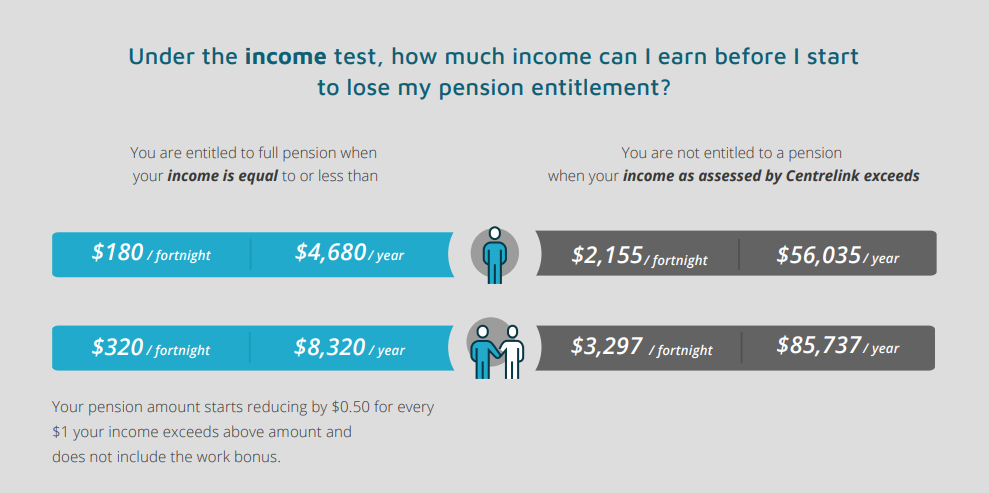

Also known as pension disqualifying income limits, this is the amount of money that you are allowed to earn before your Age Pension entitlement is removed completely

The new income disqualifying limits have been increased by $40.20 per fortnight for singles and $60.40 for couples (combined).

If you have already qualified for a pension, you do not need to do anything.

But if you have previously not been eligible, as it has been deemed that you earn too much, you may wish to recheck your eligibility in the Retirement Essentials Age Pension Entitlement Calculator. It is true that these modest limit changes may only entitle you to a few dollars of a part Age Pension. But this eligibility carries greater rewards, as you will automatically be awarded a Pension Concession Card which might save you $2000-$3000 in any given year on health costs, pharmaceuticals and energy bills. Plus you will receive the pension and energy supplements.

Here to help

Age Pension entitlement rules are complex. Understanding which assets to include, and how your assets are deemed to add to your income, can be plain confusing. That’s why the customer service team at Retirement Essentials is on hand to step you through the rules that relate to your particular situation, and how you can maximise your entitlements whilst always complying with Centrelink regulations. If you need financial planning advice we also offer affordable adviser consultations to discuss the bigger issues associated with your retirement income.

And if you would like to check how the changes to the income threshold have impacted you check out Retirement Essential’s Age Pension Eligibility Calculator to get the answers you need.

Could you please tell me the income threshold for a non-home owner per year.

Hi Margaret, with regards to the income thresholds it does not matter whether you are a homeowner or not, the only differentiating factor is whether you are in a relationship or not.

Hi

I am 66 yrs and 6 months

I will apply for age pension

How long it takes to receive money fr Centrelink ?

Hi Nayatha. Centrelink can take several weeks to approve an application and sometimes even several months if the paperwork is not in order. They will backdate the payments to the date you submit your completed application so it pays to get your application in as soon as possible. Retirement Essentials can help if you any assistance with that.

I am a homeowner and on an full single age pension however I will be getting married later this year to a widowed DVA age pensioner, who I understand will receive her pension irrespective of any amount of assets as she will be selling her house and have approximately $350K in the bank at the time of our wedding. I will however also have approximately $350K in the bank when she joins with me in our house, becoming homeowner pensioners. My question is, will my pension be calculated on our combined asset of $700K given her asset is disregarded because of the special provisions of the DVA Act for war widows and if my pension is based on the combined total could you give me a “ballpark” estimate what my pension would be under the new centrelink entitlement rules?

Hi Peter, great question! Firstly yes, Centrelink will assess you and your partner’s combined income and assets to calculate your Age Pension. The fact that she may be assessed differently by DVA for her pension does not impact how Centrelink will assess you for yours. To get an idea how much pension you may receive based on the higher figures, you can use our free calculator HERE.

The other point that is worth noting though Peter is regarding your relationship status. Although you are not yet married it does sound as though you are already in a relationship with your bride to be, therefore you should actually have already declared the relationship to Centrelink and had your pension recalculated. Whenever you do declare the relationship, Centrelink will want to know when it started and will go back and recalculate to see if you have been getting over paid previously.

Would the partner ruling apply though if Peter and his fiancée don’t live together at the moment? presuming they live in their individual houses currently and will only move in/ live together once married? Do pensioners have to declare relationships if they do not reside together?

Hi Michele, thanks for getting involved in the conversation! Centrelink can deem you to be a couple even if you live separately. Your living arrangements are one of 5 key areas that Centrelink review to determine if they consider you in a relationship or not. You can read more about the 5 areas HERE if you scroll down to the sub-heading “What we consider when assessing a member of a couple”

What is defined as a relationship, living together, sleeping together and living at different address or being friends

Hi Victor, you beat me to the punch. I’ve just posted a reply with a link to the 5 areas Centrelink review to determine if they consider you in a relationship or not. HERE it is once more, please scroll down to the sub-heading “What we consider when assessing a member of a couple”

Good morning

We are about to sell our house and down size what happens if we have 250000 over from the sale and possibly 10000 coming from inheritance, can we split and put some in each of our super ,we are 68 and 67 I am still working part time , and we both have pensions ,we still have accumulating funds ,after we move into our new house we may need to pull out some money for Reno’s

Hi Brett, thank you for reaching out, sounds like you have a busy few months coming up! You have a number of options available that are worth weighing up. For help planning your next steps we offer financial advice consultations.

Our financial advice consultations are designed to help you better understand your needs and goals for the future as well as some of the actions you can consider to help you achieve those goals. The consultation can be either online or via phone call, goes for up to 45 minutes and costs $150.

CLICK HERE to book now.

hello

my husband and I receive a part pension but didn’t receive any change with the recent increase.

our current pension is based on our income apart from our house we have no extra funds in the bank.

we do receive a small UK pension of approx. $450 per month and currently draw down $1200 per month from our super funds.

i still find it odd that we could go out and EARN a small amount and not affect our pension but will loose pension should we opt to draw a similar amount from our super!!

can you explain why we seemed to get no benefit of the latest pension rise

Hi Margaret, thanks for seeking help! The best thing to do is contact Centrelink and request a “Detailed Income and Asset Statement”. You can do this yourself if you have access to Centrelink via myGov by going to the “Documents and Appointments” heading and then “Request A Document”. Either way you will receive a summary of all the income and assets Centrelink have recorded for you and your husband as well as the values for each. You can then review it all and update Centrelink of anything that is incorrect so that your pension can be recalculated.

Harry March 29th

Hello

I have enquired with Centrelink about part time work and was told that my

earnings before pension deductions would be $300 a fortnight.

Can you please explain the work bonus and am i entitled.

I am on the age pension, my wife is also retired but still too young and has

been drawing on my super. She wont register for newstart because we look after our grand daughter 20 hours a week.

Hi Harry, thanks for getting involved. We have actually written up an article on the work bonus HERE.

Hello

I am turning 70 this year, my husband will turn 67. We have never applied for the pension as my husband was fully employed until age 64 when he was severely brain damaged in a road trauma.

He is currently in care but will come home this year. I sold our previous home to buy one more suitable for his needs & have used what was left from the other sale to do renovations. We have no income except for a small overseas pension $300 per month. We are currently using money from a compensation payment for daily life. My husband has some money in super which I have left in the fund. I have not had time since his injury to sit down & find out about pensions. Are we entitled to anything.

Hi Barbara, my condolences to you and your husband regarding his injuries. The best thing for you to do would be to complete our free eligibility calculator HERE which will let you know how much pension you are eligible for.

my wife intends to work 3 days aweek later in the year

her taxable income would then be approx $52000 and salary sacrifice would be $18500

her super balance is approx $420000 and my super is approx $320000

how much would i be allowed to earn before we would lose our entitlement to a concessional health card

Hi Ian, as a couple your gross income needs to be less than $92,416 per year combined in order to retain the Commonwealth Seniors Health Card. The super balances wont impact your income if they are in accumulation, if they are in pension phase then income will be deemed on the total balance based on Centrelink’s deeming rules.