Life is risky whether we like it or not. Most of us spend a lot of time worrying about risks and trying to counter them. But there is no such thing as a risk-free environment.

Some aspects of risk are outside our control.

Some we can manage and reduce.

But sometimes avoiding risk leads to poor outcomes.

For instance, most of us have taken a risk across the years when we’ve changed jobs, gone to a party where we don’t know anyone, or set off on a worldwide adventure. And these risks have paid off handsomely with a new satisfying career, meeting the love of your life or lifetime travel memories of great adventures. As we get older we often still take risks by joining different clubs, becoming volunteers or maybe becoming more politically active. And we reap rich rewards in return.

So it’s worth bearing these experiences in mind when we think about ways to view risk in retirement and retirement income.

When the conversation turns to money risks, there is general agreement that the ‘Big Six’ are:

- Timing – When you move from saving for retirement to spending your retirement savings, or starting a retirement income stream, can be very important. And you still want to maximise the returns on your savings over your retirement.

- Life Expectancy – people often live longer than they expect, and so often fear that their money will ‘run out’.

- Over or under spending – typically the emphasis has been on overspending and ‘running out’ but there is also the risk of underspending and living an overly frugal lifestyle. In fact many retirement experts consider this a much bigger risk than running out.

- Market volatility – as you are most likely to have some exposure to financial markets through your super or private investments, you can see your total retirement savings rise and fall in an alarming fashion at certain times

- Unexpected expenses – these often come in the form of health costs, but could also be age or disability care needs, family crises, or the need for major home repairs.

- Inflation – this is obviously topical at the moment. Retirees do well when they have an income strategy that ensures they outpace inflation and keep up with essential household costs.

How do you manage risks?

There are specific strategies to match each of the above risks and help you to respond in a timely and productive way. Such strategies are, of course, very different depending upon your individual circumstances, needs, concerns, savings and your appetite for risk. So we cannot cover all possibilities in a single article, but we can highlight some of the ways to think about risks and how to counter them. There are three key factors here:

- Your temperament

- How much latitude you have

- The nuance of financial risks

Your temperament and risk appetite

Your temperament is a major factor in how you manage any form of risk. It is also unlikely to change. Some people love embracing change and the unexpected swings and roundabouts in life. Others feel very uncomfortable when things are less predictable. It’s very important to know where you sit, on a scale of 1-5, so that your financial risk settings are aligned to your comfort levels, which means peace of mind will hopefully ensue. Having your risk tolerance evaluated is a great move for those who are unsure.

How much latitude do you have?

This question is linked to two things – your age and your savings. Let’s say you are 65, still working and have $3 million in assets and fully own your home, then you have a lot of latitude. You are well placed to take some risks with a portion of your assets as you have ‘deep pockets’, a reasonably long investment horizon, and can withstand small losses. The corollary is that if you are 75, retired, renting and have, say, $35,000 in super and savings, then every investment decision matters a lot (and knowing all your entitlements is clearly a first step!). Understanding how to project your savings across your probable lifespan is useful to then be able to understand how much latitude you have to vary your risk settings.

The nuance of financial risks

Let’s take the example of market volatility and the rollercoaster of unreliable returns. Our very human response is often to see market volatility as ‘bad’ as it makes us feel very uncomfortable to have a $250,000 super balance one day that has fallen to $2450,000 the next. This type of slide can encourage people to turn to cash as a ‘safe’ option. The term deposit with $250,000 in it on Friday will still have $250,000 there on Monday.

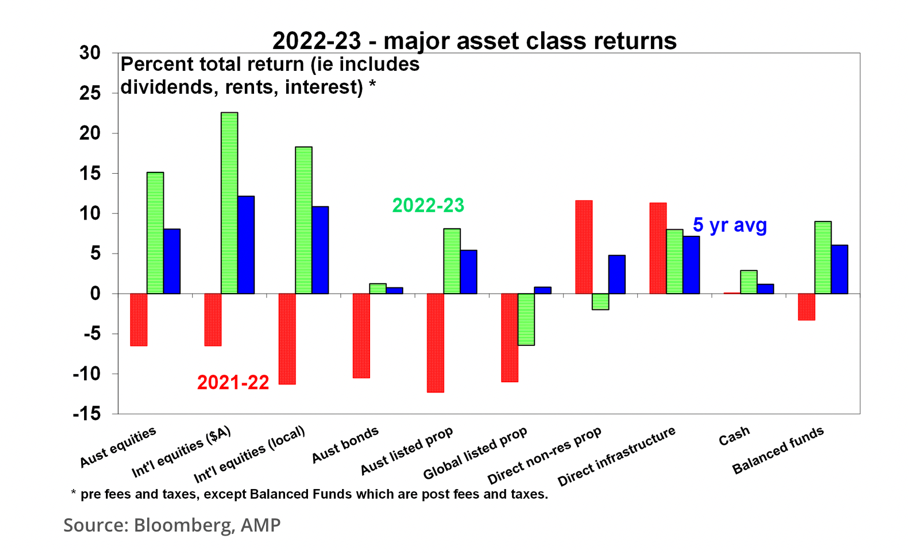

But putting most of your savings in low risk investments means that you may lose over the long run. Here’s how different Australian investment classes have performed over the past financial year. You will note that five year cash returns remain well below most types of investment. Cash typically doesn’t even keep up with inflation.

How do you review your own risk management?

Understanding and managing your own appetite for risk is not easy. Here’s a three-step process that may help you consider how you are currently responding to the risks inherent in retirement investments:

- Decide what is outside your control and try to quarantine thinking about things you can never change

- Identify money decisions which are within your control. Consider how you currently handle these decisions. Are you actively managing your assets? Or defensively guarding them? Or maybe in denial about the need to make any decisions at all?

- Review your current investment risk. What are the ‘settings’, be they for super, cash interest rates, property or other investments. Are you holding a good mix of assets? Are you receiving a mix of high, medium and low returns? Could this mix be tweaked in any way?

- If you are unsure, it’s important to seek professional advice as to whether an adjustment might improve your returns

- Plan to repeat this review on a six-monthly basis.

Remember, just as taking a risk to change jobs led you to a better career path, not all risk taking is as risky as it might seem – nor necessarily bound to lead to negative results. Some risks can deliver very happy outcomes.

Here’s some further reading on ways of considering risk in retirement.

Retirement Essentials offers specific guided discussions to help you understand risk and investment, in consultation with an adviser.

How do you view financial risk?

Do you feel that it is easily manageable?

Is minimising risk the best strategy?

Or is there room in your portfolio for different settings?

The graph above is meaningless without a legend. Please explain what each colour represents, where 2021-2022 ends, where 2022-2023 ends etc.

Hi Anthony, thank you for raising your concern! The colours represent the years to show how each particular investment performed each year. For example, Australian Equities (this first option along the horizontal line) performed worse in 21/22 (the red bar) with -5% return however performed much better in 22/23 (the green bar) with +15% and has a 5 year average (the blue bar) of +7.5%.

Hi my wife aged 64 who is retired will shortly to receive an inheritance of $300,000

She is intending to deposit this amount into her accumulation super balanced account

What do you suggest the best way she should approach this

A) deposit the amount in her supper and pay tax on the earnings

or

B) change her super account to a pension phase and draw out the minimum of 4% at her current age to avoid paying any tax

Hi Chris, thank you for reaching out. There are a few ways to strategically manage superannuation from a tax on earnings and drawdown flexibility perspective however, depending on your combined circumstances it is not always the same solution for everyone.

A little typo $2450,000 should read $245,000