by James Coyle | Dec 2, 2022 | Retirement Income

Retirement Pulse reports most think they are worse off financially than 12 months ago The Retirement Essentials’ November 2022 Retirement Pulse posed the question: Do you agree or disagree with this statement: ‘I feel better off financially that I did 12 months ago’ ...

by James Coyle | Nov 28, 2022 | Planning for Retirement

…by projecting future income It’s great to learn that you’ve got your sums wrong, if this means that you can now retire sooner than you thought. This happened a couple of weeks back with Jenny and Kumar. They’re currently aged 68 and 69 and are keen to stop work and...

by James Coyle | Nov 28, 2022 | Retirement Income

Three things you can do FOMO and FONK are well documented. Fear of Missing Out and Fear of Not Knowing can guide human behaviour in dramatic ways. But beyond the more superficial social media application, these sentiments are very relevant for retirees. The tough fact...

by James Coyle | Nov 28, 2022 | Retirement Spending

Or is it? Despite the impacts of Covid, life expectancy for Australian men and women continues to increase. But many retirees can feel conflicted when they hear about increased longevity. This is prompted by the worry that their money will run out. Whilst that’s...

by James Coyle | Nov 21, 2022 | Commonwealth Seniors Health Card

You are probably now eligible On November 4, thresholds for the Commonwealth Seniors Health Card (CSHC) changed, with some very big increases. This meant that a majority of those Australians who are NOT on an Age Pension, but are 66.5 years or older, are likely to be...

by James Coyle | Nov 18, 2022 | Planning for Retirement

Are you a mortgage prisoner? Facing up to (difficult) facts Like Jodie and Steve, it’s easy to feel trapped. Many of us often feel this way when facing the seemingly relentless need to service a home loan. But some borrowers are literally trapped. These homeowners are...

by James Coyle | Nov 18, 2022 | Centrelink Age Pension

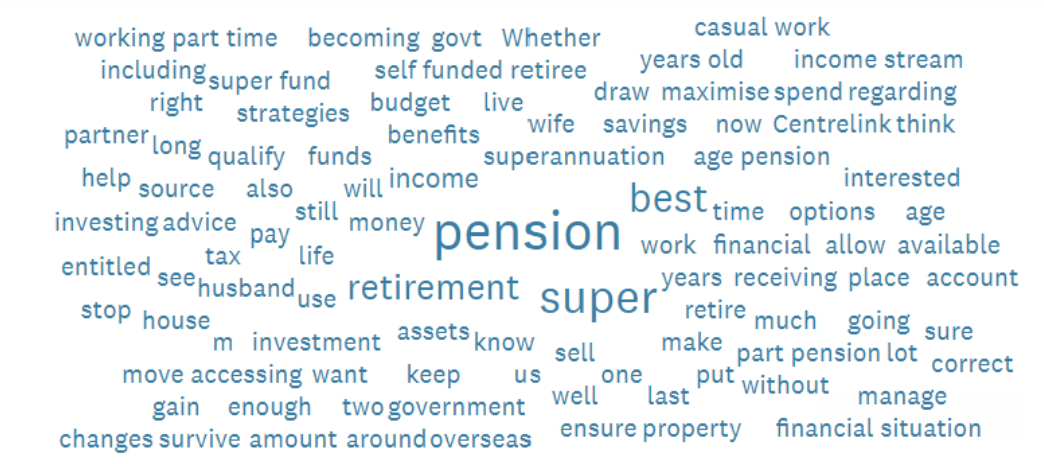

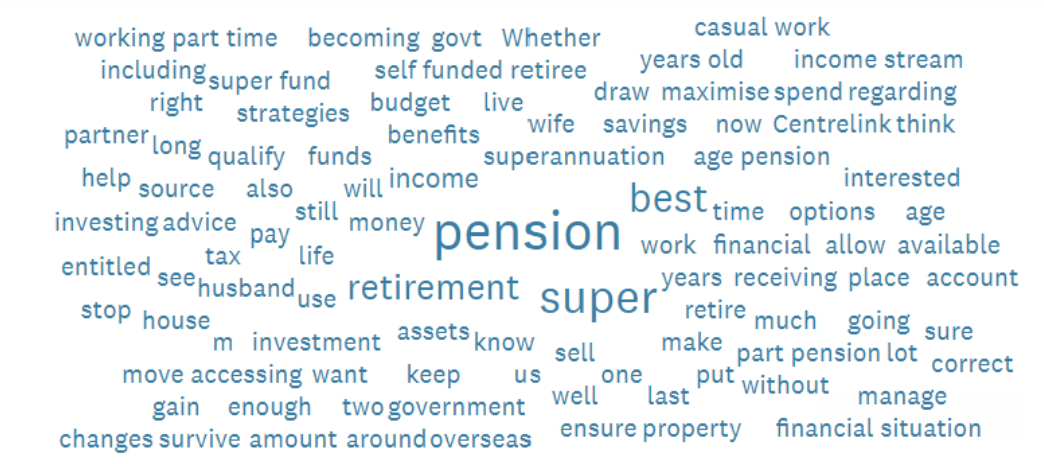

And the winner is: Max who needs more time We’ve been delighted with the volume and depth of responses to the inaugural Retirement Essentials Retirement Pulse survey, launched in October. You may recall we asked you to share the issue or question you would most like...

by James Coyle | Nov 14, 2022 | Retirement Income

What are the pros and cons? Our co-founder, Jeremy Duffield, knows a thing or two or three about retirement income. He’s also a ‘back of the envelope’ kind of guy, so is able to share his knowledge in short points and plain English. Which is a huge bonus for the team...

by James Coyle | Nov 14, 2022 | Centrelink Age Pension

The work bonus enables you to earn extra for longer Financial adviser Nicole reports that how much you can earn is one of the major concerns in her consultations with Retirement Essentials members. The rules are confusing and they are about to change again. But in a...

by James Coyle | Nov 14, 2022 | Retirement Income

Ben seeks help For Ben, lack of financial control meant a pervasive sense of fear. A worry that he’d somehow let down his partner, Roslyn, along the way. He shared these concerns in the recent Retirement Pulse (October 2022) survey. And he was far from alone. Only two...