How to save on medical bills:

Know your rights and entitlements

It’s easy to feel like a dummy sometimes when it comes to health care costs. At a time of rapidly rising household costs, medical and pharmaceutical bills can sometimes seem insurmountable, particularly when you have an unexpected diagnosis or need for surgery.

The beginning of a new financial year, however, can offer a time to review and reset. So today we look at some of the ways you might be able to pay less for necessary medical care and support.

This is a big topic and the following article will in no way attempt to cover off on all aspects of your health needs and costs. What we are planning to offer, however, is a brief roadmap which reminds you of the basic rules and your rights or entitlements, so that you can check you are doing everything within your power to minimise your health care costs.

Where possible we have also provided links to useful government services, which provide additional information to help you better understand ways of minimising health costs.

Prevention is still better than a cure

It goes without saying – or it should – that a healthy lifestyle is the best way to minimise your health costs. Yet this is something we can all forget in our rush to minimise our financial outlay. There is probably too much information available in this digital age – Dr Google included – when it comes to the recipe for longevity. Yes, most of us are interested in maintaining our health and tend to read the ‘latest’ research. But this is hardly a wholistic approach. Perhaps an annual check-up with a trusted GP is the better starting point? You can then have the necessary health checks and discuss a plan to tackle any concerns, or ways to best enhance your physical and mental wellbeing. These might include an exercise program, remedial physiotherapy or Pilates, some nutritional goals, or social prescribing as an antidote to loneliness.

Having tests and/or vaccinations also makes a lot of sense. Many such procedures are free to older Australians, or offered at a lower cost. These include breast cancer screening, bowel cancer tests, Covid, flu, and in some cases, shingles, injections. We shared detail on vaccinations for older adults in a recent update.

Medicare – our universal healthcare insurance

If you call Australia home, it’s almost guaranteed that you will have a Medicare identity and card. As our universal healthcare system, Medicare provides a safety net so that all citizens are guaranteed to receive at least a minimum level of medical support. Much of this support is provided through ‘bulk billing’, where the provider bills the government for the service, and you sign a disclaimer allowing them to receive it, with no charge to you.

Not all GPs will bulk bill. Some GPs will bill you, but you can then claim part of the fee from Medicare. This is referred to as a ‘gap’ or ‘out-of-pocket’ payment. It’s important to check before your appointment if your doctor offers bulk billing or not. You can simply ask or use the national health service tool to find out who is bulk billing in your neighbourhood. Generally speaking, bulk billing will apply to those doctors and specialists (who do bulk bill), tests and scans (such as X-rays or pathology) and eye tests.

Medicare safety net

Extra higher rebates, in the form of a Medicare Safety Net, are available for those who need to spend a lot on out-of-hospital medical appointments or tests. This is also offered for those with high pharmaceutical costs. The benefits are measured within a calendar year and you may have to provide additional information for a family safety net claim, or a pharmaceutical benefits claim. A more detailed explanation is available from Health Direct.

Using concession cards

Older Australians can also benefit from certain concession cards when it comes to managing their medical bills. It may be that your preferred doctor does not bulk bill, but you trust them and wish to remain in their care. If you are an Age Pensioner you will have automatically been issued with a Pension Concession Card. If you are a self-funded, and over the Age Pension age of 67, you are most likely to be entitled to a Commonwealth Seniors Health Card, as long as your income is below the threshold. These cards also help with medical bills in many instances. There is no single directory of what you are entitled to, as it can vary according to your state of residence, so always, always, always ask before your treatment, if there is a rebate for holders of a Pension Concession Card or a Commonwealth Seniors Health Card.

Handy concession card updates

As noted, the Pension Concession Card is automatically provided for full and part-Age Pensioners. But the Commonwealth Seniors Health Card is a benefit for which you have to apply. The good news is that 1 July means a whole new financial year. And as the CSHC is income based, it means that you are able to use the (projected) income from this current financial year as a basis for your claim, if it is likely to bring you under the threshold. Find out more about how this works here or book a consultation to get your application underway.

Additionally, Services Australia will soon be issuing Commonwealth Seniors Health Cards which are valid for two years (rather than one).

Those who already have a CSHC and are still eligible, will receive a new one by the end of September 2023. It will be valid for up to two years, expiring at the end of your birth month. From then on, you’ll be sent a new CSHC every two years before your old one expires.

Private health insurance.

Do you need it?

This is the $64 million question, of course. Conservatively, for both hospital and the highest level of extras, couples will pay around $5000-$6000 per year for private health, singles around $3,000 – $4000. This is a significant proportion of earnings for many retirees. The good news is that there is a Federal Government tax rebate for those who pay private insurance. Depending upon your family situation and earnings, this can be a substantial tax offset for those in retirement.

There are a few good strategies for those who wish to maintain at least a level of private cover. These include:

- Compare funds – this can be done online (try Finder or CompareClub) to ensure you are using the most cost-effective fund for your specific situation

- Consider whether you need both hospital and extras cover. Some individuals do not have high out-of-pocket costs on extras, so this type of cover may be less necessary and significantly reduce costs if removed.

Beware hidden costs and trade-offs.

There are certain other medical costs and treatments that aren’t always covered by Medicare or Private Health. Some treatments offered by allied health professionals may not be rebated. Ambulance cover can often require a higher insurance premium– it isn’t guaranteed within your policy. Choosing the level of medical cover that is both right for you and affordable can often come down to basic trade-offs. Only you can decide what is counted in and out.

Pharmacy costs

As we reported in March, from 1 September pharmacists will be required to issue medications for a two-month period, saving prescription costs.

for most Australians. Additionally, the Pension Concession Card and Commonwealth Seniors Health Card mean lower prescription charges for retirees who hold them. Savings don’t stop here. Many basic health care and non-prescription medicinal products are discounted by large chemist chains and supermarkets. Doing online comparisons on basics such as toothpaste, headache tablets, cold and flu treatments is a smart way to ensure you are minimising your outlays on these basic items.

Dealing with the unexpected

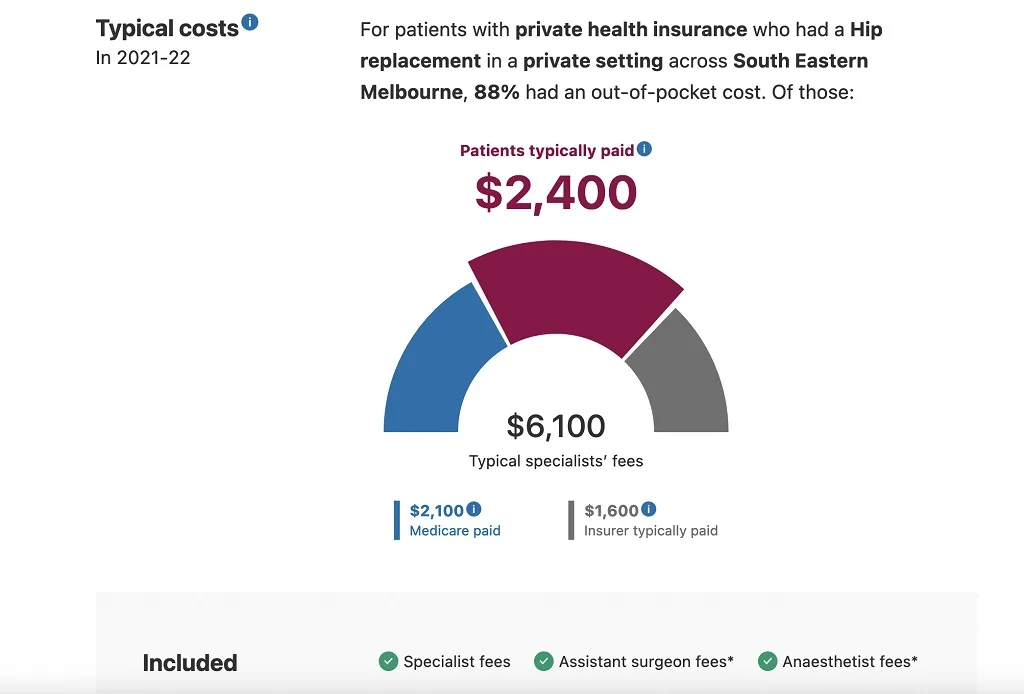

Most of us have no clue whatsoever when we encounter and unexpected diagnosis or a need for surgery. If you are being referred for further procedures, it may seem easiest to just go along with what is offered by the doctor who has treated you. But you may still like to be reassured that you are not paying over the top for your upcoming treatment. That’s where the Federal Government’s Medical Costs Finder comes in. It’s a national website which considers the many different ‘journeys’ Australians undergoing treatment might have, including:

- what the typical costs for such treatment could be, and

- how much will be covered by Medicare, an insurer and the patient.

The image below shows such a summary for someone who had a hip replacement, in a private setting in South Melbourne. It also shows the services included (specialist, assistant surgeon and anaesthetist) in this fee. Whilst it obviously doesn’t claim 100% accuracy in cost estimation, it’s helpful for those worried about pending medical bills, who can at least gain an idea of full out-of-pocket costs.

Retirement Essentials aim is to offer support and guidance for your full retirement journey. Our expertise is in maximising entitlements and offering bite-sized, affordable advice consultations to help you plan and manage your retirement income. But we also like to share relevant information to help you keep household costs down, including those related to medical bills.

What about you?

Do you have other great ways to minimise health care costs? We’d love to hear about them.

In comparing health funds also check their customer satisfaction ratings through websites such as productreview.com.au. Cheaper doesn’t always mean better. Check the fund’s satisfaction for people making claims not just for their phone manner in enrolling people into the fund.

Health funds usually allow for faster access to specialists for such things as hip replacements. Long wait times for people without health cover can be excruciating for people needing surgery and who live in constant pain while waiting.

I have recently been granted a CSHCard, and a few days ago made an appointment ( referral by treating GP) to a Optomologist. When I asked if there was any concession on my CSH card ( initial appt $300 +) I was told no concession. Is this usual ??? Thank you Chris

Hi Chris,

A lot of the medical services won’t give any concession for the CSHCard. I have found my GP, Optomologist, Dentist all say no concession unless you have a pension card.

The only concession I really see with any Medical services is a larger refund from Medicare, as the threshold is lower therefore you get more in return.

Cheers

Susan

Hi my dob is 24/12/1956

Am I entitled to claim for pension at 66yrs and 6 months as I reached this age before if was changed on 1/7/23

I have a prearranged appointment with centre link 10/07/23 for pension application

Regards

Hi Wendy, thanks for your comment! The age requirement is determined by DOB so yes, you will be able to apply because you were born prior to 01/01/1957.

I am 66 years of age and don’t qualify for the Aged Pension until next May. My husband and I are both self employed and recently lost a major contract. It looks like the remaining contract will go at the end of July. Is there a Government benefit for those over 60/65 (apart from Jobseeker) before a person qualifies for the Aged Pension?

Hi Elizabeth, unfortunately people need to have reached age 67 now to qualify for Age Pension or Commonwealth Seniors Health Card. You mention Jobseeker, I’m not aware of others (except Disability Pension if eligible), but it may be worthwhile looking further into Jobseeker to see if approved volunteering may be accepted as you are age 66. Jobseeker is not an area of our specialty, however you can contact Centrelink for more information.

I turned 70 this year, and been retired for 9 years. My wife retires next week at age 60. Can I / We be entitled to the Seniors Health Care Card? J have ongoing medical and pharmaceutical costs, which would be very helpful. Unfortunately, I do not think my GP will bulk-bill me. We live in Canberra, where doctors are very expensive.

Hi David, yes you may be eligible for the Commonwealth Seniors Health Card, maybe even the Age Pension. The best way to be certain is to check you eligibility with our free, online calculator HERE