst the overall return for accumulation funds was 8.5% that delivered by these Account-Based Pension funds (i.e. decumulation or ‘retiree’ funds) in the balanced index was 9.8%. Bearing in mind that inflation currently sits at 7%, this represents a very strong performance. A major reason for the particularly strong performance of account based pensions is that the investment earnings are tax free. If you haven’t already moved your super into an account based pension you might want to consider talking to an adviser about whether it could be a good option for you.

Account-Based Pension returns to June 2023

| Monthly | 1 yr | 3 yrs (p.a.) | 5 yrs (p.a.) | 7 yrs (p.a.) | 10 yrs (p.a.) | |

| SRP50 Balanced (60-76) Index | 1.3% | 10.0% | 8.2% | 6.4% | 7.8% | 8.3% |

| SRP50 Capital Stable (20-40) Index | 0.4% | 5.2% | 3.6% | 3.5% | 4.2% | 5.1% |

| SRP50 Growth (77-90) Index | 1.7% | 12.2% | 9.8% | 7.5% | 9.2% | 9.5% |

Source: SuperRatings estimates

Long term thinking helps

“Despite the strong performance over the past year, we suggest members remain active, and review their longer-term settings, such as whether they are in the most appropriate investment option for their situation and to check their fees, when they check their annual statements.” Mr Rappell commented.

“Twelve months ago, we did not anticipate an 8% return for this year. Many people would see this as a positive. Long term returns remaining strong. However, we expect the ups and downs observed over the last 12 months to continue and members should be prepared for their balances to fluctuate. If you are not approaching or in retirement, keep in mind that all market movements in the short term are not likely to be what you are thinking about when you retire in 20 or 30 years’ time.”

How to support long term goals for your super

Says Mr Rappell, “Those in their mid-60s probably have many years ahead of fthem. Helping them to withdraw super in a sustainable manner is the real challenge for super funds. Better retirement income products will be useful. But this can be a regulatory minefield. And each person’s retirement income ‘recipe’ will be different. Another key challenge is making such options understandable.”

What are the most useful short term actions?

“The first action,” suggests Mr Rappell, “is to try to avoid worrying day-today. Instead taking a longer term view and knowing your own risk tolerance is critical.

Then asking, does your ability to tolerate risk match your current fund settings? Perhaps try a risk profiling tool to see if you are overly conservatively invested.

Next check if your fund is measuring up. And how flexible your pension fund is.

Check that pension fund payments conform to your lifestyle and cashflow needs. And of course, how your fees compare.”

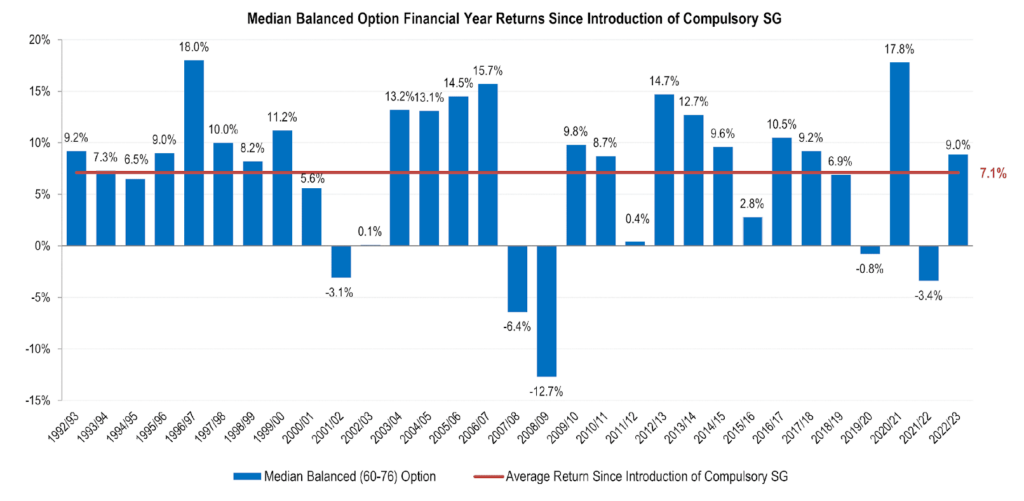

And finally, those who think long term will be heartened to be reminded that since the inception of mandatory superannuation in 1992, the average fund return has been 7.2%. This is a strong number. Staying engaged with your finances and up to date with changes is the greatest favour a retiree can do themselves.

SuperRatings is a superannuation research house with specialist areas of expertise originally established in 2002. A full range of superannuation rankings and reports can be found on the website www.superratings.com.au.

If you would like to understand more about your super and the options available to you, you can read more here.

This article is provided by Retirement Essentials Representative Number: 001260855. We are an authorised representative of SuperEd Pty Ltd ABN 88 118 480 907 AFSL #468859. This information is not intended as financial product advice, legal advice or taxation advice. It does not take into account your personal situation, goals or needs and you should assess your own financial situation, consider if the information is suitable for you and ensure you read the relevant Product Disclosure Statement (PDS) if you choose to make any changes to your financial situation. It is always advisable to consult a financial adviser before making financial decisions.

Are you able to tell me what Spirit Super returned for the 22/23 financial years please.

I have an Accumulation A/C

Hi Paul, thanks for reaching out. To best understand the performance of your own super fund you are best to contact your superannuation provider directly. If you have any concerns about your provider and want to consider other options, the government website MoneySmart provides some guidelines around how to compare superannuation funds and what to look for, including fees, performance, and other considerations. You can find this website by clicking here.

,I am rather confused as a few different advisers, I have spoken to have differing opinions on how to proceed with our retirement and find their advice a little conflicting. My wife and I have ceased work. My wife and i both have super funds. I am 66 and she 56. We own our own house. I am told I may get the commonwealth seniors card, but no pension for the near future. My super advisor has told us to live off our cash savings into the future until drawn down. My advisor is against my taking an income stream or pension from my superannuation. He has advised that i should leave my super in accumulation phase until 75 and just contact my super provider to have cash deposited into our bank account a few times a year. Although my understanding is that super is tax free once in pension phase and i would better of going that way .We feel we could live on 65K . Would appreciate your view and suggestions . Thank you

Hi Alan, it’s Sharon here. It’s great to see that you are exploring your options. You are correct, super is tax free once in pension phase. There used to be a requirement to convert your super to an income stream at age 75, but that is no longer a requirement. You have the choice now, it can remain in accumulation phase, or you can commence a tax-free income stream. The payments are tax free in both cases once age 60 is reached, but the tax on the investment earnings remains for balances in accumulation phase. There is however no requirement to withdraw a minimum amount out each year in accumulation phase, like there is when an income stream is commenced. We have the ability with our retirement forecasting tool to run some projections for you to compare your options, and this can also demonstrate at what point your Age Pension entitlements may kick in if you are looking for an income goal of $65K pa during your retirement. I would be happy to help you with this if you would like, and a meeting can be booked here

I started a self managed superannuation fund (now approx $600,000) a few years ago, and apart from the fact that it’s not performing too well, my investment advisors fees are $4400 pa & accounting & audit fees are $2900, i.e. its costing me $7300 per year to run! Should I transfer it into one of the Industry Super Funds with fees in the $hundreds only & eliminating the accounting & audit fees?

Hi Neil, SMSF’s can offer unique investment choices and features which some other ‘industry’ superfunds cannot. Most SMSF costs are flat dollar and therefore they typically become more cost effective the higher the balance whereas, depending on which ‘industry’ superfund you choose, their fees might be flat and/or % based. There are many pro’s and con’s to consider and how much you want to be involved and responsible for managing your super is an important factor. I can help identify and discuss some of these differences with you in our General Consultations (which can be booked here), alternatively you might be best discussing your concerns with your existing adviser or seeking a second opinion. Thanks, Megan