This week we turn to the fourth pillar of retirement income – private savings. As we reported in our other story this week, a significant proportion of Retirement Essentials members (71%) reported that they are accessing private savings or investments as one of the ways to fund their retirement.

This is usually in combination with a full or part Age Pension and superannuation drawdown.

Today we will consider how the pillar of private savings combines with other forms of retirement support and the top level rules attached.

In the comprehensive Treasury investigation of retirement funding – the 2020 Retirement Income Review – the authors noted that:

‘Excluding the family home, the median retiree household has about $165,000 in net wealth. Super makes up a relatively small part of that’.

Perhaps the most striking feature of the composition of retirees’ net wealth is the change in asset mix according to wealth percentile.

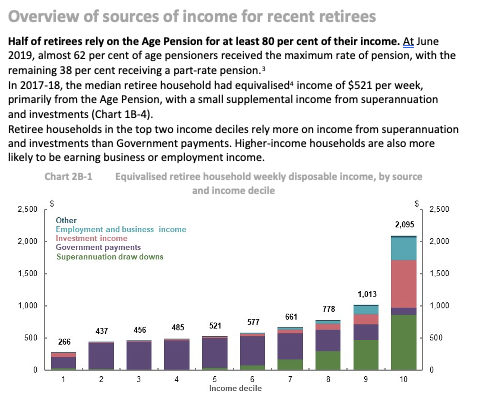

Most of us like to know where we sit in our ‘tribe’ or community. Retirees are no different. The most reliable recent estimates on sources of retiree wealth are included in the same Retirement Income Review report, quoting sources of wealth and disposable income as at 2019. Here are the estimated sources of income, by income decile, reprinted for your interest:

(Retirement Income Review page 81)

The fact that, except for the very wealthy, super is a comparatively low number, is because our compulsory superannuation system is still relatively young having been recently introduced (1992), compared to pension systems in other comparable regions, such as Europe and North America. Put simply, many people have not had enough time to contribute enough savings to their super accounts to fully fund a comfortable retirement. Others may have had a fragmented work history or have worked in low paid jobs or as solo business owners and therefore have not accrued significant super savings.

In previous weeks we have noted the complex ‘dance’ between the different pillars of retirement income and wealth.

The family home is the highest source of wealth, but not very ‘liquid’. It has a very significant benefit in that it is exempt from the Centrelink assets test. It can be used as a source of extra income, and mortgage and downsizer strategies can be utilised to increase Age Pension eligibility.

Super is, as noted, a smaller proportion of wealth for current retirees, but a highly accessible asset and the one which powers income generation most through Account Based Pensions or lump sum withdrawals.

The Age Pension, as we have seen, is the most significant and reliable form of income support for most retirees.

So how do your private savings and investments fit into this retirement income jigsaw puzzle?

Why do many retirees continue to hold savings and other assets outside super?

And does having this separate asset/pillar class just complicate your management of retirement income?

Our experienced financial advisers are talking to many retirees every week and they have shared their insights. They see two main concerns attached to those retirees who seek help to best manage the private savings portion of their nest eggs.

Firstly, if people have significant savings (particularly cash), they tend to leave it in the bank because they couldn’t get it into super and didn’t know what else to do with it. Share investments can sometimes seem intimidating. Some recent articles including beating inflation, deeming rates frozen, and the proposed increase to CSHC thresholds might be helpful on this front.

Alternatively, members may be able to move funds into super, but are worried about this option, because their super balance seems to move up and down in a volatile way and they can become anxious. So a high proportion of these savings just stay in cash indefinitely. This also comes down to financial education. There are obviously also some clients with share portfolios etc. that they have accumulated over the years, but for many clients large investments are usually in cash and it usually sits there for one of the above two reasons.

And then there are the retirees who hold investment properties, in addition to their family homes. Many will have seen significant increases in their property assets over the past 10-20 years, and many will be receiving a regular ‘pay check’ in the form of rent. These property owners will need to keep up-to-date with tax, capital gains rulings and any possible advantages of selling if and when it suits them.

Key points

As always, you are in control of your investment options and opportunities, so it is critical to understand the implications of decisions about your private savings and how they may, or may not, have an impact on the other pillars in your portfolio.

The first need, as with all the other pillars, is to know the rules of engagement with private savings asset classes – things like Capital Gains Tax (CGT), ways of using income to maximise tax concessions or super benefits, and rules attached to share ownership. There’s a lot to understand, so it may help to make a list of all your private savings and their returns over the past year, and to seek further help if you feel you don’t fully understand how they work in tandem with your other retirement funds. It’s also important to fully appraise the net returns and whether this money could be better employed in other ways. In essence – are your private savings keeping up with inflation? You may have a lot of money invested in cash. And if this preference helps you sleep at night, then that clearly works best for you. But if you suspect there is a better way, it may be time to investigate.

If you are holding your savings in cash because you don’t fully understand how it could work within your super fund, then perhaps it’s time to speak with a qualified adviser who can share all the rules you need to know, to support your best decision making.

I think the pension is not enough for retirement and your savings get eaten away with everyday living if you are on a part pension because of super and savings

The law punishes retirees for saving and working hard. No incentives for people who saved and work hard.

Pensions must be available to all who are retired or asset threshold at least needs to be for real millionaires .