by James Coyle | Mar 3, 2023 | Planning for Retirement, Retirement Spending

What’s your uppermost retirement fear? We’re often surprised by many of the responses to our Retirement Pulse surveys. In particular, in the February survey, with respondents who have yet to retire who have such strong concerns about their money lasting as long as...

by James Coyle | Feb 27, 2023 | Planning for Retirement

Changing (retirement) gears … just got easier… Retirement has never been a set and forget proposition. Times change, rules change and people’s needs do too. It’s easier, instead, to view it as a decades-long opportunity to enjoy the rewards of years of hard work. As...

by James Coyle | Feb 27, 2023 | Planning for Retirement

Meet Megan Marshall: Reducing the fear factor Megan Marshall has been working in financial services for her entire career. Initially in a work experience role, Megan soon worked part-time, then as a full-time employee with a national financial practice. Along the way...

by James Coyle | Feb 27, 2023 | Retirement Advice

There has been a multitude of reports and reviews into financial advice. Whilst the intentions are no doubt honourable, some of them can seem long winded or incomprehensible to ordinary Australians who are trying to wrangle living expenses as they transition to...

by James Coyle | Feb 17, 2023 | Investing

You’ve put money in super … … so what happens next? In recent weeks, We’ve explained many of the new rules which allow those aged 55 or over to move significantly large sums of money into super. But whilst there are good strategic reasons to do so, as well as possible...

by James Coyle | Feb 17, 2023 | Planning for Retirement

Retirement timing is critical: But is it within your control? Two years ago we asked you to share your experience of choosing the best time to leave work and enjoy the fruits of your labour. We knew, based upon Australian Bureau of Statistics (ABS) findings, that...

by James Coyle | Feb 17, 2023 | Retirement Income

Rental housing crisis: Swipe right for income A recent suggestion by NSW Premier Dominic Perrottet has sparked debate about Age Pension income and how Centrelink treats rental income. Speaking at the Sydney Summit conference in early February, the Premier expressed...

by James Coyle | Feb 10, 2023 | Planning for Retirement

When a loved one dies … How does Centrelink help? Even when someone we love is terminally ill, few of us can say we were prepared for the finality of their death. This week we tackle this very sensitive topic with the intention of offering a constructive summary of...

by James Coyle | Feb 10, 2023 | Centrelink Age Pension

What does the ‘Bring-Forward’ rule mean? Who can use it? There were multiple changes in superannuation last year, many in relation to non-concessional super contributions. In particular, as we reported, the ages at which different types of contributions can be made...

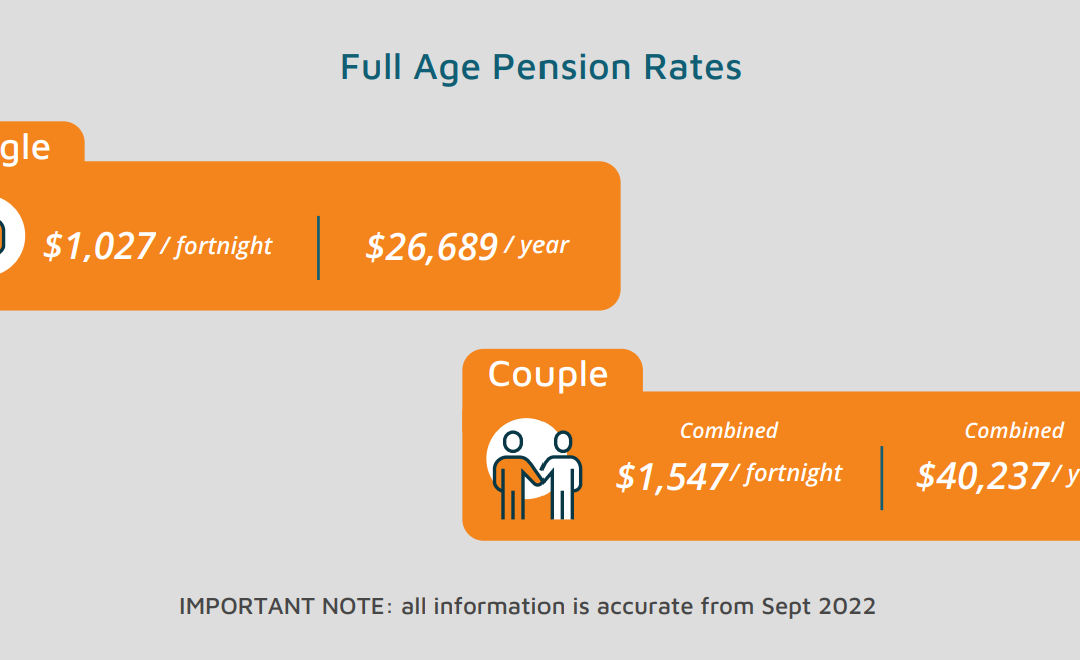

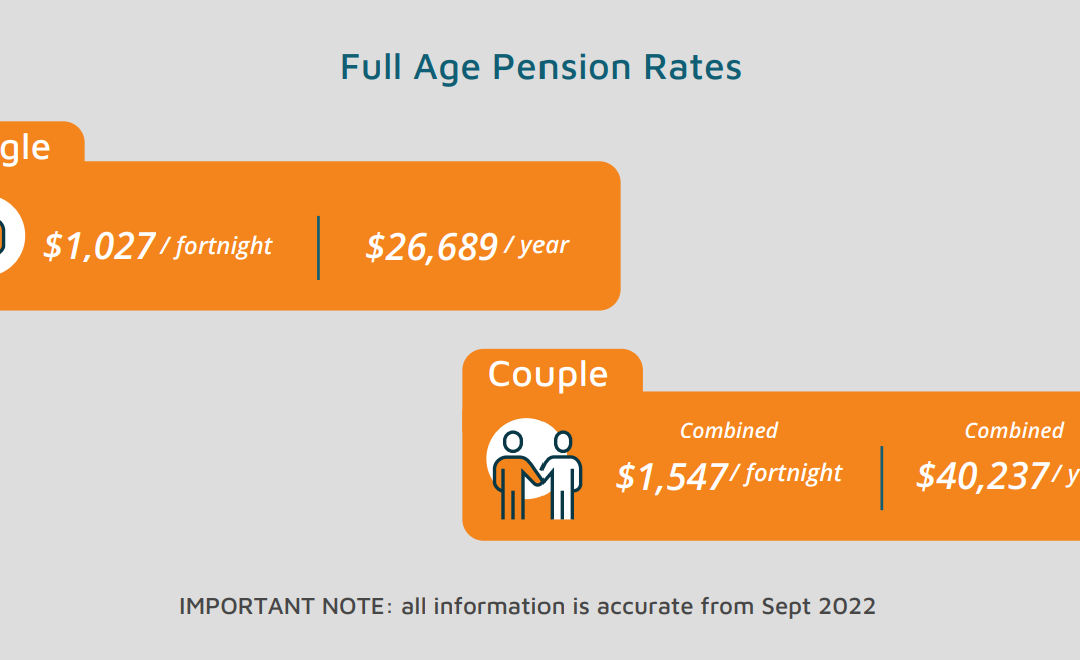

by James Coyle | Feb 9, 2023 | Centrelink Age Pension

All you need to know in 2023 The Age Pension provides core funding for about seven out of 10 Australian retirees. The stated intention of this entitlement, according to the responsible department, the Department of Social Services, is to to support the basic...